Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Yes, the analysis of Sofia's property market is included in our pack

If you're a foreigner thinking about buying a property in Sofia to rent it out, you're probably wondering whether the numbers actually work and what rules you need to follow.

This guide breaks down the real rental yields, tenant demand, legal requirements, and neighborhood performance you need to know as of early 2026.

We constantly update this blog post to reflect the latest data and regulatory changes in Sofia's rental market.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Sofia.

Insights

- Sofia's gross rental yields in 2026 typically range from 4.5% to 6.5%, but neighborhoods like Studentski Grad and Mladost can push toward the higher end due to lower purchase prices combined with steady student and young professional demand.

- Foreigners can own apartments in Sofia outright, but houses often require a Bulgarian company structure because the Constitution restricts foreign ownership of land itself.

- Short-term rentals in Sofia average around 60% occupancy with a nightly rate of about $65, which can beat long-term gross income but comes with significantly higher operational costs and compliance requirements.

- Sofia's tourist tax increased from January 2025, adding a real cost line that short-term rental operators must now factor into their budgets.

- Metro proximity is one of the strongest rent boosters in Sofia, often adding 10% to 15% to monthly rent compared to similar apartments without easy metro access.

- A realistic net rental yield for foreign owners using light property management in Sofia lands between 3.0% and 4.8% after accounting for vacancy, building fees, and local taxes.

- Furnished apartments in Sofia rent faster and command a 10% to 20% premium, but only when the furniture is modern and cohesive rather than cheap and mismatched.

- Bulgaria has no national rent control, so landlords in Sofia can freely set initial rents and negotiate increases directly in the lease contract.

Can I legally rent out a property in Sofia as a foreigner right now?

Can a foreigner own-and-rent a residential property in Sofia in 2026?

As of early 2026, a foreign individual can legally own a residential apartment in Sofia and rent it out without major restrictions, making the city accessible for international property investors.

The most common ownership structure for foreigners buying apartments is direct personal ownership, though those purchasing houses with land often use a Bulgarian limited liability company (EOOD or OOD) to hold the land component.

The single most important restriction to know is that Bulgaria's Constitution limits foreign ownership of land, which means foreigners typically cannot own the land under a house directly unless they qualify through EU citizenship or specific treaty provisions.

If you're not a local, you might want to read our guide to foreign property ownership in Sofia.

Do I need residency to rent out in Sofia right now?

No, you do not need Bulgarian residency to be a landlord in Sofia, and many foreign owners successfully rent out their properties while living abroad.

However, you will need a Bulgarian tax identifier to legally collect and declare rental income, which for foreigners without an EGN (personal number) typically means registering for a BULSTAT number through the official registry.

A local Bulgarian bank account is not legally required, but it is strongly recommended because it simplifies rent collection, bill payments, and working with property managers.

Managing a Sofia rental remotely is entirely feasible if you use a local property manager or agency to handle tenant relations, inspections, and maintenance on your behalf.

Thinking of buying real estate in Sofia?

Acquiring property in a different country is a complex task. Don't fall into common traps – grab our guide and make better decisions.

What rental strategy makes the most money in Sofia in 2026?

Is long-term renting more profitable than short-term in Sofia in 2026?

As of early 2026, short-term rentals in Sofia can generate higher gross income than long-term leases, but long-term renting typically delivers more predictable net returns with far less operational work.

A well-managed one-bedroom apartment in central Sofia might earn around 700 to 800 euros per month on a long-term lease (roughly 8,400 to 9,600 euros annually), while the same unit on Airbnb at 60% occupancy and $65 per night could gross around 11,000 to 12,000 euros annually before higher costs eat into the margin.

Short-term renting tends to make more financial sense for properties in Sofia's tourist-friendly center, near major landmarks, or close to business districts where corporate travelers and tourists concentrate.

What's the average gross rental yield in Sofia in 2026?

As of early 2026, the average gross rental yield for residential properties in Sofia falls in the range of 4.5% to 6.5%, depending on neighborhood, property condition, and unit type.

Most mainstream Sofia apartments cluster between 4.5% and 5.5% gross yield, while properties in higher-demand but lower-priced areas like Studentski Grad or Mladost can reach 6% to 6.5%.

Studios and one-bedroom apartments typically achieve the highest gross rental yields in Sofia because they have the lowest purchase prices relative to the rents they can command from the city's large pool of young professionals and students.

By the way, we have much more granular data about rental yields in our property pack about Sofia.

What's the realistic net rental yield after costs in Sofia in 2026?

As of early 2026, the realistic net rental yield for a foreign owner with light property management in Sofia typically falls between 3.0% and 4.8%.

Most landlords in Sofia actually experience net yields in the 3.5% to 4.5% range once all recurring costs are deducted from their gross rental income.

The three main cost categories that reduce gross yield to net yield in Sofia are building entrance and maintenance fees (which are higher than many foreigners expect), vacancy and turnover costs (typically half a month to one and a half months per year), and the combination of local property tax plus the annual waste collection fee.

You might want to check our latest analysis about gross and net rental yields in Sofia.

What monthly rent can I get in Sofia in 2026?

As of early 2026, typical monthly asking rents in Sofia are roughly 900 to 1,100 Bulgarian leva (450 to 550 euros or $470 to $580) for a studio, 1,200 to 1,500 leva (600 to 750 euros or $630 to $790) for a one-bedroom, and 1,600 to 2,100 leva (800 to 1,050 euros or $840 to $1,100) for a two-bedroom apartment.

A realistic entry-level monthly rent for a decent studio in Sofia starts around 850 to 1,000 leva (430 to 510 euros or $450 to $530), with prices rising for better locations or newer buildings.

A typical mid-range one-bedroom apartment in Sofia rents for about 1,200 to 1,400 leva (610 to 710 euros or $640 to $750), with renovated units in popular neighborhoods like Lozenets or Ivan Vazov pushing toward the higher end.

A typical two-bedroom apartment in Sofia commands rents of 1,600 to 2,000 leva (800 to 1,000 euros or $840 to $1,050), and premium locations like Center or Iztok can push rents 20% to 40% higher.

If you want to know more about this topic, you can read our guide about rents and rental incomes in Sofia.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

What are the real numbers I should budget for renting out in Sofia in 2026?

What's the total "all-in" monthly cost to hold a rental in Sofia in 2026?

As of early 2026, the total all-in monthly cost to hold a typical rental apartment in Sofia (excluding mortgage and assuming tenants pay utilities) runs about 280 to 440 leva (140 to 220 euros or $150 to $230) for a studio, 340 to 540 leva (170 to 270 euros or $180 to $285) for a one-bedroom, and 440 to 700 leva (220 to 350 euros or $230 to $370) for a two-bedroom.

A realistic monthly holding cost range for most standard Sofia rental apartments is 300 to 600 leva (150 to 300 euros or $160 to $315), depending on building age, size, and whether you use professional management.

The single largest contributor to monthly holding costs in Sofia is typically the building entrance and maintenance fee (called "taksa" locally), which covers common area cleaning, elevator maintenance, and building repairs, and can range from 50 to 150 leva per month depending on the building's age and amenities.

You want to go into more details? Check our list of property taxes and fees you have to pay when buying a property in Sofia.

What's the typical vacancy rate in Sofia in 2026?

As of early 2026, a realistic planning assumption for vacancy in Sofia is around 4% to 12% annually, which translates to roughly half a month to one and a half months vacant per year for a typical rental.

Landlords in Sofia should budget for about one month of vacancy per year as a baseline, though well-priced apartments near metro stations often achieve near-zero vacancy while overpriced or poorly located units can sit empty for two months or more.

The main factor that causes vacancy rates to vary across Sofia neighborhoods is proximity to public transport, especially the metro system, because tenants prioritize easy commuting and will pay faster for apartments that offer it.

Tenant turnover and vacancy in Sofia tend to peak in late summer (August and September) when students and young professionals relocate before the academic and business year begins.

We have a whole part covering the best rental strategies in our pack about buying a property in Sofia.

Get fresh and reliable information about the market in Sofia

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Where do rentals perform best in Sofia in 2026?

Which neighborhoods have the highest long-term demand in Sofia in 2026?

As of early 2026, the three Sofia neighborhoods with the highest overall long-term rental demand are Lozenets, Ivan Vazov, and Oborishte (including the Doctor's Garden area), all of which combine central locations with strong amenities and excellent transport links.

Families looking for long-term rentals in Sofia tend to concentrate in Lozenets, Izgrev, Ivan Vazov, Vitosha, and Boyana, where they find larger apartments, good schools, parks, and quieter residential streets.

Students drive strong rental demand in Studentski Grad, Dianabad, Darvenitsa, and parts of Mladost, all of which offer affordable rooms near universities and late-night services.

Expats and international professionals prefer Lozenets, Ivan Vazov, Iztok, Center (Oborishte), and Krastova Vada, where they find renovated apartments, an international atmosphere, and easy commuting to business districts.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Sofia.

Which neighborhoods have the best yield in Sofia in 2026?

As of early 2026, the Sofia neighborhoods with the best rental yields are Studentski Grad, Mladost (especially near metro stations and business parks), and Ovcha Kupel, where lower purchase prices combine with solid tenant demand.

Gross rental yields in these top-performing Sofia neighborhoods typically range from 5.5% to 6.5%, compared to 4.5% to 5.5% in premium central areas where purchase prices are higher.

The main characteristic that allows these neighborhoods to achieve higher yields is their role as "gateway" areas for budget-conscious tenants, meaning rents stay healthy because of deep demand from students and young workers, while purchase prices remain well below the city average.

We cover a lot of neighborhoods and provide a lot of updated data in our pack about real estate in Sofia.

Where do tenants pay the highest rents in Sofia in 2026?

As of early 2026, the three Sofia neighborhoods where tenants pay the highest rents are Center (Oborishte and the old town core), Lozenets, and Iztok, where one-bedroom apartments commonly rent for 1,500 to 2,000 leva (760 to 1,020 euros or $800 to $1,070) per month.

A standard renovated apartment in these premium Sofia neighborhoods typically rents for 1,400 to 2,200 leva (710 to 1,120 euros or $750 to $1,180) per month, with larger or newer units commanding even more.

What makes these neighborhoods command Sofia's highest rents is the combination of walkable access to restaurants, cafes, and cultural venues, plus proximity to embassies, international schools, and major corporate offices that attract high-income tenants.

The typical tenant profile in these highest-rent Sofia neighborhoods includes senior expat professionals, diplomats, executives at multinational companies, and successful local entrepreneurs who prioritize convenience and prestige over value.

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of Bulgaria. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

What do tenants actually want in Sofia in 2026?

What features increase rent the most in Sofia in 2026?

As of early 2026, the three property features that increase monthly rent the most in Sofia are proximity to a metro station (within a 10-minute walk), modern heating with good insulation (which matters enormously in Sofia's cold winters), and air conditioning (increasingly expected for summer comfort).

Metro proximity is the single most valuable rent-boosting feature in Sofia, typically adding 10% to 15% to monthly rent compared to similar apartments that require a bus or tram commute.

One commonly overrated feature that Sofia landlords invest in but tenants rarely pay extra for is a luxury bathtub, because most renters prefer a functional modern shower and would rather see the money spent on better heating or kitchen appliances.

One affordable upgrade that delivers strong returns in Sofia is installing split-system air conditioning, which typically costs 800 to 1,500 leva (400 to 760 euros) but can justify a rent increase of 50 to 100 leva per month while also helping the apartment rent faster.

Do furnished rentals rent faster in Sofia in 2026?

As of early 2026, furnished apartments in Sofia typically rent one to three weeks faster than unfurnished ones, especially for units targeting expats, students, and young professionals who want to move in immediately without buying furniture.

Furnished apartments in Sofia generally command a rent premium of 10% to 20% over unfurnished equivalents, but this premium only materializes when the furniture is modern, clean, and cohesive rather than a random collection of old pieces.

Get to know the market before you buy a property in Sofia

Better information leads to better decisions. Get all the data you need before investing a large amount of money. Download our guide.

How regulated is long-term renting in Sofia right now?

Can I freely set rent prices in Sofia right now?

In Sofia and throughout Bulgaria, landlords have full freedom to set initial rent prices at whatever level the market will bear, as there is no national rent control or price cap system in place.

Rent increases during a tenancy are also not capped by law in Bulgaria, meaning landlords and tenants typically agree on any increase terms (such as annual adjustments linked to inflation) directly in the lease contract.

What's the standard lease length in Sofia right now?

The standard lease length for residential rentals in Sofia is 12 months, often with an option to renew, though shorter or longer terms can be negotiated between landlord and tenant.

Bulgarian law does not set a strict maximum on security deposits, but the market standard in Sofia is one to two months' rent (roughly 600 to 1,500 leva or 300 to 760 euros or $315 to $800 for a typical one-bedroom), with two months more common for higher-end properties.

Security deposits in Bulgaria must be returned at the end of the tenancy minus any documented deductions for damage or unpaid rent, and landlords are expected to provide an itemized accounting if they withhold any portion.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

How does short-term renting really work in Sofia in 2026?

Is Airbnb legal in Sofia right now?

Yes, Airbnb-style short-term rentals are legal in Sofia, but only if you operate as properly registered tourist accommodation under Bulgaria's Tourism Act framework.

To legally operate a short-term rental in Sofia, you need to register your property with the tourism system through the Ministry of Tourism's National Tourism Register and use the ESTI platform (Bulgaria's Unified Tourist Information System) to report guest stays.

Bulgaria does not impose a simple nationwide cap on annual rental nights like some Western European cities do, but instead focuses on registration, guest reporting through ESTI, and proper tourist tax collection and remittance.

Operating an unregistered or non-compliant short-term rental in Sofia can result in fines and potential enforcement action, so compliance with registration and reporting requirements is strongly recommended.

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in Sofia.

What's the average short-term occupancy in Sofia in 2026?

As of early 2026, the average annual occupancy rate for short-term rentals in Sofia is approximately 60%, based on platform performance data across thousands of active listings.

Most short-term rentals in Sofia experience occupancy rates ranging from 45% to 75%, with professional operators and well-located properties achieving the higher end while poorly optimized listings struggle at the lower end.

The highest occupancy months for Sofia short-term rentals are typically May through September (summer tourism) and December (holiday travel), when both leisure and business visitors boost demand.

The lowest occupancy months in Sofia are usually January through March and November, when tourism slows and business travel dips, leaving operators with more vacant nights to fill.

Finally, please note that you can find much more granular data about this topic in our property pack about Sofia.

What's the average nightly rate in Sofia in 2026?

As of early 2026, the average nightly rate (ADR) for short-term rentals in Sofia is approximately $65 (around 60 euros or 120 Bulgarian leva), based on aggregated platform data.

A realistic nightly rate range for most Sofia short-term rental listings is $40 to $100 (roughly 37 to 92 euros or 75 to 195 leva), with budget studios at the low end and premium central apartments or larger units at the high end.

The typical nightly rate difference between peak season (summer and December holidays) and off-season in Sofia is about $15 to $25 (roughly 14 to 23 euros or 30 to 50 leva), meaning savvy operators adjust pricing dynamically throughout the year.

Is short-term rental supply saturated in Sofia in 2026?

As of early 2026, the Sofia short-term rental market is competitive but not fully saturated, with around 4,400 active listings maintaining roughly 60% occupancy, which suggests demand still rewards quality operators.

The number of active short-term rental listings in Sofia has grown steadily in recent years, but the market has not collapsed into oversupply because tourism demand and business travel have grown alongside new listings.

The most oversaturated neighborhoods for short-term rentals in Sofia are Center (around Vitosha Boulevard and the old town) and parts of Oborishte, where competition is intense and only top-rated listings achieve strong bookings.

Neighborhoods that still have room for new short-term rental supply in Sofia include areas near Sofia Airport, business park zones in Mladost, and emerging areas like Krastova Vada, where new buildings attract travelers but competition remains lighter.

Don't lose money on your property in Sofia

100% of people who have lost money there have spent less than 1 hour researching the market. We have reviewed everything there is to know. Grab our guide now.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Sofia, we always rely on the strongest methodology we can, and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| National Assembly of Bulgaria | It's the official publisher of Bulgaria's Constitution in English. | We used it to ground the foreigner land ownership rule in Article 22. We then explained what it means for buying typical residential property in Sofia. |

| Ministry of Tourism (National Register) | It's the official registry for tourist accommodation in Bulgaria. | We used it to explain what legal short-term rental registration means. We pointed readers to where compliance records are managed. |

| ESTI Portal | It's the government's live system for tourist stay reporting. | We used it to verify ESTI is operational, not just a concept. We referenced it when explaining short-term rental compliance steps. |

| AirDNA | It's a widely used dataset for short-term rental performance metrics. | We used it to estimate Sofia's STR occupancy, nightly rates, and listing counts. We turned those into rental strategy comparisons. |

| Global Property Guide | It compiles rent data from major portals with consistent methodology. | We used it to establish Sofia rent levels by unit type. We cross-referenced it with other sources to build reliable ranges. |

| Numbeo | It aggregates crowd-sourced cost and rent data globally. | We used it to validate rent ranges and cost-of-living context. We compared its figures with portal-based sources for consistency. |

| BTA (Bulgarian News Agency) | It reports official market data citing major property portals. | We used it for Sofia's price-per-square-meter benchmarks. We applied those to calculate gross rental yields. |

| National Statistical Institute (NSI) | It's Bulgaria's official agency for inflation and housing statistics. | We used it to understand Bulgaria's inflation environment. We used that context to validate rent and cost figures for early 2026. |

| ECB Data Portal | It provides harmonized inflation data for EU countries. | We used it as a second inflation source separate from NSI. We sanity-checked that our cost and rent ranges fit the economic reality. |

| PwC Tax Summaries | It's a major professional reference for tax rules by country. | We used it to explain how rental income is taxed in Bulgaria. We cross-checked it with government guidance for accuracy. |

| BULSTAT Register | It's the official system for certain foreign individual registrations. | We used it to explain the tax identifier foreigners need. We translated that into practical landlord setup steps. |

| VisitSofia | It's Sofia's official tourism portal for municipal updates. | We used it to confirm the 2025 tourist tax rate change. We included tourist tax as a real cost line in STR budgeting. |

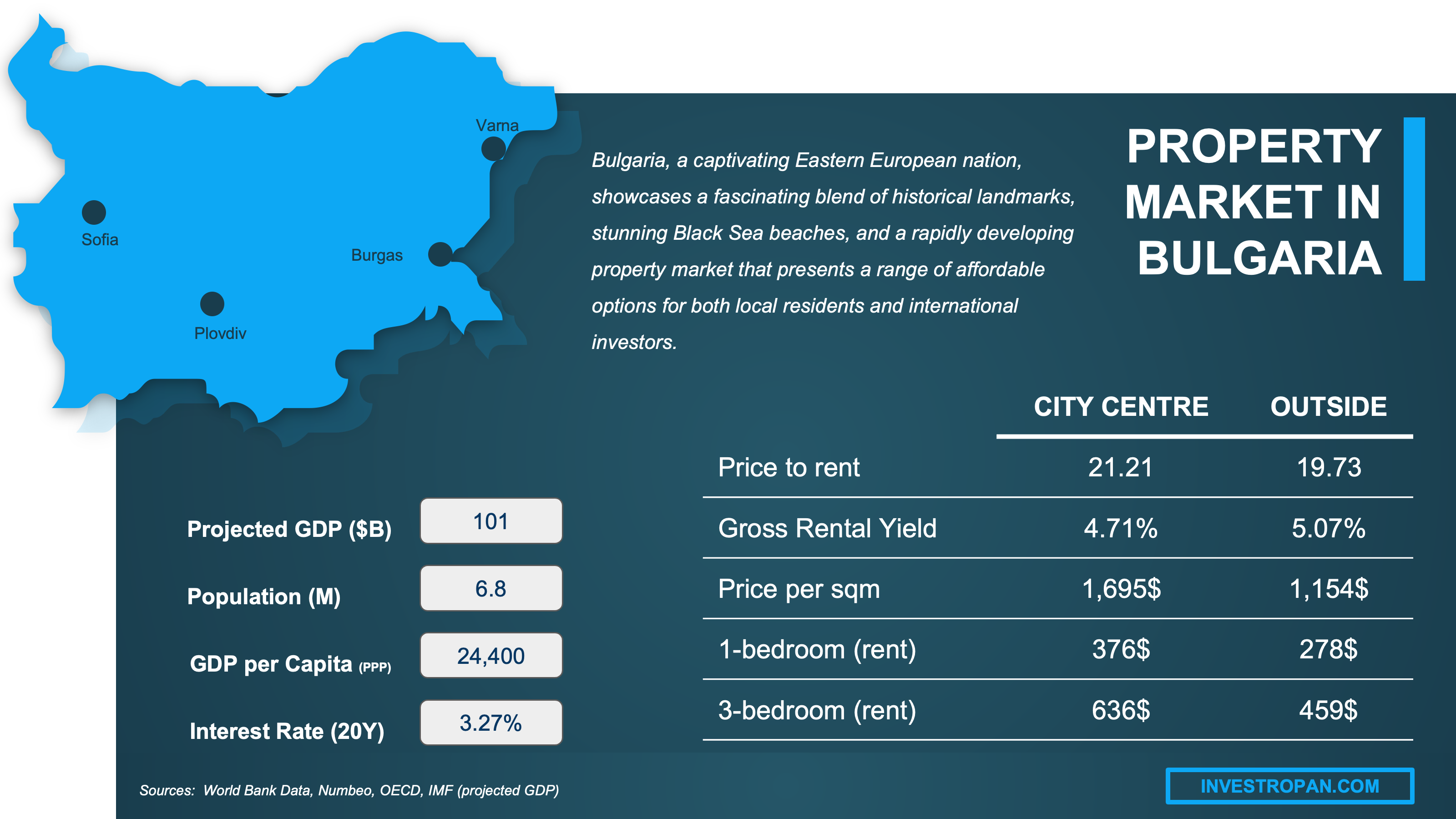

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Related blog posts