Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Yes, the analysis of Sofia's property market is included in our pack

This guide breaks down the real numbers behind rental yields in Sofia, covering everything from gross and net returns to neighborhood differences and the costs that eat into your profits.

We constantly update this blog post to reflect the latest market conditions in Bulgaria's capital.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Sofia.

Insights

- Sofia's average gross rental yield sits around 4.5% in early 2026, which is moderate by European standards but still attractive given the city's relatively low property prices averaging around €2,310 per square meter.

- The gap between Sofia's highest and lowest yielding neighborhoods can reach 2 to 3 percentage points, meaning location choice alone can make or break your investment returns.

- Studentski Grad consistently delivers some of Sofia's strongest rental yields due to constant student and young professional demand, often reaching gross yields above 5%.

- District heating costs in Sofia can swing significantly between seasons, and landlords with older, poorly insulated units face utility cost risks that can shave a full percentage point off net yields.

- Leasing commissions in Sofia typically run between half a month and one full month of rent, which creates a meaningful drag on net yields if tenant turnover is frequent.

- Sofia's prestige neighborhoods like Lozenets and Iztok often compress gross yields to the low 4% range or below, as buyers pay premium prices that rents cannot fully justify.

- Metro Line 3 expansion is expected to boost rents in corridors touching Geo Milev, Slatina, and eventually Studentski Grad, making these areas worth watching for yield improvements.

- Studios and one-bedroom apartments in Sofia typically outperform larger units on yield, as rent per square meter is higher for compact spaces favored by students and young workers.

What are the rental yields in Sofia as of 2026?

What's the average gross rental yield in Sofia as of 2026?

As of early 2026, the average gross rental yield for residential property in Sofia is estimated at around 4.5%, which reflects a balance between the city's rising property prices and steady rental demand.

Most typical residential properties in Sofia fall within a gross yield range of roughly 4.0% to 5.5%, depending on property type, condition, and location within the city.

Compared to other European capitals, Sofia's gross yields remain relatively attractive, sitting above cities like Vienna or Prague but below some Eastern European markets with higher perceived risk.

The single most important factor shaping Sofia's gross yields right now is the rapid rise in purchase prices, which reached about €2,310 per square meter by the end of 2025, compressing yields unless rents catch up at a similar pace.

What's the average net rental yield in Sofia as of 2026?

As of early 2026, the average net rental yield in Sofia is estimated at around 3.2%, after accounting for typical landlord expenses like vacancy, maintenance, and management costs.

This means Sofia landlords typically see gross yields reduced by roughly 1.0 to 1.5 percentage points once all recurring costs are factored in, which is a significant gap that many first-time investors underestimate.

The expense category that most significantly reduces gross yield in Sofia is the combination of vacancy friction and re-letting costs, including agency commissions that can run up to one month's rent each time you place a new tenant.

Most standard investment properties in Sofia deliver net yields in the range of 2.6% to 4.0%, with the wide spread reflecting differences in property age, location, tenant turnover rates, and whether the landlord uses professional management.

By the way, you will find much more detailed rent ranges in our property pack covering the real estate market in Sofia.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What yield is considered "good" in Sofia in 2026?

In Sofia's 2026 rental market, a gross yield of 5.0% or higher is generally considered "good" by local investors, as it provides a cushion above the citywide average and allows for a reasonable net return after expenses.

The threshold that typically separates average-performing properties from high-performing ones sits right around that 5% gross mark, since anything below tends to compress net yields into the uncomfortable 2% to 3% territory once costs are deducted, while properties above 5% gross can deliver net returns closer to 4%.

How much do yields vary by neighborhood in Sofia as of 2026?

As of early 2026, gross rental yields in Sofia can vary by roughly 2 to 3 percentage points between the city's highest-yield and lowest-yield neighborhoods, which is a substantial spread that makes location one of the most important investment decisions.

The neighborhoods that typically deliver the highest rental yields in Sofia are working-class and student-heavy areas like Studentski Grad, Lyulin, Nadezhda, and Druzhba, where property prices remain moderate but rental demand stays consistent year-round.

On the other end, neighborhoods like Lozenets, Iztok, Ivan Vazov, and Oborishte tend to deliver the lowest yields in Sofia because prestige pricing pushes purchase costs well above what rents can justify.

The main reason yields vary so much across Sofia's neighborhoods is simply that purchase prices in prime areas run ahead of rents, while in more affordable districts, the rent-to-price ratio stays more favorable for investors.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Sofia.

How much do yields vary by property type in Sofia as of 2026?

As of early 2026, gross rental yields in Sofia range from roughly 3.5% for detached houses and villas up to around 5.5% or more for well-located studios and one-bedroom apartments.

Studios and compact one-bedroom apartments currently deliver the highest average gross rental yields in Sofia because they attract the largest tenant pool, including students, young professionals, and expats, while requiring lower purchase prices relative to the rents they command.

Detached houses and larger villas tend to deliver the lowest average gross yields in Sofia since their higher purchase prices and maintenance costs are rarely offset by proportionally higher rents.

The key reason yields differ between property types in Sofia is that rent per square meter drops as unit size increases, meaning you pay more for space that generates less income per euro invested.

By the way, you might want to read the following:

What's the typical vacancy rate in Sofia as of 2026?

As of early 2026, the typical residential vacancy rate in Sofia is estimated at around 3% to 6%, depending on the property's location, condition, and pricing strategy.

Across Sofia's neighborhoods, vacancy rates can range from as low as 2% to 3% in high-demand student and metro-connected areas, up to 7% or higher for overpriced units or properties in poorly connected locations.

The main factor driving vacancy rates in Sofia right now is the balance between unit quality and asking rent, since the rental market is tight for well-priced, energy-efficient apartments but softer for older stock with high winter utility bills.

Sofia's vacancy rate compares favorably to many European cities, reflecting strong underlying demand from students, young professionals, and a growing expat community in Bulgaria's capital.

Finally please note that you will have all the indicators you need in our property pack covering the real estate market in Sofia.

What's the rent-to-price ratio in Sofia as of 2026?

As of early 2026, the average monthly rent-to-price ratio in Sofia is approximately 0.33% to 0.46%, which translates to an annual ratio of roughly 4.0% to 5.5% depending on property type and neighborhood.

A monthly rent-to-price ratio above 0.40% is generally considered favorable for buy-to-let investors in Sofia, as this directly corresponds to a gross rental yield above 5%, the threshold most local investors target for a "good" return.

Sofia's rent-to-price ratio sits in the middle range compared to other European capitals, offering better returns than cities like Munich or Amsterdam but lower than some higher-risk emerging markets in the region.

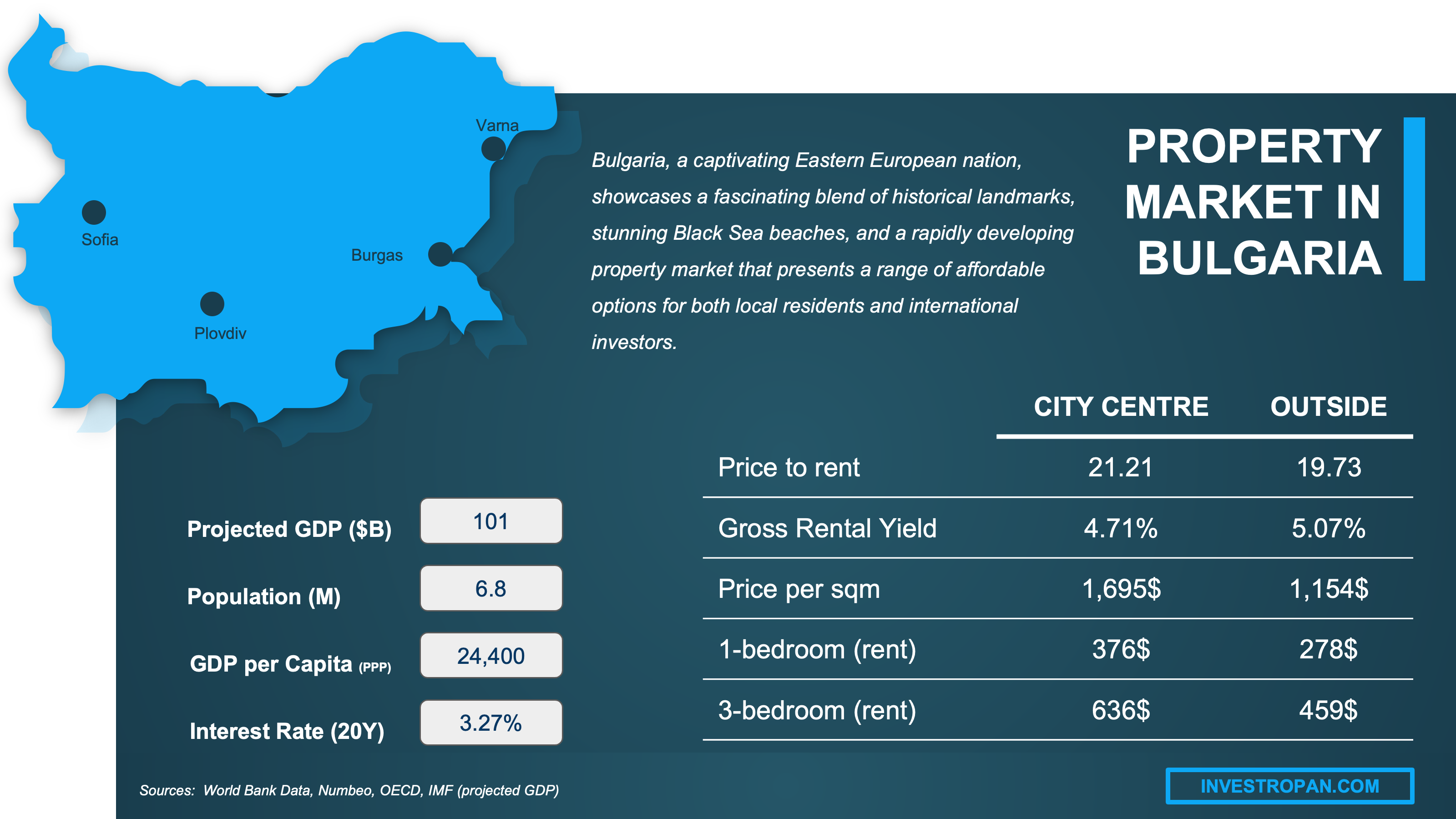

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which neighborhoods and micro-areas in Sofia give the best yields as of 2026?

Where are the highest-yield areas in Sofia as of 2026?

As of early 2026, the highest-yield neighborhoods in Sofia are Studentski Grad, Lyulin, and Druzhba, all of which combine moderate property prices with strong, consistent rental demand from students and working-class tenants.

In these top-performing areas, gross rental yields typically range from around 4.8% to 6.0%, noticeably above Sofia's citywide average of roughly 4.5%.

The main characteristic these high-yield neighborhoods share is value-level pricing combined with structural demand, whether from universities in Studentski Grad, large residential populations in Lyulin, or commuter access to business zones in Druzhba.

You'll find a much more detailed analysis of the areas with high profitability potential in our property pack covering the real estate market in Sofia.

Where are the lowest-yield areas in Sofia as of 2026?

As of early 2026, the lowest-yield neighborhoods in Sofia are Lozenets, Iztok, and Ivan Vazov, where prestige pricing pushes property values well above what rental income can justify.

In these premium areas, gross rental yields typically fall in the range of 3.3% to 4.2%, which sits below Sofia's citywide average and can translate to net yields under 3% after expenses.

The main reason yields are compressed in these Sofia neighborhoods is that buyers pay a "lifestyle premium" for green spaces, embassy proximity, and upscale amenities that tenants are not willing to fully compensate through higher rents.

Buying a property in a low-yield area is one of the mistakes we cover in our list of risks and pitfalls people face when buying property in Sofia.

Which areas have the lowest vacancy in Sofia as of 2026?

As of early 2026, the neighborhoods with the lowest residential vacancy rates in Sofia are Studentski Grad, Mladost, and the Geo Milev/Slatina corridor, where consistent demand from students, workers, and commuters keeps units occupied year-round.

In these low-vacancy areas, vacancy rates typically fall in the range of 2% to 4%, well below Sofia's citywide average of 3% to 6%.

The main demand driver keeping vacancy low in these Sofia neighborhoods is proximity to employment hubs and universities, combined with good metro and public transport connections that make them convenient for a wide range of tenants.

The trade-off investors typically face when targeting these low-vacancy areas is that the most desirable spots within them often command higher purchase prices, which can slightly compress yields even as occupancy stays strong.

Which areas have the most renter demand in Sofia right now?

The neighborhoods experiencing the strongest renter demand in Sofia right now are Mladost, Studentski Grad, and the city Center, where the overlap of jobs, transport, and livable budgets creates persistent competition for available units.

The renter profile driving most of this demand includes young professionals working in Sofia's business parks, university students, and a growing number of expats and remote workers attracted to Bulgaria's low cost of living.

In these high-demand neighborhoods, well-priced rental listings are often filled within one to two weeks, especially for furnished, energy-efficient apartments near metro stations.

If you want to optimize your cashflow, you can read our complete guide on how to buy and rent out in Sofia.

Which upcoming projects could boost rents and rental yields in Sofia as of 2026?

As of early 2026, the top infrastructure projects expected to boost rents in Sofia are the Metro Line 3 extensions, new station additions between Vitosha and Studentski Grad, and ongoing improvements to road and public transport connections in the southern arc of the city.

The neighborhoods most likely to benefit from these projects are Geo Milev, Slatina, Levski, and eventually Studentski Grad, as new metro stations bring significant improvements in commute times that tenants are willing to pay more for.

Once these projects are completed, investors might realistically expect rent increases of 5% to 15% in micro-areas within walking distance of new metro stations, based on how previous station openings have affected nearby rental markets.

You'll find our latest property market analysis about Sofia here.

Get fresh and reliable information about the market in Sofia

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What property type should I buy for renting in Sofia as of 2026?

Between studios and larger units in Sofia, which performs best in 2026?

As of early 2026, studios and one-bedroom apartments are the better-performing unit type in Sofia in terms of both rental yield and occupancy rates, thanks to strong demand from students, young professionals, and single tenants.

Studios in Sofia typically deliver gross rental yields in the range of 5.0% to 6.0% (roughly 9.8% to 11.8% in BGN terms, or $5.40 to $6.50 per $100 invested in USD), while larger two and three-bedroom units often fall to 4.0% to 4.8%.

The main factor explaining this difference is that rent per square meter drops as unit size increases in Sofia, so smaller units generate more income relative to their purchase price.

However, larger units might be the better investment choice if you're targeting families relocating to Sofia for work or expats seeking more space, since these tenants often sign longer leases and have lower turnover.

What property types are in most demand in Sofia as of 2026?

As of early 2026, the most in-demand property type in Sofia is the furnished, energy-efficient one-bedroom or two-bedroom apartment located near metro stations or major employment areas.

The top three property types ranked by current tenant demand in Sofia are compact one-bedroom apartments, practical two-bedroom units with efficient layouts, and well-maintained studios in student or young professional neighborhoods.

The primary trend driving this demand pattern is Sofia's growing population of young professionals, students, and remote workers who prioritize location, low utility bills, and turnkey living over extra space.

One property type currently underperforming in demand is the large, poorly insulated apartment in older panel blocks, which struggles to attract tenants due to high winter heating costs and dated interiors.

What unit size has the best yield per m² in Sofia as of 2026?

As of early 2026, the unit size range that delivers the best gross rental yield per square meter in Sofia is approximately 35 to 60 square meters, which covers studios and compact one-bedroom apartments.

For this optimal unit size in Sofia, typical gross rental yields run around 5.0% to 6.0% annually, translating to roughly BGN 9.8 to 11.8 per BGN 100 invested, €5.00 to €6.00 per €100, or $5.40 to $6.50 per $100 USD.

Smaller units below 35 square meters sometimes face regulatory or financing constraints, while larger units above 60 square meters see diminishing returns because tenants are not willing to pay proportionally more rent for extra space in Sofia's rental market.

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in Sofia.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

What costs cut my net yield in Sofia as of 2026?

What are typical property taxes and recurring local fees in Sofia as of 2026?

As of early 2026, the annual property tax for a typical rental apartment in Sofia ranges from roughly BGN 200 to BGN 600 (approximately €100 to €300 or $110 to $325 USD), depending on the property's assessed value and location within the municipality.

Beyond property tax, Sofia landlords must also budget for the municipal waste fee, which is transitioning to a "polluter pays" model in 2026, and potentially building association fees that cover common area maintenance in apartment complexes.

In total, these taxes and fees typically represent around 2% to 4% of gross rental income for a standard Sofia investment property, making them a meaningful but not dominant cost category.

By the way, we cover all the hidden fees and taxes in our property pack covering the real estate market in Sofia.

What insurance, maintenance, and annual repair costs should landlords budget in Sofia right now?

Annual landlord insurance for a typical rental property in Sofia costs approximately BGN 300 to BGN 800 (roughly €150 to €400 or $165 to $435 USD), covering basic property and liability protection.

For maintenance and repairs, Sofia landlords should budget around 0.8% to 1.2% of property value annually for apartments, or 1.0% to 1.8% for houses and townhouses, which accounts for routine upkeep and periodic repairs.

The type of repair expense that most commonly catches Sofia landlords off guard is heating system failures in winter, particularly in older buildings on district heating, where boiler repairs or radiator replacements can be urgent and costly.

In total, landlords should realistically budget BGN 2,000 to BGN 5,000 annually (approximately €1,000 to €2,500 or $1,100 to $2,700 USD) for the combined costs of insurance, maintenance, and repairs on a typical Sofia rental property.

Which utilities do landlords typically pay, and what do they cost in Sofia right now?

In most long-term Sofia rentals, tenants pay their own consumption utilities like electricity, heating, and water, while landlords typically cover common-area electricity, elevator maintenance, and building cleaning through monthly association fees.

For the landlord-paid portion, monthly costs in a typical Sofia apartment building run approximately BGN 50 to BGN 150 (roughly €25 to €75 or $27 to $80 USD), though this varies based on building size and amenities.

What does full-service property management cost, including leasing, in Sofia as of 2026?

As of early 2026, full-service property management fees in Sofia typically run around 8% to 12% of monthly rent collected, which covers rent collection, tenant communication, and coordination of maintenance and repairs.

On top of ongoing management, leasing or tenant-placement fees in Sofia usually cost between half a month and one full month of rent each time a new tenant is placed, translating to roughly BGN 400 to BGN 1,200 (€200 to €600 or $220 to $650 USD) depending on the rental rate.

What's a realistic vacancy buffer in Sofia as of 2026?

As of early 2026, Sofia landlords should set aside approximately 4% to 8% of annual rental income as a vacancy buffer, which translates to roughly two to four weeks of potential vacancy per year.

In practice, well-located and correctly priced Sofia rental properties experience closer to two to three weeks of vacancy annually, while properties in weaker locations or with above-market rents may see four to six weeks or more between tenants.

Buying real estate in Sofia can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Sofia, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| National Statistical Institute (NSI) - House Price Index | It's Bulgaria's official producer of housing price statistics with a published methodology. | We use it to anchor price movements in Sofia (new vs. existing dwellings) in a way that's comparable over time. We then layer market price levels from major brokers on top to translate index changes into price per square meter reality. |

| Eurostat - Compliance Review of Bulgaria's HPI | Eurostat audits how official HPIs are compiled, which is a strong quality check. | We use it to validate that Bulgaria's official HPI follows EU rules and good statistical practice. We reference it when explaining why we trust NSI's index for triangulation. |

| NSI - Inflation & CPI Releases | It's the official inflation release, which includes housing-related price movements. | We use it to contextualize rent growth vs. overall inflation pressures. We then sanity-check whether asking-rent changes look plausible relative to the broader price environment. |

| NSI - CPI/HICP Statistical Portal | This is NSI's official gateway to Bulgaria's consumer price datasets. | We use it as the official home for rent-related inflation series. We use those movements as a cross-check against portal asking rents. |

| European Commission - Sofia Metro Line 3 Project | It's an EU-level project page tied to official funding and scope. | We use it to ground upcoming infrastructure claims in something verifiable. We then link the likely rent impact to neighborhoods touched by new stations. |

| Metro Sofia - Expansion News | It's the official metro operator describing works and planned stations. | We use it to identify which corridors and micro-areas are likely to get a demand boost. We then translate that into where rents may tighten first. |

| Toplofikatsiya Sofia - Official Heat Price Page | It's the district heating utility publishing regulated tariffs for Sofia. | We use it to estimate landlord-paid heating and hot-water cost risk in buildings on district heating. We include it in the net-yield cost stack, especially for older stock. |

| KEVR/EWRC - Energy & Water Regulator | It's the regulator that approves household energy and heating tariffs. | We use it as the authoritative anchor that tariffs are regulated and periodically reset. We pair it with press coverage of specific decisions for timing and magnitude. |

| Bulgarian Telegraph Agency (BTA) - Tariff Decision Coverage | BTA is Bulgaria's national news agency and usually reports directly from regulator briefings. | We use it to pin down the regulatory period and direction of heating-price changes. We then translate that into a realistic utilities buffer for net yields. |

| The Sofia Globe - Electricity Price Coverage | It's a long-running English-language outlet that clearly cites the regulator and dates. | We use it as a practical summary of what changed and when for electricity costs. We then include electricity as a landlord cost only where it's customarily paid by the owner. |

| National Revenue Agency (NRA) | It's the tax authority that governs rental-income declarations and payments. | We use it as the top-level authoritative reference for tax administration. We then keep tax assumptions conservative in the net-yield model and flag where professional tax advice matters. |

| Global Property Guide - Sofia Rents & Yields Dataset | It's a well-known cross-country real-estate data publisher with a transparent asking price plus asking rent yield method. | We use it for a consistent, neighborhood-specific gross yield benchmark in Sofia. We then triangulate it against local broker commentary and Sofia price levels to produce a 2026 estimate. |

| Global Property Guide - Sofia Asking Rents | It's the companion rent table to the yields dataset, using a consistent portal-driven approach. | We use it to anchor typical asking rent by unit type in Sofia. We then adjust for 2026 positioning with a conservative rent-growth assumption. |

| Bulgarian Properties - Sofia Market Snapshot | It's a large, established brokerage that publishes market commentary with concrete numbers. | We use it to translate Sofia prices into a usable price per square meter level for 2026 framing. We then combine it with asking rents to compute rent-to-price ratios and yields. |

| Bulgarian Properties - Published Fees/Commissions | It's a transparent fee schedule from a major market participant. | We use it to anchor leasing-commission assumptions. We then convert half or full month commission into an annualized yield drag based on expected tenant turnover. |

| Sofia Municipality - Taxes and Rents Guide | It's the official municipal resource for understanding local taxes and fees in Sofia. | We use it to verify property tax and municipal fee structures. We then incorporate these costs into our net yield calculations. |

| Novinite - Rental Market Analysis | It's a major Bulgarian news outlet with direct insights from leading property portals. | We use it to validate rental demand patterns and market tightness in Sofia. We then factor these demand signals into our vacancy and occupancy estimates. |

| Lexology - Bulgaria Waste Fee Reform | It's a legal analysis platform covering Bulgaria's shift to polluter-pays waste collection fees. | We use it to flag upcoming changes to municipal fee structures in 2026. We then note this as a potential cost factor for landlords to monitor. |

Get the full checklist for your due diligence in Sofia

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

Related blog posts