Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Yes, the analysis of Sofia's property market is included in our pack

Buying property in Sofia as a foreigner comes with specific rules that depend heavily on your nationality and whether you want to own land or just the building itself.

We constantly update this blog post to reflect the latest regulations, costs, and market conditions in Sofia's real estate market.

This guide covers everything from legal ownership rights to closing costs, taxes, and mortgage options available to foreign buyers in Sofia in 2026.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Sofia.

Insights

- EU and EEA citizens can own land directly in Sofia, but non-EU foreigners must typically buy through a Bulgarian company, adding around 500 to 1,500 euros yearly in corporate compliance costs.

- Sofia's transfer tax runs at roughly 3% of the property price, making it the single largest closing cost for buyers in 2026.

- Foreigners can generally expect mortgage rates between 3.2% and 4.6% in Sofia, with non-residents usually landing at the higher end of that range.

- The biggest mistake foreign buyers make in Sofia is purchasing new-build apartments before verifying the "Act 16" commissioning certificate, which can block utility connections and legal occupancy.

- Annual property taxes in Sofia typically run between 150 and 350 euros for a standard apartment, combining building tax and the household waste fee.

- Banks like UniCredit Bulbank explicitly market mortgage products for buyers without permanent Bulgarian residence, with loan-to-value ratios typically capped at 60% to 75%.

- You do not need a special visa to buy property in Sofia, and purchases can legally happen while on a standard tourist visa or visa-free short stay.

- Buying residential property in Sofia does not automatically qualify you for residency or citizenship in Bulgaria, despite what some sellers may suggest.

- Total closing costs in Sofia range from about 6.5% without a buyer's agent to around 9% when including a typical 3% agent commission plus VAT.

- Short-term rental owners in Sofia face not just income tax at a flat 10% rate, but also separate tourism registration requirements and a municipal tourist tax.

What can I legally buy and truly own as a foreigner in Sofia?

What property types can foreigners legally buy in Sofia right now?

Foreigners can legally buy apartments, condos, penthouses, maisonettes, townhouses, and houses in Sofia in their own name, as the restriction primarily affects land ownership rather than buildings themselves.

The main legal complication for foreign buyers in Sofia is that non-EU citizens generally cannot own land directly in their personal name under Bulgaria's Constitution, though EU and EEA nationals face no such restriction.

When you buy an apartment in Sofia, you typically also acquire "ideal shares" of common areas and sometimes the land parcel, which means non-EU buyers need to discuss with their lawyer how to structure this portion of the purchase.

Most foreign buyers in Sofia start with apartments in popular neighborhoods like Lozenets, Iztok, Oborishte, Ivan Vazov, or Mladost, because the land ownership complications are simpler to navigate compared to detached houses or villas.

Finally, please note that our pack about the property market in Sofia is specifically tailored to foreigners.

Can I own land in my own name in Sofia right now?

If you are an EU or EEA citizen, you can own land directly in your own name in Sofia under the conditions arising from Bulgaria's EU accession, but non-EU foreigners generally cannot own land directly except in limited cases like inheritance.

The most common workaround for non-EU buyers who want a house or villa with land in Sofia is to purchase through a Bulgarian company that owns the land, which means you own the company rather than the land directly.

This company structure adds ongoing costs including accounting, annual filings, a corporate bank account, and registered office requirements, typically running between 500 and 1,500 euros per year depending on complexity.

As of 2026, what other key foreign-ownership rules or limits should I know in Sofia?

As of early 2026, the most important additional rule to understand is the "Act 16" commissioning requirement for new-build properties in Sofia, which determines whether a building can legally be occupied and connected to utilities.

There is no foreign ownership quota for apartments or condos in Sofia, meaning foreigners can buy without competing for a limited allocation of units in any building.

Foreign buyers must obtain a Bulgarian identifier number for tax and administrative purposes, which the National Revenue Agency uses for property declarations, tax payments, and utility registrations.

No major regulatory changes specifically targeting foreign ownership have taken effect recently in Sofia, though Bulgaria's once-discussed "citizenship-by-investment" pathways have been curtailed and should be treated with caution if anyone promotes them.

What's the biggest ownership mistake foreigners make in Sofia right now?

The single biggest mistake foreigners make in Sofia is buying a new-build or recently finished apartment without verifying that the building has received its "Act 16" commissioning certificate, which proves the property is legally ready for occupancy.

If you skip this check and the building lacks proper commissioning, you may find yourself unable to connect utilities, register the property correctly, secure financing, or legally live in the unit you just paid for.

Other classic pitfalls in Sofia include not checking for mortgages or encumbrances from the developer's financing chain, missing problems with "ideal shares" of land attached to apartments, and buying "ateliers" or office spaces marketed as residential units.

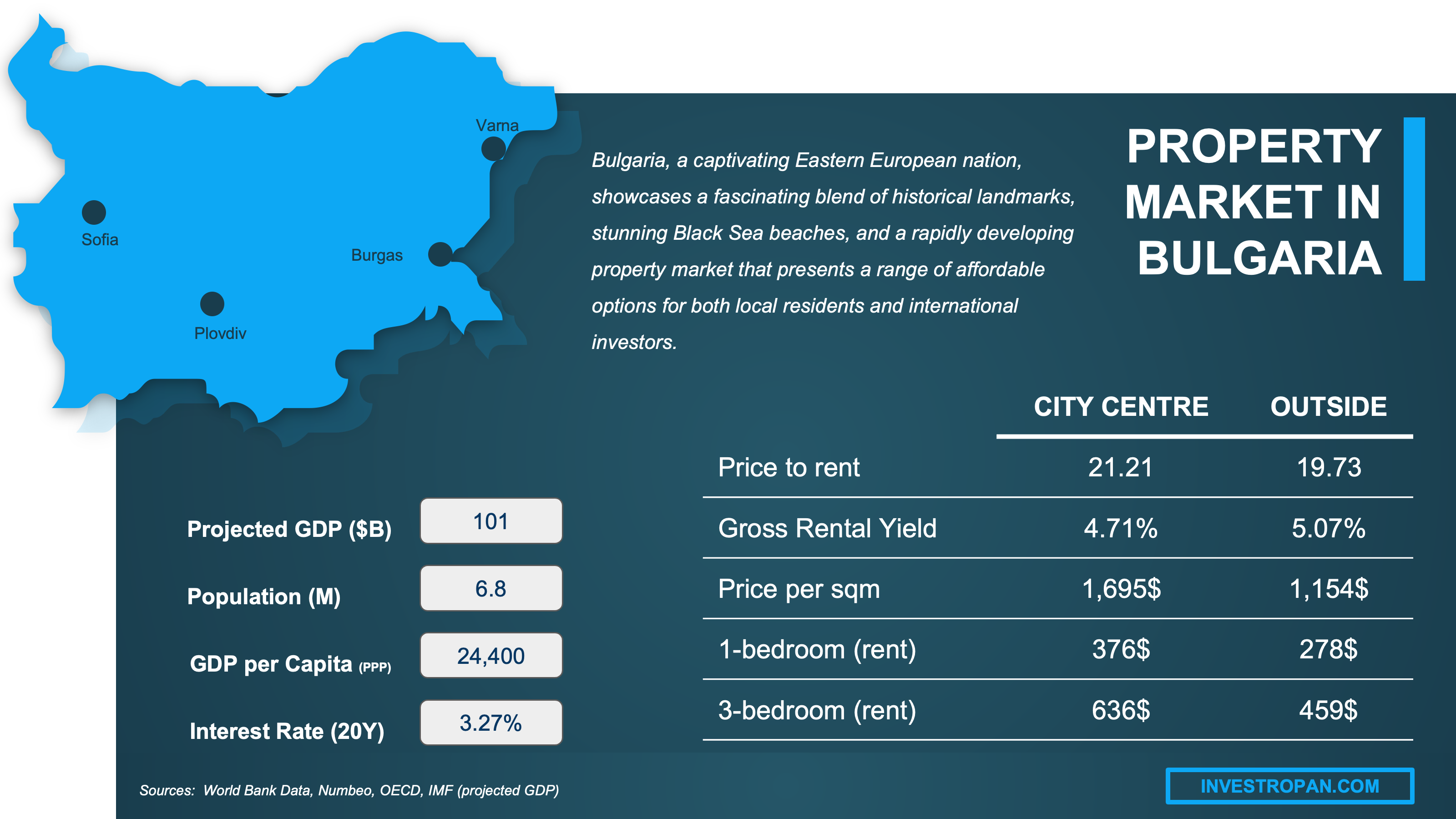

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which visa or residency status changes what I can do in Sofia?

Do I need a specific visa to buy property in Sofia right now?

You do not need a special visa to buy property in Sofia, and you can legally sign a purchase contract at a notary even while on a short-stay tourist visa or visa-free entry under the standard 90-day rule.

The main administrative barrier for buyers without local residency is obtaining a Bulgarian identifier number for tax purposes, which the National Revenue Agency requires for property declarations and fee payments.

You should expect to need this identifier before or shortly after purchase, as it links to your property tax account, utility connections, and any future transactions involving the property.

A typical document set for foreign buyers in Sofia includes your passport, a notarized power of attorney if you cannot attend in person, proof of funds, and any apostilled documents your notary or lawyer requests for the specific transaction.

Does buying property help me get residency and citizenship in Sofia in 2026?

As of early 2026, buying residential property in Sofia does not automatically qualify you for residency or citizenship in Bulgaria, despite what some sellers or agents may suggest.

Property ownership may support a broader application narrative if you pursue residency through other channels, but Bulgaria has curtailed its once-promoted "citizenship-by-investment" pathways, so treat any "buy a flat, get a passport" pitch as a red flag.

Other pathways to Bulgarian residency include employment-based permits, business registration with sufficient capital, family reunification, or long-term visa extensions that eventually lead to permanent residence after meeting time and documentation requirements.

We give you all the details you need about the different pathways to get residency and citizenship in Sofia here.

Can I legally rent out property on my visa in Sofia right now?

Your visa status generally does not prevent you from renting out property you own in Sofia, since the right to lease comes from ownership rather than immigration classification.

You do not need to live in Bulgaria to rent out your Sofia property, and most foreign owners manage their rentals remotely through a local property manager or agent who handles tenant relations and compliance.

If you plan short-term or tourist rentals in Sofia, be aware that you face additional obligations beyond income tax, including tourism registration with the municipality and payment of a separate tourist tax that applies per guest per night.

We cover everything there is to know about buying and renting out in Sofia here.

Get fresh and reliable information about the market in Sofia

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

How does the buying process actually work step-by-step in Sofia?

What are the exact steps to buy property in Sofia right now?

The standard sequence to buy property in Sofia includes selecting the property, negotiating terms, signing a preliminary contract with a deposit of around 5% to 10%, completing due diligence on title and building status, signing the notarial deed, registering the transfer in the Property Register, and handling post-sale administration like municipal declarations and utility transfers.

You do not always need to be physically present in Sofia, since many foreign buyers use a notarized power of attorney that allows a lawyer or representative to sign the notarial deed on their behalf.

The step that typically makes the deal legally binding in Sofia is the signing of the notarial deed at a Bulgarian notary's office, which formally transfers ownership and creates the document that gets registered.

The typical timeline from accepted offer to final registration in Sofia runs between 4 and 8 weeks for straightforward transactions, though complex deals involving company structures or financing can take longer.

We have a document entirely dedicated to the whole buying process our pack about properties in Sofia.

Is it mandatory to get a lawyer or a notary to buy a property in Sofia right now?

A notary is functionally mandatory in Sofia because the transfer of property ownership must be executed through a notarial deed, which the notary then submits for registration in the Property Register.

The key difference is that the notary in Sofia handles the formal transfer and registration process, while a lawyer conducts due diligence on title, encumbrances, building status, and contract terms before you commit to the purchase.

One essential item to include in your lawyer's engagement scope is verification of the "Act 16" commissioning status for any new-build property in Sofia, since this check protects you from buying a unit that cannot legally be occupied.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

What checks should I run so I don't buy a problem property in Sofia?

How do I verify title and ownership history in Sofia right now?

The official registry to verify title and ownership history in Sofia is the Property Register, which your notary or lawyer will search to confirm the current owner and trace the ownership chain.

The key document to request is a certificate or extract from the Property Register showing who holds title, when they acquired it, and how the property has changed hands over time.

A realistic look-back period for ownership history checks in Sofia is typically 10 to 20 years, which helps catch problems from privatization, inheritance disputes, or developer financing chains.

One clear red flag that should pause a purchase is finding multiple claims, unresolved inheritance disputes, or gaps in the chain of title where ownership cannot be clearly traced from one seller to the next.

You will find here the list of classic mistakes people make when buying a property in Sofia.

How do I confirm there are no liens in Sofia right now?

The standard way to confirm there are no liens or encumbrances on a property in Sofia is to request an official certificate of encumbrances from the Property Register, which lists any mortgages, attachments, seizures, or other registered burdens.

One common type of encumbrance to specifically ask about in Sofia is a mortgage from the developer's construction financing, which can remain attached to individual units if not properly released before or at sale.

The single best proof of lien status is an official registry extract dated close to your closing, since encumbrances can be registered at any time and an outdated certificate might miss recent claims.

How do I check zoning and permitted use in Sofia right now?

The authority to check zoning and permitted use in Sofia is the municipal urban planning department, while the Geodesy, Cartography and Cadastre Agency confirms the cadastral identifier and property boundaries.

The document that typically confirms zoning classification in Sofia is the detailed urban plan or a certificate from the municipality stating the property's designated use, whether residential, commercial, or mixed.

A common zoning pitfall that foreign buyers miss in Sofia is purchasing an "atelier" or office space that was marketed as residential, which can create problems with occupancy permits, utility rates, and resale value.

Buying real estate in Sofia can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Can I get a mortgage as a foreigner in Sofia, and on what terms?

Do banks lend to foreigners for homes in Sofia in 2026?

As of early 2026, yes, Bulgarian banks do lend to foreigners for home purchases in Sofia, though the terms are generally stricter than for local borrowers.

Foreign buyers in Sofia can typically expect loan-to-value ratios between 60% and 75%, meaning you should plan for a down payment of at least 25% to 40% of the property price.

The most common eligibility requirement that determines whether a foreigner qualifies for a Sofia mortgage is the ability to document stable income, preferably from EU sources, since banks need confidence in repayment capacity from abroad.

You can also read our latest update about mortgage and interest rates in Bulgaria.

Which banks are most foreigner-friendly in Sofia in 2026?

As of early 2026, the banks most commonly cited as foreigner-friendly for mortgages in Sofia are UniCredit Bulbank, DSK Bank, and United Bulgarian Bank (UBB), all of which have experience processing international documentation.

The feature that makes these banks more accessible to foreigners in Sofia is their willingness to work with non-Bulgarian income documentation and, in some cases, to explicitly market mortgage products for buyers without permanent residence.

These banks will generally lend to non-residents in Sofia, though terms may be stricter, with higher down payments, shorter loan terms, or requirements for salary accounts and additional guarantees.

We actually have a specific document about how to get a mortgage as a foreigner in our pack covering real estate in Sofia.

What mortgage rates are foreigners offered in Sofia in 2026?

As of early 2026, foreigners buying property in Sofia can expect mortgage interest rates in the range of roughly 3.2% to 4.6% nominal annual interest, with non-residents and those with foreign-source income typically offered rates toward the higher end.

Fixed-rate mortgages in Sofia usually come with a higher initial interest rate than variable products, but they offer payment stability for an initial period of typically 1 to 5 years before converting to a variable rate linked to market indices.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What will taxes, fees, and ongoing costs look like in Sofia?

What are the total closing costs as a percent in Sofia in 2026?

The typical total closing cost in Sofia in 2026 runs around 6.5% of the purchase price if you do not use a buyer's agent, or approximately 9% if you include a standard agent commission.

The realistic range for closing costs in Sofia spans from about 5.5% on the low end for straightforward transactions to around 10% when all fees and a buyer's agent are included.

The specific fee categories that make up total closing costs in Sofia include the local transfer tax, notary fees, Property Register registration fee, lawyer fees for due diligence, and optionally a buyer-side real estate agent commission.

The single biggest contributor to closing costs in Sofia is the transfer tax, which the municipality sets at approximately 3% of the property price under the national Local Taxes and Fees Act framework.

If you want to go into more details, we also have a blog article detailing all the property taxes and fees in Sofia.

What annual property tax should I budget in Sofia in 2026?

As of early 2026, a typical Sofia apartment owner should budget roughly 150 to 350 euros per year (approximately 300 to 700 BGN or 160 to 370 USD) for combined annual property tax and household waste fee, though larger or higher-value properties will pay more.

Annual property tax in Sofia is assessed as a per-mille rate applied to the property's tax valuation, with the building tax at roughly 1.875 per mille and the household waste fee at around 1.6 per mille, both set by the municipality within national limits.

How is rental income taxed for foreigners in Sofia in 2026?

As of early 2026, rental income earned by foreigners from Sofia property is subject to Bulgaria's flat personal income tax rate of 10%, which applies to Bulgarian-source income regardless of where the owner resides.

Foreign owners must typically file an annual tax return with the Bulgarian National Revenue Agency to declare their rental income, and if renting short-term to tourists, they also face separate tourism registration and tourist tax obligations administered by the municipality.

What insurance is common and how much in Sofia in 2026?

As of early 2026, a standard homeowners insurance policy for an apartment in Sofia typically costs between 80 and 200 euros per year (roughly 160 to 400 BGN or 85 to 210 USD), while houses and villas run higher at approximately 200 to 600 euros depending on size and coverage.

The most common type of property insurance coverage that owners carry in Sofia is a basic policy covering fire, water damage, and natural disasters, with optional add-ons for theft, liability, and earthquake damage.

The biggest factor that affects insurance premiums for the same property type in Sofia is the insured value and scope of coverage, since broader policies including earthquake protection and higher rebuild values cost significantly more than basic fire and water coverage.

Get the full checklist for your due diligence in Sofia

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Sofia, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Constitution of Bulgaria (Art. 22) | Bulgaria's highest legal text setting binding rules on foreign land ownership. | We used it to anchor the core rule on who can own land directly. We then applied it to typical Sofia purchase structures. |

| Ministry of Finance - Property Tax | Official government explanation of how property tax works in Bulgaria. | We used it to explain annual property tax and municipal rate-setting authority. We paired it with Sofia-specific rates from local sources. |

| Ministry of Finance - Transfer Tax | Official government summary of local transfer tax rules. | We used it to describe what triggers transfer tax and the calculation basis. We then estimated Sofia closing costs. |

| National Revenue Agency (NRA) | Bulgaria's tax authority providing practical guidance for property owners. | We used it for owner obligations and declaration timing. We cross-referenced with Ministry pages for consistency. |

| European e-Justice Portal | EU portal describing how Bulgaria's property registration system works. | We used it to explain the Property Register's role in title verification. We connected it to due diligence steps. |

| Cadastre Agency (AGCC) | State agency responsible for cadastral data and property boundaries. | We used it to explain how to verify cadastral identifiers and boundaries. We linked it to zoning checks. |

| DNCK (Construction Control) | Competent authority for building commissioning and permits of use. | We used it to explain the "Act 16" requirement for new builds. We highlighted it as Sofia's biggest buyer risk. |

| Bulgaria eGov Portal | Official e-government portal summarizing visa categories and requirements. | We used it to explain Type C versus Type D visas. We separated immigration rules from property ownership rights. |

| Bulgarian National Bank | Central bank providing credible system-level credit and market data. | We used it to confirm banks are actively lending in Bulgaria. We paired it with bank product pages for specifics. |

| UniCredit Bulbank | Primary lender source showing mortgage products for non-residents. | We used it to confirm a major bank explicitly serves foreign buyers. We cited it for LTV and eligibility context. |

| DSK Bank | Major Bulgarian retail bank with significant mortgage presence. | We used it to verify foreigner mortgage availability at a second major lender. We included it in bank comparisons. |

| United Bulgarian Bank (UBB) | Major lender offering fixed-rate mortgage products. | We used it to show another foreigner-accessible bank option. We noted their fixed-rate product availability. |

| PwC Tax Summaries | Major international tax reference with regularly updated country guides. | We used it to cross-check Bulgaria's flat income tax rate. We paired it with Bulgarian government sources. |

| Mediapool | Reputable Bulgarian outlet reporting on Sofia municipal decisions. | We used it for Sofia's household waste fee rate. We verified against municipal documents. |

| Sofia Municipality | Official portal for Sofia's local tax administration. | We used it to ground practical steps for declarations and payments. We paired it with national legal sources. |

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of Bulgaria. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

Related blog posts