Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Everything you need to know before buying real estate is included in our Bulgaria Property Pack

Bulgaria just adopted the euro in January 2026, which has made the real estate market more accessible to foreign buyers and removed currency risk for eurozone investors.

In this article, we cover the current housing prices in Bulgaria, how fast properties sell, where prices are rising fastest, and what mistakes buyers commonly make.

We constantly update this blog post as the Bulgarian property market evolves throughout 2026.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Bulgaria.

How's the real estate market going in Bulgaria in 2026?

What's the average days-on-market in Bulgaria in 2026?

As of early 2026, the estimated average days-on-market for residential properties in Bulgaria is around 60 days, though this varies significantly between Sofia (around 45 days) and smaller cities or resort areas (75 to 120 days).

In reality, most typical listings in Bulgaria sell within a range of 40 to 90 days, with well-priced apartments in Sofia's popular districts like Lozenets, Mladost, or near metro stations often moving faster.

Compared to one or two years ago, properties in Bulgaria are selling at a similar pace or slightly faster, because mortgage rates remain near historic lows (around 2.5% for local buyers) and buyer demand has stayed strong ahead of and following euro adoption.

Are properties selling above or below asking in Bulgaria in 2026?

As of early 2026, the estimated average sale-to-asking price ratio for residential properties in Bulgaria is around 97%, meaning most homes sell about 3% below their initial asking price.

Roughly 10 to 15% of properties in Bulgaria sell at or above asking price, while the majority sell slightly below, and we are moderately confident in this estimate because it aligns with the strong but not overheated market conditions observed in official house price index data.

Properties most likely to see bidding wars and above-asking sales in Bulgaria are renovated two-bedroom apartments near Sofia metro stations, new builds in Plovdiv's Kapana district, and sea-view units in Varna's Briz or Chayka neighborhoods.

By the way, you will find much more detailed data in our property pack covering the real estate market in Bulgaria.

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of Bulgaria. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

What kinds of residential properties can I realistically buy in Bulgaria?

What property types dominate in Bulgaria right now?

The estimated breakdown of residential property types available for sale in Bulgaria is roughly 70% apartments, 20% houses and villas, and 10% rural properties and land plots.

Apartments in multi-family buildings represent the largest share of the Bulgarian real estate market, especially in Sofia, Plovdiv, Varna, and Burgas where urban density is highest.

Apartments became so prevalent in Bulgaria because of mass housing construction during the communist era (the famous "panel" buildings), followed by intensive new apartment development in city centers and suburbs since EU accession in 2007.

If you want to know more, you should read our dedicated analyses:

Are new builds widely available in Bulgaria right now?

The estimated share of new-build properties among all residential listings in Bulgaria is around 25 to 35%, with particularly high concentrations in the major cities where construction activity has been intense.

As of early 2026, the neighborhoods with the highest concentration of new-build developments in Bulgaria include Sofia's Krustova Vada, Manastirski Livadi, and Mladost districts, Plovdiv's Trakiya and southern suburbs, and Varna's Vinitsa and Briz areas.

Get fresh and reliable information about the market in Bulgaria

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Which neighborhoods are improving fastest in Bulgaria in 2026?

Which areas in Bulgaria are gentrifying in 2026?

As of early 2026, the top neighborhoods in Bulgaria showing the clearest signs of gentrification include Sofia's Hadzhi Dimitar, Reduta, and parts of Nadezhda, Plovdiv's Kapana and Karshiyaka districts, and Varna's Briz area.

The visible changes indicating gentrification in these Bulgarian neighborhoods include new specialty coffee shops and coworking spaces (especially in Kapana), extensive building renovations turning old industrial spaces into lofts, and an influx of young professionals and digital nomads attracted by lower rents than city centers.

The estimated price appreciation in these gentrifying Bulgarian neighborhoods over the past two to three years has been around 25 to 40%, with some micro-areas in Sofia's Hadzhi Dimitar seeing even sharper gains due to metro line construction.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Bulgaria.

Where are infrastructure projects boosting demand in Bulgaria in 2026?

As of early 2026, the top areas in Bulgaria where major infrastructure projects are boosting housing demand include Sofia's Levski, Slatina, and Geo Milev districts (metro expansion), Plovdiv's southern ring road corridor, and Burgas's airport connectivity zone.

The specific infrastructure projects driving demand in Bulgaria include Sofia Metro Line 3 extensions through Hadzhi Dimitar, Levski G, and toward Slatina (adding 10 new stations), the planned metro extension to Studentski Grad, and highway improvements connecting Plovdiv to Sofia.

The estimated timeline for completion of these major Bulgarian infrastructure projects is mid-2026 for the Levski metro section, late 2026 or early 2027 for the Slatina extension, and 2028 or beyond for the Studentski Grad metro branch.

The typical price impact on nearby properties in Bulgaria once infrastructure projects are announced versus completed is around 5 to 10% upon announcement and an additional 10 to 15% after completion, based on how previous metro stations affected surrounding neighborhoods like Vitosha and Ovcha Kupel.

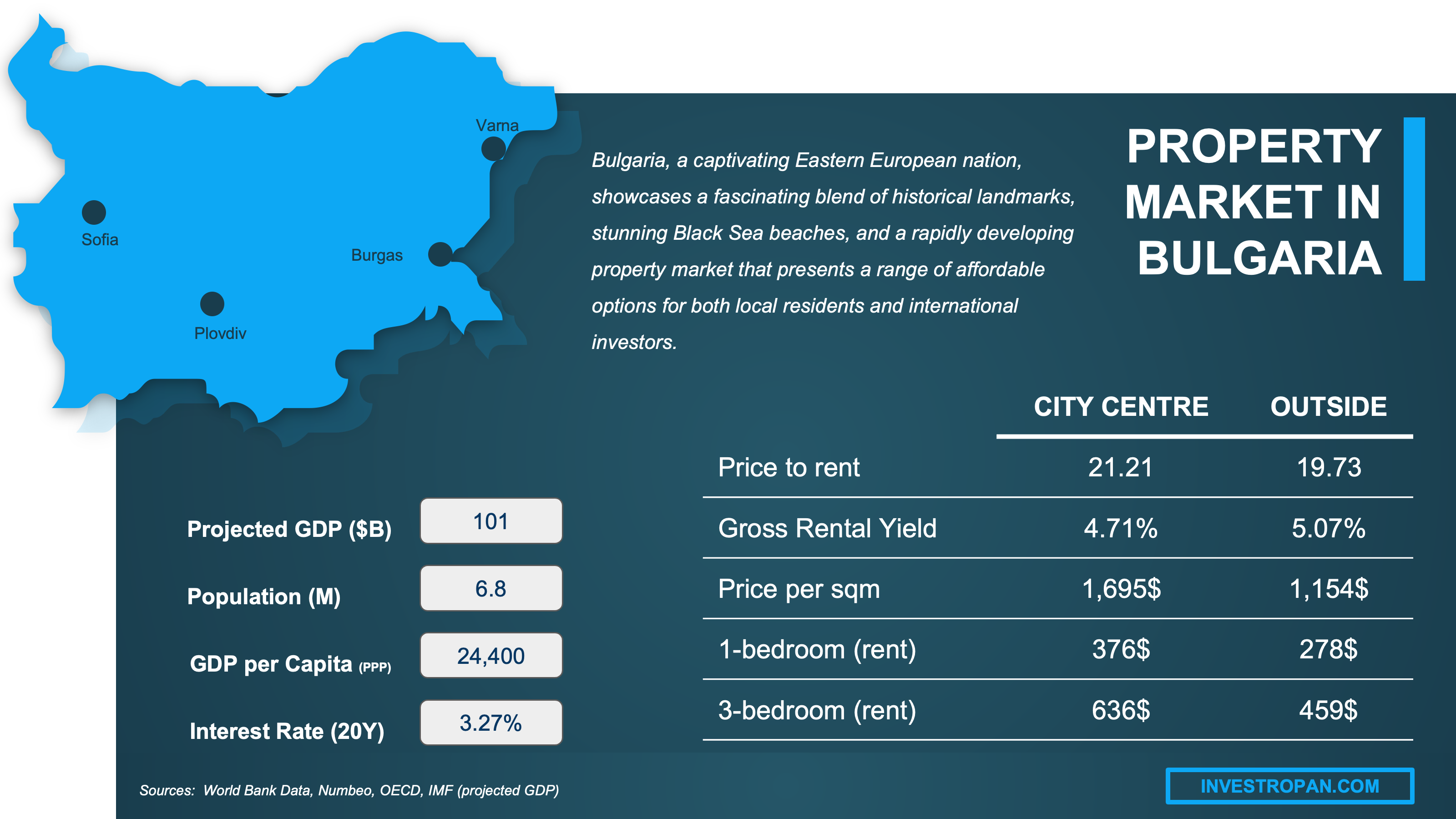

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

What do locals and insiders say the market feels like in Bulgaria?

Do people think homes are overpriced in Bulgaria in 2026?

As of early 2026, the general sentiment among locals and market insiders in Bulgaria is mixed: Sofia residents often feel prices are "expensive for local salaries" while foreign buyers and investors still consider Bulgaria "affordable by EU standards."

The specific evidence locals in Bulgaria typically cite when arguing homes are overpriced includes comparing average Sofia apartment prices (around 2,000 to 2,500 euros per square meter) against average monthly salaries (around 1,300 euros), which makes buying without family help or a dual income very difficult.

The counterarguments from those who believe Bulgarian property prices are fair include pointing to the even higher prices in neighboring Romania, Greece, and Serbia, plus the strong rental yields (4 to 6%) and Bulgaria's new euro membership reducing investment risk.

The price-to-income ratio in Bulgaria is higher in Sofia (around 12 to 15 years of average salary to buy an average apartment) than the national average, but still lower than capital cities in most Western European countries.

What are common buyer mistakes people regret in Bulgaria right now?

The most frequently cited buyer mistake people regret in Bulgaria is purchasing an apartment without thoroughly checking building documents, common area obligations, and potential hidden debts tied to the property through the Property Register.

The second most common mistake buyers mention regretting in Bulgaria is assuming coastal or resort properties will generate easy Airbnb income without researching actual occupancy rates and seasonality, which leads to disappointment when summer-only demand doesn't cover year-round costs.

If you want to go deeper, you can check our list of risks and pitfalls people face when buying property in Bulgaria.

It's because of these mistakes that we have decided to build our pack covering the property buying process in Bulgaria.

Get the full checklist for your due diligence in Bulgaria

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

How easy is it for foreigners to buy in Bulgaria in 2026?

Do foreigners face extra challenges in Bulgaria right now?

The estimated overall difficulty level for foreigners buying apartments in Bulgaria is "moderate" compared to local buyers, though buying houses with land can be more complex due to constitutional restrictions on foreign land ownership.

The specific legal restrictions applying to foreign buyers in Bulgaria include Article 22 of the Bulgarian Constitution, which historically limited foreign land ownership, though EU citizens now have largely equivalent rights for land acquisition and non-EU buyers can purchase through a Bulgarian company structure.

The practical challenges foreigners most commonly encounter in Bulgaria include navigating notary procedures conducted primarily in Bulgarian, understanding the dual-pricing phenomenon where some sellers still quote in leva while others use euros, and ensuring proper title verification through the Property Register since buyer protection depends heavily on registry checks.

We will tell you more in our blog article about foreigner property ownership in Bulgaria.

Do banks lend to foreigners in Bulgaria in 2026?

As of early 2026, mortgage financing is available to foreign buyers in Bulgaria, though EU citizens with documented EU income have an easier approval process than non-residents with complex or overseas income sources.

The typical loan-to-value ratios for foreign buyers in Bulgaria range from 50 to 70% (compared to 80 to 85% for locals), and interest rates for foreigners typically range from 3.5 to 5%, which is higher than the 2.5 to 3.2% rates Bulgarian residents receive.

Banks in Bulgaria typically require foreign applicants to provide proof of stable income (at least 2,000 euros per month), translated and apostilled employment documents, a valid passport, and sometimes a Bulgarian guarantor or local bank account history.

You can also read our latest update about mortgage and interest rates in Bulgaria.

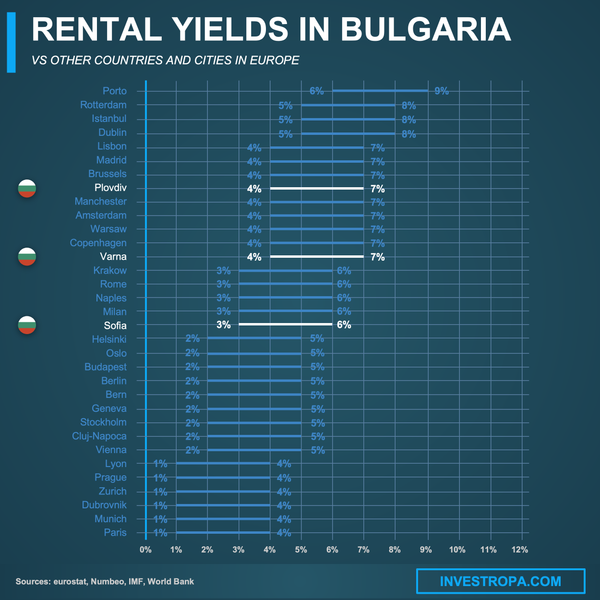

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How risky is buying in Bulgaria compared to other nearby markets?

Is Bulgaria more volatile than nearby places in 2026?

As of early 2026, Bulgaria's property price volatility is higher than mature Western EU markets and roughly comparable to other fast-growing Central and Eastern European countries like Romania and Serbia.

Over the past decade, Bulgaria experienced moderate price swings, with strong growth from 2017 to 2025 (prices roughly doubled in major cities), whereas Romania saw similar growth patterns and Greece experienced deeper corrections followed by recovery.

If you want to go into more details, we also have a blog article detailing the updated housing prices in Bulgaria.

Is Bulgaria resilient during downturns historically?

Bulgaria's historical resilience during economic downturns is moderate: prime city micro-markets (especially central Sofia) tend to hold value better, while overbuilt resort areas and tourism-dependent coastal pockets can correct more sharply.

During the 2008 to 2012 global financial crisis, Bulgarian property prices dropped by roughly 30 to 40% from peak to trough, and the recovery to previous price levels took approximately 8 to 10 years in most markets.

The property types and neighborhoods in Bulgaria that have historically held value best during downturns include central Sofia apartments near business districts, quality new builds in Plovdiv's center, and well-located Varna properties with year-round appeal rather than purely seasonal tourism demand.

Get to know the market before you buy a property in Bulgaria

Better information leads to better decisions. Get all the data you need before investing a large amount of money. Download our guide.

How strong is rental demand behind the scenes in Bulgaria in 2026?

Is long-term rental demand growing in Bulgaria in 2026?

As of early 2026, long-term rental demand in Bulgaria is growing steadily in major cities, driven by internal migration toward Sofia and rising housing costs that make renting more accessible than buying for many young Bulgarians.

The tenant demographics driving long-term rental demand in Bulgaria include young professionals in IT and outsourcing sectors, university students (especially in Sofia, Plovdiv, and Varna), and a growing number of digital nomads and remote workers from other EU countries attracted by Bulgaria's low cost of living.

The neighborhoods with the strongest long-term rental demand in Bulgaria right now include Sofia's Studentski Grad (students), Lozenets and Iztok (professionals), Plovdiv's center and Kapana (mixed), and Varna's Sea Garden area (professionals and expats).

You might want to check our latest analysis about rental yields in Bulgaria.

Is short-term rental demand growing in Bulgaria in 2026?

Bulgaria currently has relatively light regulation of short-term rentals compared to Western European cities, though hosts must register with local authorities and pay a tourist tax, and stricter rules may emerge as the market matures post-euro adoption.

As of early 2026, short-term rental demand in Bulgaria is growing in urban city-break destinations like Sofia and cultural hubs like Plovdiv, while coastal and ski resort demand remains highly seasonal.

The current estimated average occupancy rate for short-term rentals in Bulgaria is around 45 to 55% annually in Sofia and 35 to 50% in coastal areas like Sunny Beach, though coastal properties can reach 80%+ occupancy during summer months.

The guest demographics driving short-term rental demand in Bulgaria include European weekend tourists (especially from the UK, Germany, and Poland), budget-conscious families seeking Black Sea beach holidays, and an increasing number of digital nomads staying for one to three months.

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in Bulgaria.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What are the realistic short-term and long-term projections for Bulgaria in 2026?

What's the 12-month outlook for demand in Bulgaria in 2026?

As of early 2026, the 12-month demand outlook for residential property in Bulgaria is positive but moderating, with analysts expecting a shift from "very hot" to "hot" as the initial euro adoption surge stabilizes.

The key factors most likely to influence Bulgarian housing demand over the next 12 months include eurozone interest rate movements, continued EU infrastructure funding, and whether mortgage lending standards tighten further following the Bulgarian National Bank's recent prudential measures.

The forecasted price movement for Bulgaria over the next 12 months is around 5 to 10% growth nationally, with Sofia potentially seeing 8 to 12% and coastal resort areas experiencing more variable growth depending on tourism performance.

By the way, we also have an update regarding price forecasts in Bulgaria.

What's the 3 to 5 year outlook for housing in Bulgaria in 2026?

As of early 2026, the 3 to 5 year outlook for housing prices and demand in Bulgaria is moderately positive, with expectations of sustainable real (inflation-adjusted) price growth in major cities and potential flattening in overbuilt resort pockets.

The major development projects expected to shape Bulgaria over the next 3 to 5 years include Sofia Metro extensions to Studentski Grad and the Ring Road interchange, continued EU-funded highway improvements, and airport modernization in Sofia and coastal airports.

The single biggest uncertainty that could alter Bulgaria's 3 to 5 year housing outlook is a potential eurozone-wide recession or sharp increase in ECB interest rates, which would directly affect Bulgarian mortgage costs now that the country uses the euro.

Are demographics or other trends pushing prices up in Bulgaria in 2026?

As of early 2026, demographic trends in Bulgaria are creating uneven price pressure: while the national population is declining, urban concentration in Sofia and a few regional hubs is intensifying, which supports city-center demand.

The specific demographic shifts most affecting Bulgarian prices include continued rural-to-urban migration (especially young workers moving to Sofia), an aging population that reduces household formation in smaller towns, and modest return migration of Bulgarians from Western Europe seeking better value.

The non-demographic trends also pushing prices in Bulgaria include the remote work revolution (making Bulgaria attractive for digital nomads seeking low costs and EU access), increased foreign investment following euro adoption, and growing interest from retirees seeking affordable EU healthcare.

These demographic and trend-driven price pressures in Bulgaria are expected to continue for at least the next 5 to 10 years, as urban concentration and EU integration benefits are structural rather than cyclical.

What scenario would cause a downturn in Bulgaria in 2026?

As of early 2026, the most likely scenario that could trigger a housing downturn in Bulgaria would be a combination of ECB interest rate hikes (raising mortgage costs), a eurozone recession reducing foreign investment, and possible oversupply in specific new-build segments.

The early warning signs that would indicate a downturn is beginning in Bulgaria include a sharp slowdown in mortgage lending growth (already being watched after BNB's tighter standards), rising inventory levels without price adjustments, and a noticeable drop in transaction volumes in previously hot markets like Sofia's outer districts.

Based on historical patterns, a potential downturn in Bulgaria could realistically see prices decline by 10 to 20% in vulnerable segments (coastal resorts, oversupplied new builds), while prime Sofia locations would likely hold up better with corrections of 5 to 10%.

Make a profitable investment in Bulgaria

Better information leads to better decisions. Save time and money. Download our guide.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Bulgaria, we always rely on the strongest methodology we can ... and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| National Statistical Institute (NSI) | It's Bulgaria's official statistics office that publishes the house price index and building permits data. | We used it to anchor price momentum to an official, repeatable index. We also used it to track new supply entering the market through permits and completions data. |

| Bulgarian National Bank (BNB) | It's the central bank publishing mortgage lending data and credit conditions reports. | We used it to gauge mortgage momentum and lending standards. We also used it to interpret how buyer affordability might shift in 2026. |

| European Central Bank (ECB) | It's the ECB's official source confirming Bulgaria's euro adoption and conversion rate. | We used it to explain what changed structurally in January 2026 with currency and financing conditions. We also used it to frame scenarios that could affect demand. |

| Eurostat | It's the EU's statistical office providing comparable housing and tourism data across member states. | We used it to benchmark Bulgaria's housing context against Europe. We also used it to cross-check tourism demand backing short-term rentals. |

| FRED (BIS Series) | It's a widely used distribution of Bank for International Settlements housing price data. | We used it to analyze Bulgaria's longer housing cycles and compare volatility with other markets. We also used it to support our historical resilience discussion. |

| Registry Agency (EPZEU) | It's the official gateway to Bulgaria's Property Register services. | We used it to explain how ownership and encumbrances are verified. We also used it to flag the essential registry checks foreign buyers should never skip. |

| IMF Bulgaria | It's the IMF's macro snapshot with forward projections for growth and inflation. | We used it to ground the 2026 to 2030 housing outlook in plausible economic conditions. We also used it to identify what shocks could trigger a downturn. |

| World Bank | It's a reputable source for demographics and headline macro indicators. | We used it to frame the demand base including population trends. We also used it to explain urban concentration despite national population decline. |

| AirDNA | It's a well-known short-term rental data provider with transparent occupancy and revenue metrics. | We used it to estimate short-term rental demand strength and seasonality. We also used it to show how Airbnb economics differ from long-term rentals in Bulgaria. |

| Bulgarian Telegraph Agency (BTA) | It's Bulgaria's national news agency with authoritative coverage of economic and real estate developments. | We used it to incorporate analyst forecasts and market sentiment. We also used it to verify construction volume trends and expert opinions on 2026 price growth. |