Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Yes, the analysis of Sofia's property market is included in our pack

If you're a foreigner looking to buy residential property in Sofia, understanding the real costs beyond the purchase price is essential to avoid surprises.

We constantly update this blog post to reflect the latest taxes, fees, and regulations affecting property buyers in Sofia in 2026.

Below, you'll find a complete breakdown of every cost, from mandatory government taxes to optional professional fees.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Sofia.

Overall, how much extra should I budget on top of the purchase price in Sofia in 2026?

How much are total buyer closing costs in Sofia in 2026?

As of early 2026, total buyer closing costs in Sofia typically range from about 4% to 12% of the purchase price, which means on a 200,000 BGN property (roughly 102,000 EUR or 111,000 USD), you should expect to pay between 8,000 BGN and 24,000 BGN (4,100 to 12,300 EUR or 4,400 to 13,300 USD) in additional costs.

The minimum extra budget possible in Sofia, when you skip the agent and keep everything bare-bones legal, is around 4% to 4.8% of the purchase price, so on that same 200,000 BGN property, you'd pay roughly 8,000 to 9,600 BGN (4,100 to 4,900 EUR or 4,400 to 5,300 USD).

The maximum extra budget buyers should realistically plan for in Sofia, when including an agent, lawyer, translations, and all potential extras, is around 9% to 12% of the purchase price, meaning 18,000 to 24,000 BGN (9,200 to 12,300 EUR or 10,000 to 13,300 USD) on a 200,000 BGN property.

The main factors that push your Sofia closing costs toward the low or high end include whether you hire a buyer's agent (adds 2% to 3%), whether you need a lawyer for due diligence (adds 0.5% to 1%), and whether you require translation services as a non-Bulgarian speaker (adds 200 to 600 BGN).

What's the usual total % of fees and taxes over the purchase price in Sofia?

The usual total percentage of fees and taxes over the purchase price in Sofia falls between 6% and 9% for most foreign buyers who use standard professional services.

The realistic low-to-high percentage range that covers most standard property transactions in Sofia runs from about 4% (bare minimum with no agent) to around 12% (full professional support with extras), though most buyers land somewhere in the middle.

Of that total percentage in Sofia, roughly 3% to 3.5% goes to government-mandated costs (the 3% municipal acquisition tax plus registration fees), while the remaining 3% to 8% covers professional service fees like agents, lawyers, and translators.

By the way, you will find much more detailed data in our property pack covering the real estate market in Sofia.

What costs are always mandatory when buying in Sofia in 2026?

As of early 2026, the mandatory costs when buying property in Sofia include the 3% municipal acquisition tax, the Property Register registration fee (around 0.1% of the property value), and the notary fee (roughly 0.4% to 1.2% depending on the price bracket) plus VAT on the notary service.

Optional but highly recommended costs for buyers in Sofia include hiring an independent lawyer for contract review and title checks (0.5% to 1%), using an official interpreter at the notary if you don't speak Bulgarian, and getting a technical inspection for older buildings.

Don't lose money on your property in Sofia

100% of people who have lost money there have spent less than 1 hour researching the market. We have reviewed everything there is to know. Grab our guide now.

What taxes do I pay when buying a property in Sofia in 2026?

What is the property transfer tax rate in Sofia in 2026?

As of early 2026, the property transfer tax rate in Sofia is 3% of the declared transaction value, which is among the highest municipal rates in Bulgaria.

There are no extra transfer taxes specifically for foreigners buying property in Sofia, as the 3% municipal acquisition tax applies equally regardless of your nationality.

Buyers may pay VAT on residential property purchases in Sofia primarily when buying new-build properties from VAT-registered developers, though in practice the VAT is usually already included in the quoted price.

In Bulgaria, there isn't a separate "stamp duty" like in the UK; instead, the main purchase-side tax you'll pay in Sofia is the 3% municipal acquisition tax combined with the registration and notary fees.

Are there tax exemptions or reduced rates for first-time buyers in Sofia?

As of early 2026, Bulgaria does not offer broad first-time buyer tax exemptions or reduced municipal acquisition tax rates like some other European countries do.

If you buy property through a company in Sofia, the same municipal acquisition tax and registration structure applies, but the main differences appear in ongoing taxation, reporting requirements, and potential VAT structuring opportunities.

The key tax difference between new-build and resale properties in Sofia is that new-build purchases from developers more commonly include VAT in the transaction, while resale properties are often VAT-exempt.

Since there are no standard first-time buyer exemptions in Sofia, there is no specific documentation required to qualify for such benefits, though any narrow condition-based reliefs would require proof of eligibility through official channels.

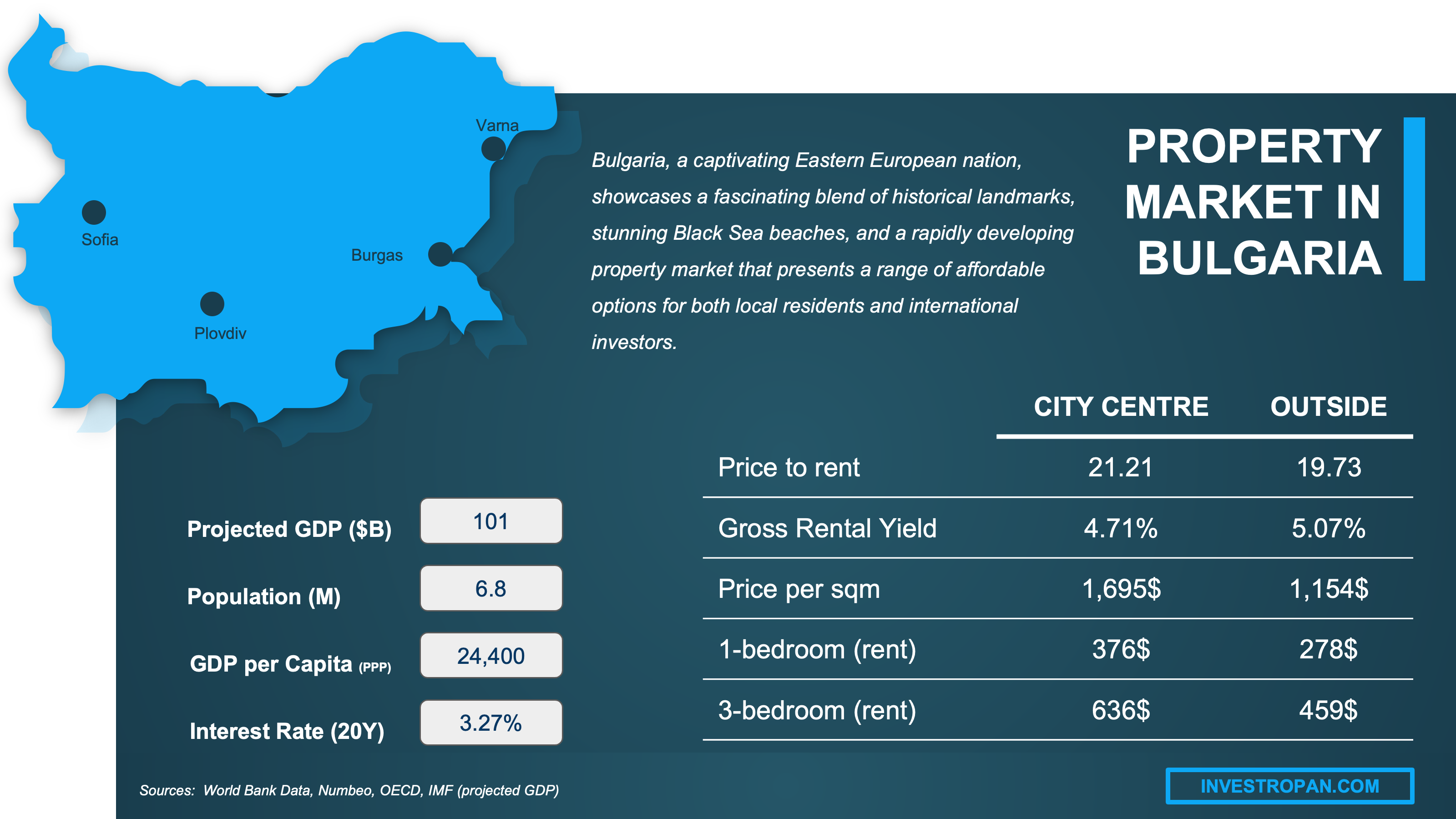

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Which professional fees will I pay as a buyer in Sofia in 2026?

How much does a notary or conveyancing lawyer cost in Sofia in 2026?

As of early 2026, notary fees in Sofia are tariff-based and typically run between 0.4% and 1.2% of the property price (plus 20% VAT on the notary service), so on a 200,000 BGN property you might pay roughly 800 to 2,400 BGN (410 to 1,230 EUR or 440 to 1,330 USD) for the notary alone.

Notary fees in Sofia are charged as a percentage based on progressive brackets set by the official tariff, meaning the percentage decreases as the property value increases.

Translation and interpreter services for foreign buyers in Sofia typically cost between 200 and 600 BGN (100 to 300 EUR or 110 to 330 USD) for a straightforward closing, with more complex transactions requiring additional document translation costing more.

If your situation involves renting out the property, buying through a company, or complex residency issues, a tax advisor consultation in Sofia typically costs between 400 and 1,200 BGN (200 to 600 EUR or 220 to 660 USD).

Lawyer fees for contract review and due diligence in Sofia commonly range from 0.5% to 1% of the transaction value, often with minimum fees of around 500 to 1,000 BGN (255 to 510 EUR or 275 to 550 USD).

We have a whole part dedicated to these topics in our our real estate pack about Sofia.

What's the typical real estate agent fee in Sofia in 2026?

As of early 2026, the typical real estate agent fee in Sofia ranges from 2% to 3% of the purchase price, sometimes plus 20% VAT depending on how the agency invoices.

In Sofia, it's common for buyers to pay the agent fee, though arrangements vary and sometimes both buyer and seller pay their respective agents, so you should clarify this before signing anything.

The realistic low-to-high range for agent fees in Sofia runs from about 2% (negotiated rate or smaller agencies) to around 3.5% including VAT (full-service agencies), making agent selection an important cost consideration.

How much do legal checks cost (title, liens, permits) in Sofia?

Legal checks in Sofia, including title search, liens verification, and permits review, typically cost between 200 and 800 BGN (100 to 400 EUR or 110 to 440 USD) when itemized separately, though many lawyers include basic checks in their package fee.

Property valuation fees in Sofia, often required if you're taking a mortgage, generally run between 300 and 700 BGN (150 to 350 EUR or 165 to 385 USD).

The most critical legal check you should never skip in Sofia is the encumbrance and title verification through the Property Register, as this confirms there are no hidden debts, mortgages, or ownership disputes attached to the property.

Buying a property with hidden issues is something we mention in our list of risks and pitfalls people face when buying real estate in Sofia.

Get the full checklist for your due diligence in Sofia

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What hidden or surprise costs should I watch for in Sofia right now?

What are the most common unexpected fees buyers discover in Sofia?

The most common unexpected fees buyers discover in Sofia include mandatory interpreter costs at the notary for non-Bulgarian speakers, extra document retrieval fees for certificates and cadastral extracts, preliminary contract deposits that tie up cash flow, and condominium fund arrears that become your responsibility after purchase.

Yes, you could inherit unpaid property taxes, building maintenance dues, or recorded encumbrances in Sofia if you don't verify these through proper legal checks before completing the purchase.

Scams involving fake listings or fake fees do occur in Sofia, usually following a pattern of pressure, urgency, and demands for deposits before proper verification, so always pay deposits only under a clear written agreement and verify ownership through official channels.

Fees that are usually not disclosed upfront by sellers or agents in Sofia include translation costs, extra certificate fees, and sometimes the true nature of the agent fee arrangement where both parties end up paying.

In our property pack covering the property buying process in Sofia, we go into details so you can avoid these pitfalls.

Are there extra fees if the property has a tenant in Sofia?

Extra costs when buying a tenanted property in Sofia may include 200 to 800 BGN (100 to 400 EUR or 110 to 440 USD) for legal review of the existing lease, potential handover or eviction costs if there are disputes, and administrative effort for rent assignment.

When you buy a tenanted property in Sofia, you generally inherit the existing lease agreement and must honor its terms, including notice periods and tenant rights under Bulgarian law.

Terminating an existing lease immediately after purchase in Sofia is usually not possible unless the lease contract specifically allows it or the tenant agrees, as Bulgarian law protects tenants' rights to the contracted term.

A sitting tenant in Sofia typically affects the property's market value negatively by 5% to 15% and gives buyers more negotiating power, especially if the tenant situation is complicated or the lease terms are unfavorable.

If you want to optimize your rental strategy, you can read our complete guide on how to buy and rent out in Sofia.

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which fees are negotiable, and who really pays what in Sofia?

Which closing costs are negotiable in Sofia right now?

The negotiable closing costs in Sofia include the real estate agent commission (both rate and who pays), the lawyer fee scope and price, and who covers translation and extra certificate costs.

The closing costs that are fixed by law and cannot be negotiated in Sofia include the 3% municipal acquisition tax, the Registry Agency registration fee, and the notary fee which follows an official tariff.

On negotiable fees in Sofia, buyers can typically achieve discounts of 0.5% to 1% on agent commissions through negotiation, and can sometimes get agents to bundle translation or certificate services into their fee.

Can I ask the seller to cover some closing costs in Sofia?

In Sofia, there is a moderate likelihood that sellers will agree to cover some closing costs, especially in a buyer's market or when the property has been listed for a while.

The specific closing costs sellers are most commonly willing to cover in Sofia include sharing agent fees or structuring the deal so each party pays their own agent, and sometimes offering repair credits that effectively offset your out-of-pocket closing costs.

Sellers in Sofia are more likely to accept covering closing costs when the property has been on the market for over 60 days, when it needs renovation, when there are document complications, or during slower market periods.

Is price bargaining common in Sofia in 2026?

As of early 2026, price bargaining is common and expected in Sofia's property market, though how much you can negotiate depends heavily on the property's condition, location, and how long it has been listed.

Buyers in Sofia typically negotiate between 2% and 5% below the asking price in normal situations, and up to 5% to 10% (roughly 10,000 to 20,000 BGN or 5,100 to 10,200 EUR or 5,500 to 11,100 USD on a 200,000 BGN property) when the property has clear drawbacks like no elevator, renovation needs, or complicated documents.

Don't sign a document you don't understand in Sofia

Buying a property over there? We have reviewed all the documents you need to know. Stay out of trouble - grab our comprehensive guide.

What monthly, quarterly or annual costs will I pay as an owner in Sofia?

What's the realistic monthly owner budget in Sofia right now?

A realistic monthly owner budget in Sofia for non-mortgage, non-rent costs typically falls between 300 and 700 BGN (150 to 350 EUR or 165 to 385 USD) for a standard apartment.

The main recurring expense categories that make up this monthly budget in Sofia include building maintenance and common area fees (called "condominium fees"), utilities like electricity, heating, water, and internet, and occasional repair reserves.

The realistic low-to-high range for monthly owner costs in Sofia runs from about 200 BGN (100 EUR or 110 USD) for a small, efficient apartment to over 1,000 BGN (510 EUR or 550 USD) for a larger property in a building with extensive amenities.

The monthly cost that tends to vary the most in Sofia is heating, which can swing dramatically depending on the building's insulation quality, heating system type, and whether you're in a harsh winter month or a mild one.

You can see how this budget affect your gross and rental yields in Sofia here.

What is the annual property tax amount in Sofia in 2026?

As of early 2026, annual property tax in Sofia consists of two main components: the immovable property tax and the household waste fee, which together can range from 200 to 800 BGN (100 to 400 EUR or 110 to 440 USD) annually for a typical apartment depending on its tax valuation.

The realistic low-to-high range for annual property taxes in Sofia runs from about 100 BGN (50 EUR or 55 USD) for a small, lower-valued apartment to over 1,500 BGN (765 EUR or 830 USD) for larger or more valuable properties.

Property tax in Sofia is calculated based on the tax valuation of the property, which considers factors like location, size, construction type, and age, rather than the actual market price you paid.

Some exemptions or reductions on property tax in Sofia may apply for certain categories like primary residences or properties owned by individuals with disabilities, though these are not broadly applicable and require meeting specific conditions.

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of Bulgaria. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

If I rent it out, what extra taxes and fees apply in Sofia in 2026?

What tax rate applies to rental income in Sofia in 2026?

As of early 2026, rental income from property in Sofia is subject to Bulgaria's flat 10% personal income tax rate for individuals.

Landlords in Sofia can deduct certain expenses from rental income, with Bulgarian law providing statutory deductible expense allowances rather than requiring itemized documentation of every expense.

The realistic effective tax rate after deductions for typical landlords in Sofia often works out to around 7% to 9% of gross rental income, depending on how expenses are calculated.

Foreign property owners generally pay the same 10% rental income tax rate as Bulgarian residents, though the mechanics of how the tax is collected and reported may differ based on your residency status and any applicable tax treaties.

Do I pay tax on short-term rentals in Sofia in 2026?

As of early 2026, short-term rental income in Sofia is taxable and may trigger additional compliance requirements including platform reporting obligations and potentially tourist-related registration.

Short-term rental income in Sofia can be taxed similarly to long-term rental income at the 10% rate, but the administrative burden is typically higher due to stricter scrutiny, reporting requirements, and potential local regulations for tourist accommodations.

If you want to optimize your rental strategy, you can read our complete guide on how to buy and rent out in Sofia.

Get to know the market before buying a property in Sofia

Better information leads to better decisions. Get all the data you need before investing a large amount of money. Download our guide.

If I sell later, what taxes and fees will I pay in Sofia in 2026?

What's the total cost of selling as a % of price in Sofia in 2026?

As of early 2026, the total cost of selling a property in Sofia typically ranges from about 2.5% to 4.5% of the sale price.

The realistic low-to-high percentage range for total selling costs in Sofia runs from around 2% if you sell without an agent and have simple paperwork to over 5% if you need extensive legal cleanup or agree to cover more deal costs.

The specific cost categories that typically make up selling expenses in Sofia include the real estate agent commission (2% to 3%), potential capital gains tax (if applicable), notary and administrative fees for the transfer, and any legal fees for document preparation.

The single largest contributor to selling expenses in Sofia is usually the real estate agent commission, which at 2% to 3% of the sale price represents the biggest chunk of most sellers' costs.

What capital gains tax applies when selling in Sofia in 2026?

As of early 2026, capital gains from selling property in Sofia are generally taxed at Bulgaria's flat 10% personal income tax rate when the gain is taxable.

A commonly used exemption from capital gains tax in Sofia applies when you sell one residential property per year that you've owned for more than three years, though specific conditions and limitations apply.

Foreigners do not pay a special surcharge or different capital gains rate when selling property in Sofia, though the mechanics of how tax is collected may differ based on residency status and any applicable tax treaties.

Capital gain in Sofia is calculated as the sale price minus your original purchase price, with potential adjustments for documented improvement costs, and the resulting gain is then subject to the 10% tax if no exemption applies.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Sofia, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why It's Authoritative | How We Used It |

|---|---|---|

| Sofia Municipality Tax Ordinance | Official local government source for Sofia's tax rates. | We used it to confirm Sofia's 3% property acquisition tax rate. We treated it as our anchor for buyer tax budgeting. |

| Registry Agency Tariff | Published by Bulgaria's Registry Agency that collects the fees. | We used it to ground all Property Register and registration fee estimates. We treated it as the definitive state fee document. |

| Notary Chamber Tariff | Official fee schedule from Bulgaria's professional notary body. | We used it to estimate notary costs across different price brackets. We explained why fees rise with property value. |

| Bulgarian VAT Act | Ministry of Finance's published text of the VAT law. | We used it to explain when VAT applies in residential transactions. We clarified VAT treatment for new-builds versus resales. |

| Ministry of Finance Personal Income Tax Overview | Official government overview of Bulgaria's income tax regime. | We used it to frame how Bulgaria taxes individuals and rental income. We kept our tax guidance aligned with official framing. |

| PwC Bulgaria Tax Summaries | Major professional firm with continuously updated tax guidance. | We used it to validate exemptions and practical interpretations. We cross-checked our explanations against practitioner reality. |

| RSM Bulgaria | Established global advisory firm with Bulgaria-specific expertise. | We used it to triangulate capital gains calculations. We reinforced the three-year holding period exemption explanation. |

| Tranio Bulgaria Guide | Long-running international property platform with consistent methodology. | We used it for market-practice ranges on agent and lawyer fees. We treated it as a reality check for what buyers actually pay. |

| Lawfirm.bg | Law firm publication reflecting Bulgarian transaction practice. | We used it to triangulate agent fees and total cost ranges. We validated typical transaction expenses against their guidance. |

| Sofia Municipality Waste Fee Publication | Official municipal publication on household waste fees. | We used it to confirm ongoing owner cost structures. We included it in our annual property tax calculations. |

Get fresh and reliable information about the market in Sofia

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Related blog posts