Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Everything you need to know before buying real estate is included in our Bulgaria Property Pack

If you're exploring buy-to-let investments in Bulgaria, understanding rental yields is essential before you commit your money.

This guide breaks down what landlords actually earn in Bulgaria in 2026, from gross and net yields to neighborhood-level differences and the costs that eat into your returns.

We constantly update this blog post to reflect the latest market conditions and data.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Bulgaria.

What are the rental yields in Bulgaria as of 2026?

What's the average gross rental yield in Bulgaria as of 2026?

As of early 2026, the average gross rental yield in Bulgaria is around 4.6% per year, which means landlords typically collect about 4.6% of their property's value in annual rent before any expenses.

Most residential properties across Bulgaria fall within a gross yield range of 3.5% to 6.5%, with the higher end concentrated in affordable, high-demand urban districts and smaller unit types.

This puts Bulgaria roughly in line with other Central and Eastern European markets, where yields tend to be higher than in Western Europe but have been compressing as property prices climb faster than rents.

The single biggest factor shaping Bulgaria's gross yields right now is the rapid property price growth seen in 2024 and 2025, which has outpaced rent increases and mechanically pushed yields downward even as the rental market stays healthy.

What's the average net rental yield in Bulgaria as of 2026?

As of early 2026, the average net rental yield in Bulgaria is approximately 3.2% per year, which is what remains after subtracting vacancy, management, taxes, and maintenance from your gross rental income.

The typical gap between gross and net yields in Bulgaria is about 1.2 to 1.5 percentage points, meaning landlords lose roughly a quarter to a third of their gross income to operating costs.

Property management fees tend to be the single largest expense category for Bulgaria landlords, especially those who use full-service agencies charging 8% to 10% of monthly rent plus tenant-placement fees.

Realistic net yields across standard investment properties in Bulgaria range from 2.2% to 4.8%, with the variation driven mainly by whether you self-manage, how much your building charges in common fees, and how well you control vacancy.

By the way, you will find much more detailed rent ranges in our property pack covering the real estate market in Bulgaria.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What yield is considered "good" in Bulgaria in 2026?

Local investors in Bulgaria generally consider a gross rental yield of 5.5% or higher to be "good" in early 2026, since this comfortably beats the national average and provides a meaningful cushion above holding costs.

The threshold that separates average-performing properties from high-performing ones sits around 6% to 6.5% gross, and anything above that range is typically found only in specific working-class districts or with smaller unit types that command premium rent per square meter.

How much do yields vary by neighborhood in Bulgaria as of 2026?

As of early 2026, the spread in gross rental yields between the highest-yield and lowest-yield neighborhoods in Bulgaria's major cities can easily reach 2.5 to 3 percentage points, which means your location choice can matter more than almost any other investment decision.

The highest rental yields in Bulgaria typically come from neighborhoods with strong renter demand but moderate property prices, such as Studentski Grad, Lyulin, and Druzhba in Sofia, or Trakia and Kichuk Parizh in Plovdiv, where gross yields often reach 5.5% to 6.5%.

The lowest yields appear in premium, lifestyle-driven neighborhoods like Lozenets, Iztok, and Oborishte in Sofia, or Kapana in Plovdiv, where buyers pay a prestige premium that rents simply don't match, pushing gross yields down to 3% to 4%.

The main reason yields vary so much across Bulgaria's neighborhoods is that property prices reflect lifestyle desirability and capital appreciation expectations, while rents reflect tenant budgets and practical needs, and these two forces don't move in lockstep.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Bulgaria.

How much do yields vary by property type in Bulgaria as of 2026?

As of early 2026, gross rental yields in Bulgaria range from around 3% for large premium apartments and houses up to 6.4% for well-located studios and one-bedroom units, which is a substantial spread that makes property type selection a key yield driver.

Studios and one-bedroom apartments currently deliver the highest average gross rental yields in Bulgaria, typically falling between 5.2% and 6.4%, because smaller units command the strongest rent per square meter and attract the deepest tenant pool of students, young professionals, and relocators.

Large apartments with three or more bedrooms and houses or townhouses tend to deliver the lowest gross yields in Bulgaria, usually ranging from 3% to 4.5%, because their higher purchase prices are not matched by proportionally higher rents.

The key reason yields differ between property types in Bulgaria is that rent scales slowly with size while purchase prices scale faster, so the math naturally favors compact, efficient units in high-demand locations.

By the way, you might want to read the following:

What's the typical vacancy rate in Bulgaria as of 2026?

As of early 2026, the typical residential vacancy rate for long-term rentals in Bulgaria's major cities like Sofia, Plovdiv, Varna, and Burgas sits around 5%, which translates to roughly one month of lost rent per year for a well-priced unit.

Vacancy rates across different Bulgarian neighborhoods realistically range from 3% in high-demand areas with strong employment anchors to 8% or more in seasonal markets or where landlords overprice their units.

The main factor driving vacancy rates in Bulgaria right now is pricing discipline, because overpriced units create "invisible vacancy" that can stretch turnover gaps far beyond normal market friction.

Bulgaria's big-city vacancy rates are broadly comparable to other Central European capitals, though the national housing stock includes many structurally vacant dwellings in depopulating regions that don't reflect the investable urban rental market.

Finally please note that you will have all the indicators you need in our property pack covering the real estate market in Bulgaria.

What's the rent-to-price ratio in Bulgaria as of 2026?

As of early 2026, the average rent-to-price ratio in Bulgaria is approximately 0.38% per month, meaning if you buy a property for 100,000 EUR, you can expect to collect around 380 EUR in monthly rent before expenses.

A rent-to-price ratio above 0.45% per month (equivalent to roughly 5.5% gross annual yield) is generally considered favorable for buy-to-let investors in Bulgaria, since it provides enough margin to cover costs and still generate meaningful cash flow.

Bulgaria's rent-to-price ratio is competitive compared to Western European cities where ratios often fall below 0.3%, but it has been compressing as property prices surge, making it important to target the right neighborhoods to achieve strong returns.

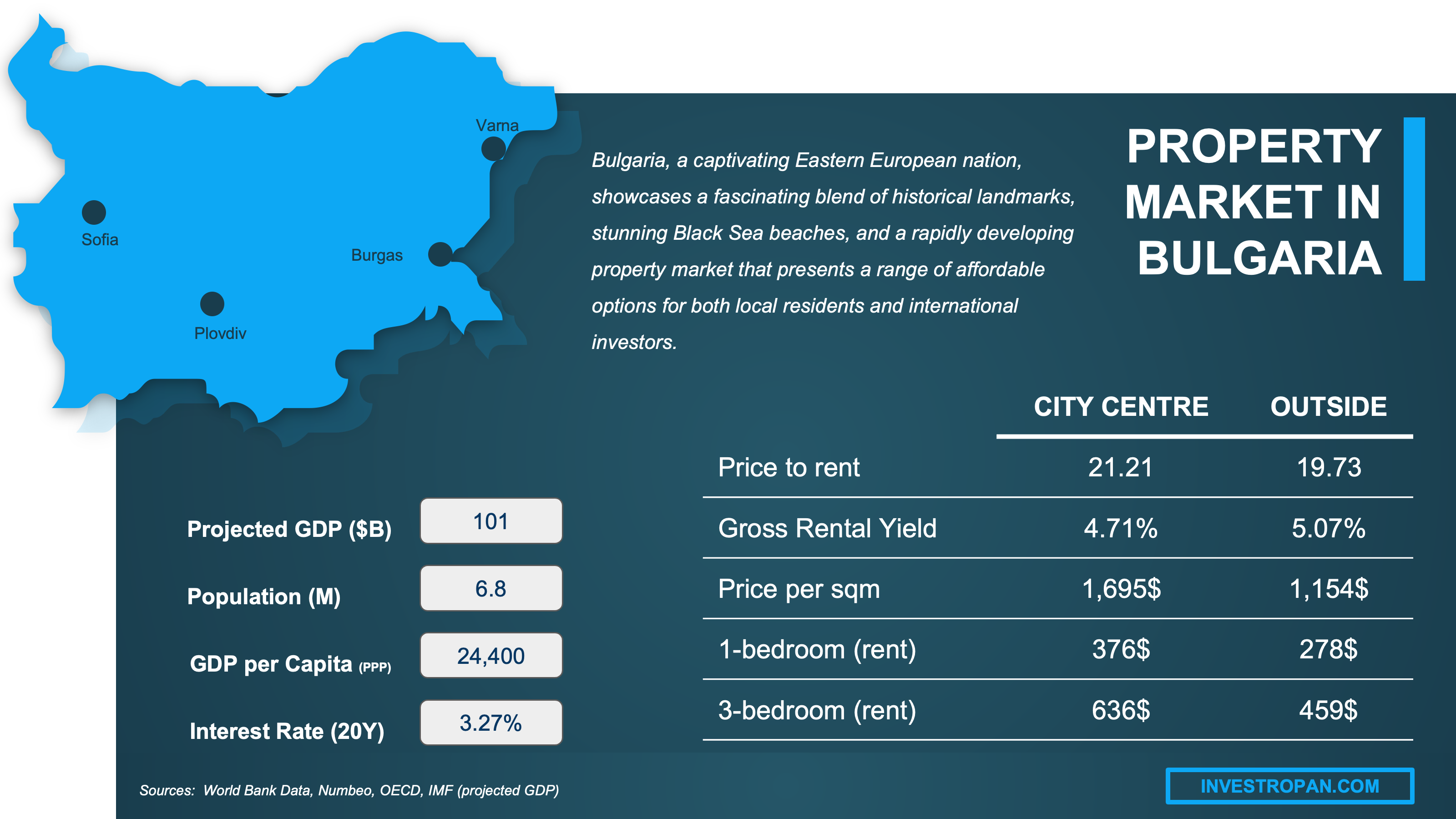

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which neighborhoods and micro-areas in Bulgaria give the best yields as of 2026?

Where are the highest-yield areas in Bulgaria as of 2026?

As of early 2026, the top highest-yield neighborhoods in Bulgaria include Studentski Grad and Lyulin in Sofia, Trakia in Plovdiv, and Vladislav Varnenchik in Varna, all of which combine strong tenant demand with relatively affordable purchase prices.

In these high-performing areas, gross rental yields typically range from 5.5% to 6.5%, with Studentski Grad often reaching the upper end due to constant student and young professional demand, and Trakia benefiting from industrial employment nearby.

The main characteristic these high-yield neighborhoods share is that they serve practical, employment-driven or education-driven tenant bases rather than lifestyle buyers, which keeps prices grounded while rents stay firm.

You'll find a much more detailed analysis of the areas with high profitability potential in our property pack covering the real estate market in Bulgaria.

Where are the lowest-yield areas in Bulgaria as of 2026?

As of early 2026, the lowest-yield neighborhoods in Bulgaria include Lozenets, Iztok, and Oborishte in Sofia, along with Kapana in Plovdiv and Chayka in Varna, where buyers pay premium prices for prestige locations.

In these low-yield areas, gross rental yields typically range from 3% to 4%, which can make cash flow tight or even negative once you factor in management, taxes, and vacancy.

The main reason yields are compressed in these Bulgaria neighborhoods is that property prices reflect capital appreciation expectations and lifestyle desirability, but tenants are not willing to pay proportionally higher rents for the same prestige factors that drive purchase prices.

Buying a property in a low-yield area is one of the mistakes we cover in our list of risks and pitfalls people face when buying property in Bulgaria.

Which areas have the lowest vacancy in Bulgaria as of 2026?

As of early 2026, the neighborhoods with the lowest residential vacancy rates in Bulgaria include Studentski Grad and Mladost in Sofia, Trakia in Plovdiv, and Briz in Varna, where continuous tenant demand keeps units filled.

In these low-vacancy areas, vacancy rates typically stay in the 3% to 4% range, meaning landlords lose less than two weeks of rent per year to turnover gaps if they price correctly.

The main demand driver keeping vacancy low in these Bulgaria neighborhoods is proximity to major employment centers, universities, or metro stations that create a constant inflow of renters who need practical, well-connected housing.

The trade-off investors typically face when targeting these low-vacancy areas is that strong demand often gets priced in, so you may sacrifice some gross yield in exchange for the security of consistent occupancy and fewer tenant-search headaches.

Which areas have the most renter demand in Bulgaria right now?

The neighborhoods currently experiencing the strongest renter demand in Bulgaria are Studentski Grad and Mladost in Sofia, Trakia in Plovdiv, and the city center areas of Varna, where jobs, universities, and transit access concentrate.

The tenant profiles driving most of this demand include young professionals relocating for tech and business park jobs, university students, and families seeking affordable housing near schools and employment nodes.

In these high-demand Bulgaria neighborhoods, well-priced rental listings typically get filled within one to three weeks, compared to a month or more in slower markets or for overpriced units.

If you want to optimize your cashflow, you can read our complete guide on how to buy and rent out in Bulgaria.

Which upcoming projects could boost rents and rental yields in Bulgaria as of 2026?

As of early 2026, the top infrastructure projects expected to boost rents in Bulgaria include Sofia's metro expansion toward Slatina and Sofia Tech Park, continued growth at Plovdiv's Trakia Economic Zone, and Varna Airport's development pipeline.

The neighborhoods most likely to benefit from these projects include Slatina, Geo Milev, and parts of Mladost in Sofia, Trakia and Kichuk Parizh in Plovdiv, and central Varna and Levski near improved airport connectivity.

Investors might realistically expect rent increases of 5% to 15% in affected neighborhoods once these projects complete, though the timeline varies and the biggest gains typically come to those who buy before infrastructure improvements are fully priced in.

You'll find our latest property market analysis about Bulgaria here.

Get fresh and reliable information about the market in Bulgaria

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What property type should I buy for renting in Bulgaria as of 2026?

Between studios and larger units in Bulgaria, which performs best in 2026?

As of early 2026, studios and one-bedroom apartments perform best in Bulgaria in terms of both rental yield and occupancy, making them the preferred choice for investors focused on cash flow.

Studios in Bulgaria typically deliver gross yields of 5.2% to 6.4% (around 250 to 450 EUR or 300 to 500 USD monthly rent), while larger two-bedroom units yield 4.3% to 5.5% (350 to 600 EUR or 400 to 650 USD monthly rent), showing a clear advantage for smaller formats.

The main factor explaining this outperformance is that rent per square meter is highest for compact units, and the tenant pool of students, young professionals, and singles is simply larger and more active than the family renter segment.

However, larger two-bedroom units can be the better investment choice if you're targeting families or couples who tend to stay longer, reducing turnover costs and providing more stable, predictable income even at slightly lower yields.

What property types are in most demand in Bulgaria as of 2026?

As of early 2026, the most in-demand property type for long-term rentals in Bulgaria is the one-bedroom apartment, which hits the sweet spot between affordability for tenants and yield potential for landlords.

The top three property types ranked by current tenant demand in Bulgaria are one-bedroom apartments, studios, and modern two-bedroom apartments with parking or easy transit access, in that order.

The primary trend driving this demand pattern is Bulgaria's ongoing urbanization and the growth of young professional employment in Sofia and Plovdiv, where single renters and couples need practical, well-located housing rather than large family homes.

One property type currently underperforming in demand and likely to remain so is the large detached house or villa in urban areas, where the tenant pool is too small and niche to ensure consistent occupancy at yields that justify the higher purchase price.

What unit size has the best yield per m² in Bulgaria as of 2026?

As of early 2026, the unit size range that delivers the best gross rental yield per square meter in Bulgaria is 35 to 55 square meters, which covers studios and compact one-bedroom apartments.

For this optimal size, the typical gross rental yield per square meter works out to roughly 8 to 12 EUR (15 to 25 BGN or 9 to 13 USD) per month, which is significantly higher than what larger units achieve per square meter.

The main reason smaller units deliver better yield per square meter is that tenants pay for livable space rather than extra rooms, so a 30-square-meter studio can rent for 60% to 70% of what a 60-square-meter apartment commands, effectively doubling the rent efficiency.

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in Bulgaria.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

What costs cut my net yield in Bulgaria as of 2026?

What are typical property taxes and recurring local fees in Bulgaria as of 2026?

As of early 2026, the annual property tax for a typical rental apartment in Bulgaria usually ranges from 50 to 150 BGN (25 to 75 EUR or 30 to 85 USD), depending on the municipality and the property's tax valuation.

Beyond property tax, Bulgaria landlords must also budget for the annual waste collection fee, which typically adds another 100 to 350 BGN (50 to 175 EUR or 55 to 190 USD) per year, bringing the combined recurring local fees to roughly 150 to 500 BGN annually.

These taxes and fees typically represent just 1% to 3% of gross rental income in Bulgaria, making them one of the smallest cost categories for landlords, though they still need to be factored into net yield calculations.

By the way, we cover all the hidden fees and taxes in our property pack covering the real estate market in Bulgaria.

What insurance, maintenance, and annual repair costs should landlords budget in Bulgaria right now?

Annual landlord insurance for a typical rental apartment in Bulgaria costs approximately 150 to 400 BGN (75 to 200 EUR or 85 to 220 USD), with houses requiring higher coverage due to greater exposure.

For maintenance and repairs, Bulgaria landlords should budget around 0.5% to 1% of the property's value per year, which works out to roughly 500 to 1,500 BGN (250 to 750 EUR or 275 to 825 USD) annually for an average apartment.

The repair expense that most commonly catches Bulgaria landlords off guard is building common-area fees in newer managed complexes, which can run 50 to 200 BGN (25 to 100 EUR) per month and are often underestimated when calculating returns.

In total, landlords should realistically budget 800 to 2,000 BGN (400 to 1,000 EUR or 450 to 1,100 USD) per year for combined insurance, maintenance, and repairs on a typical Bulgaria rental property.

Which utilities do landlords typically pay, and what do they cost in Bulgaria right now?

In most long-term Bulgaria rentals, tenants pay for electricity, water, heating, and internet directly, while landlords typically cover only the building's common-area fees and sometimes arrange internet for furnished or corporate lets.

If a Bulgaria landlord does include utilities in the rent, which is more common for expat or corporate tenants, the monthly cost for a typical apartment runs approximately 150 to 350 BGN (75 to 175 EUR or 85 to 190 USD), depending on consumption and whether district heating is used.

What does full-service property management cost, including leasing, in Bulgaria as of 2026?

As of early 2026, full-service property management in Bulgaria typically costs 8% to 10% of monthly rent, which translates to roughly 40 to 80 BGN (20 to 40 EUR or 22 to 45 USD) per month for an average-priced rental apartment.

On top of ongoing management, Bulgaria agencies usually charge a tenant-placement or leasing fee equivalent to about one month's rent, which works out to 400 to 800 BGN (200 to 400 EUR or 220 to 440 USD) each time a new tenant is found.

What's a realistic vacancy buffer in Bulgaria as of 2026?

As of early 2026, landlords in Bulgaria should set aside approximately 8% of annual rental income as a vacancy buffer, which accounts for the typical one month of vacancy per year in major cities.

In practice, this means Bulgaria landlords experience roughly three to five weeks of vacancy per year on average, though well-priced units in high-demand areas like Studentski Grad or Mladost often stay vacant for less than two weeks between tenants.

Buying real estate in Bulgaria can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Bulgaria, we always rely on the strongest methodology we can, and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| National Statistical Institute (NSI) - Housing Price Statistics | Bulgaria's official statistics office provides the cleanest baseline for tracking how property prices have actually moved. | We used NSI's house price indices to anchor the direction and pace of price changes through 2025. We then stress-tested our yield estimates against the "prices rose faster than rents" scenario these indices implied. |

| NSI - House Price Index Methodology | This explains exactly how Bulgaria's official house price index is built, which matters when using it as a backbone for analysis. | We used it to confirm what the HPI covers, including both new and existing dwelling transactions. We relied on it to keep our assumptions consistent with NSI's scope and frequency. |

| Eurostat - Bulgaria HPI Compliance Report | Eurostat is the EU's top statistical authority, and this document validates Bulgaria's HPI compilation process. | We used it as an external quality check that NSI's HPI follows EU statistical standards. We also used it to justify treating NSI's price trend as the most credible official reference. |

| BIS / FRED - Bulgaria Residential Property Prices | This republishes BIS data in a standardized, transparent format that's easy to verify and cite. | We used it as a second independent price series to triangulate NSI's story. We mainly used it to confirm that 2024-2025 price acceleration wasn't a single-source artifact. |

| Eurostat / FRED - HICP Actual Rentals (Bulgaria) | This is Eurostat's official rent inflation data distributed through a reputable public data portal. | We used it to anchor rent inflation when projecting 2026 rent levels. We also used it to justify yield compression when prices rise faster than rents. |

| Ministry of Finance - Immovable Property Tax | It's an official government source stating the legal tax-rate ranges and rules in plain terms. | We used it to estimate annual property tax as a cost drag on net yield. We also used it to explain why Bulgaria's holding taxes are typically not the main yield killer. |

| Ministry of Finance - Personal Income Tax | It's the government's official page explaining how personal income tax works in Bulgaria. | We used it to frame rental-income taxation as part of the net-yield calculation. We used it alongside PwC's tax guide to translate the rules into a landlord-friendly estimate. |

| Local Taxes and Fees Act (Official Translation) | This is the primary legal text for municipal property taxes and fees in Bulgaria. | We used it to confirm that municipalities set rates within statutory ranges. We then used it to justify giving net-yield ranges since exact rates depend on the municipality. |

| Sofia Municipality - Local Taxes Portal | It's the official municipal portal for Bulgaria's largest rental market. | We used it as a practical reference for how owners interact with local taxes and fees. We used Sofia as the typical big-city example because it dominates rental demand. |

| PwC Worldwide Tax Summaries - Bulgaria | PwC is a top-tier tax firm and this is a maintained reference guide with clear scope notes. | We used it to translate Bulgaria's personal tax structure into usable landlord assumptions. We used it to cross-check that our rental-income tax treatment is directionally correct. |

| Energo-Pro Sales - Household Electricity Prices | It's a major regulated supplier publishing tariff components tied to the regulator's decisions. | We used it to ground utility-cost discussion in a verifiable tariff source. We used it to explain why landlords typically avoid including utilities in long-term rents. |

| Energy and Water Regulatory Commission (EWRC) | It's Bulgaria's national utility regulator and the authoritative backstop for regulated tariffs. | We used it to support that household energy prices are regulator-set in the regulated segment. We used it to keep utility cost estimates within plausible bounds. |

| Bulgarian Properties - Market Insights | It's a long-running national brokerage and research publisher with named experts and repeatable reporting. | We used it for level-setting on Sofia pricing and market context heading into 2026. We triangulated it with portal pricing to avoid relying on a single private source. |

| Imoti.net - Price Statistics | It's one of Bulgaria's biggest property portals, with statistics derived from large listing volumes. | We used it to compare relative yield differences by neighborhood. We treated it as market asking data and cross-checked the direction with other sources. |

| Imot.bg - Average Prices by Neighborhood | It's another major national portal with neighborhood-level statistics that Bulgarians actually watch. | We used it specifically for Sofia micro-area examples. We used it as a second portal to cross-validate neighborhood price dispersion. |

| Global Property Guide - Bulgaria Rental Yields | It's a well-known international property data publisher showing yield snapshots and city comparisons. | We used it as an external benchmark for Bulgaria's gross yield level. We cross-checked it against portal-based rent and price ratios to keep our 2026 estimate realistic. |

| Global Property Guide - Sofia Asking Rents | It clearly states it uses local portals and updates on a defined schedule, making it auditable. | We used it to sanity-check typical asking rent levels in our rent-to-price calculations. We treated it as a rent level reference rather than an official statistic. |

| BTA - Sofia Metro Expansion | BTA is Bulgaria's national news agency and typically reports directly from official statements. | We used it to identify concrete infrastructure timelines that can shift renter demand. We used it to support upcoming projects tied to specific Sofia neighborhoods. |

| Trakia Economic Zone | It's the official platform for Bulgaria's largest industrial cluster, directly relevant to Plovdiv renter demand. | We used it to justify sustained employment-driven rental demand in Plovdiv's industrial-adjacent districts. We used it to tie demand growth to a real economic anchor. |

| Varna Airport - Future Projects | It's an official airport source, so the project pipeline is verifiable. | We used it as an example of infrastructure investment reinforcing Varna's employment and connectivity. We used it to support why some Varna districts can see firmer rents. |

| ECB Data Portal - Structural Housing Indicators | The European Central Bank provides standardized housing indicator definitions used across the EU. | We used it to anchor vacancy rate concepts and ensure our definitions align with international standards. We applied these frameworks to Bulgaria's specific market conditions. |

Get the full checklist for your due diligence in Bulgaria

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.