Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Everything you need to know before buying real estate is included in our Bulgaria Property Pack

Bulgaria's property market is entering 2026 on the back of extraordinary price growth, with house prices having surged 156% since 2015 according to Eurostat, making it one of the fastest-appreciating markets in all of Europe.

The country officially adopted the euro on January 1, 2026, and this milestone is reshaping how both local and foreign buyers approach residential real estate in cities like Sofia, Plovdiv, Varna, and Burgas.

We update this guide regularly to reflect the latest neighborhood trends, price shifts, and rental yields across Bulgaria's most investable areas.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Bulgaria.

What's the Current Real Estate Market Situation by Area in Bulgaria?

Which areas in Bulgaria have the highest property prices per square meter in 2026?

As of early 2026, the three most expensive areas for property in Bulgaria are Sofia's Iztok district (around 3,900 euros per square meter), followed by Oborishte near the Doctor's Garden area (around 3,300 euros per square meter), and Lozenets near South Park (also around 3,300 euros per square meter).

In these premium Sofia neighborhoods, prices typically range from 3,000 to 5,500 euros per square meter depending on building quality, floor level, and whether parking is included, with some ultra-prime new developments in Oborishte and the Doctor's Garden area exceeding 5,000 euros per square meter.

Each of these high-price neighborhoods commands a premium for distinct reasons:

- Iztok and Yavorov: Embassy presence, low building density, and extremely limited new supply create scarcity value.

- Oborishte (Doctor's Garden): Walkable green space, quiet streets, and proximity to elite schools attract wealthy families.

- Lozenets (South Park area): Cafe culture, metro access, and appeal to young professionals and expats drive demand.

- Ivan Vazov: Architectural charm, central location, and strong tenant demand from diplomats and executives.

Which areas in Bulgaria have the most affordable property prices in 2026?

As of early 2026, the most affordable property prices in Bulgaria's major cities are found in Sofia's Lyulin district (around 1,500 to 1,700 euros per square meter), Nadezhda (around 1,500 euros per square meter), Plovdiv's Trakia neighborhood (around 1,100 to 1,400 euros per square meter), and Varna's Vladislav Varnenchik district (around 1,200 euros per square meter).

In these budget-friendly areas, you can expect to pay between 1,100 and 1,700 euros per square meter for typical apartments, which means a decent one-bedroom apartment in Sofia's Lyulin could cost around 85,000 to 100,000 euros, while a similar unit in Plovdiv's Trakia might be available for 55,000 to 70,000 euros.

The main trade-offs in these lower-priced Bulgaria neighborhoods include longer commutes to city centers and business districts in Lyulin and Nadezhda, predominantly older panel-block housing stock (especially in Trakia) that may require renovation, and in Vladislav Varnenchik, you're trading sea views for distance from Varna's beach and center.

You can also read our latest analysis regarding housing prices in Bulgaria.

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of Bulgaria. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

Which Areas in Bulgaria Offer the Best Rental Yields?

Which neighborhoods in Bulgaria have the highest gross rental yields in 2026?

As of early 2026, the neighborhoods with the highest gross rental yields in Bulgaria include Sofia's Studentski Grad (around 4.7% to 5.1%), Burgas city center (around 5.1% to 5.3%), Varna's Briz district (around 4.5% to 5.1%), and Plovdiv's Trakia area (around 4.7% to 5.5%).

Across Bulgaria's major cities, the typical gross rental yield range for residential investment properties sits between 3.7% and 5.5%, with the national average around 4.3% as of late 2025, though individual property performance can vary significantly based on purchase price, location, and management quality.

Here's why these specific neighborhoods deliver stronger rental returns than other areas in Bulgaria:

- Studentski Grad (Sofia): Constant student and young professional demand keeps vacancy low and rents stable year-round.

- Burgas center: Lower purchase prices than Varna combined with solid summer tourism and growing local economy.

- Briz (Varna): New developments attract professionals seeking modern apartments near the sea at reasonable prices.

- Trakia (Plovdiv): Affordable entry prices and proximity to Plovdiv's tech parks create strong tenant demand.

Finally, please note that we cover the rental yields in Bulgaria here.

Make a profitable investment in Bulgaria

Better information leads to better decisions. Save time and money. Download our guide.

Which Areas in Bulgaria Are Best for Short-Term Vacation Rentals?

Which neighborhoods in Bulgaria perform best on Airbnb in 2026?

As of early 2026, the top-performing Airbnb neighborhoods in Bulgaria are Sofia's Sredets district (around 60% occupancy and 64 dollars average nightly rate), Varna's Greek Quarter (around 55% occupancy and 77 dollars average nightly rate), Plovdiv's Old Town near Kapana (strong festival-driven demand), and Bansko's gondola-adjacent zone (around 35% occupancy but 97 dollars average nightly rate).

In Sofia's best short-term rental areas like Sredets and Oborishte, top-performing properties can generate between 1,200 and 2,000 euros per month in gross revenue, while Varna's Greek Quarter and Chayka area see stronger summer peaks with monthly revenues reaching 1,500 to 2,500 euros during July and August.

The main factors driving Airbnb success differ by neighborhood in Bulgaria:

- Sredets (Sofia center): Year-round business travel plus walkable tourist attractions mean consistent bookings.

- Greek Quarter (Varna): Beach access combined with historic charm appeals to both families and couples.

- Kapana area (Plovdiv): Arts festivals and cultural events create booking spikes throughout the year.

- Gondola zone (Bansko): Ski-in convenience justifies premium winter rates despite lower annual occupancy.

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in Bulgaria.

Which tourist areas in Bulgaria are becoming oversaturated with short-term rentals?

The tourist areas in Bulgaria showing the clearest signs of short-term rental oversaturation are Sunny Beach (Slanchev Bryag), the Sveti Vlas resort cluster, and parts of Golden Sands north of Varna, all of which have seen massive inventory growth outpacing visitor demand.

In Sunny Beach alone, thousands of apartments compete for bookings during a roughly four-month summer season, with AirDNA data showing similar patterns in Bansko where annual occupancy hovers around 35% despite high peak-season demand, indicating a classic "too much supply for too few weeks" problem.

The clearest warning sign of oversaturation in these Bulgaria resort areas is aggressive price discounting during shoulder seasons, where hosts slash nightly rates by 40% to 60% below summer peaks just to fill calendars, ultimately compressing annual returns well below what optimistic projections suggest.

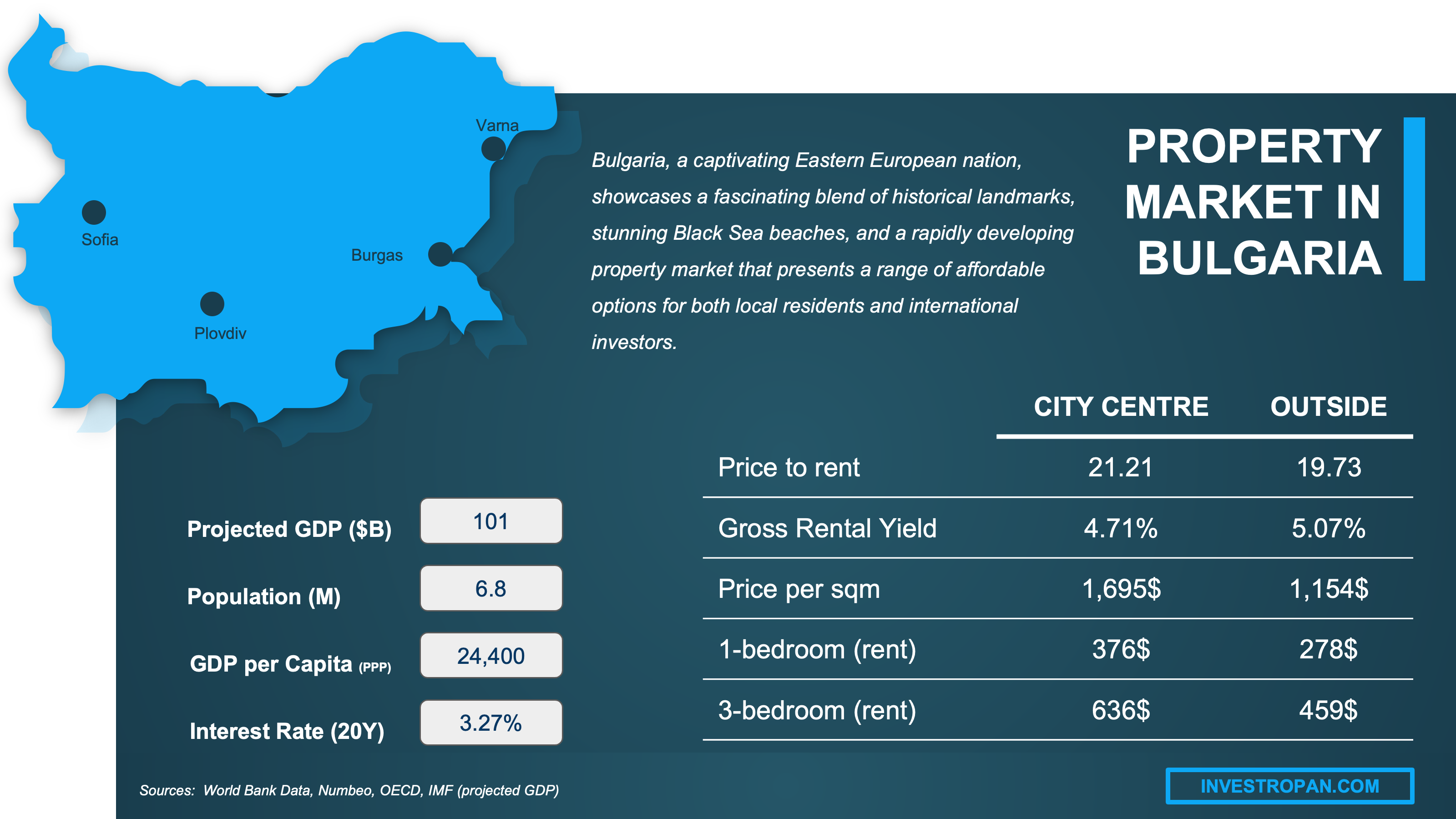

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which Areas in Bulgaria Are Best for Long-Term Rentals?

Which neighborhoods in Bulgaria have the strongest demand for long-term tenants?

The neighborhoods with the strongest long-term rental demand in Bulgaria are Sofia's Mladost district (tech workers and office employees), Studentski Grad (university students), Lozenets (expats and professionals), and Plovdiv's Karshiaka area (families and young professionals).

In these high-demand Bulgaria neighborhoods, well-priced apartments typically rent within two to four weeks of listing, with vacancy rates staying below 5% annually in areas like Mladost and Studentski Grad where tenant pools are deep and turnover is predictable around academic and business cycles.

Different tenant profiles drive demand in each of these Bulgarian neighborhoods:

- Mladost (Sofia): IT professionals and corporate employees near Business Park Sofia and major office complexes.

- Studentski Grad (Sofia): Students from Sofia University and New Bulgarian University seeking affordable housing.

- Lozenets (Sofia): Expats, diplomats, and senior professionals wanting walkable lifestyle amenities.

- Karshiaka (Plovdiv): Young families and tech workers attracted by green spaces and proximity to Plovdiv's center.

The single most important amenity driving long-term tenant demand across these Bulgaria neighborhoods is metro or reliable public transport access, with Sofia apartments within 500 meters of a metro station commanding both faster rentals and 10% to 15% rent premiums compared to car-dependent locations.

Finally, please note that we provide a very granular rental analysis in our property pack about Bulgaria.

What are the average long-term monthly rents by neighborhood in Bulgaria in 2026?

As of early 2026, average monthly rents in Bulgaria's main neighborhoods range from around 400 euros for a one-bedroom in Sofia's outer districts like Lyulin, up to 1,000 to 1,200 euros for premium one-bedroom apartments in central Sofia areas like Lozenets and Ivan Vazov.

In the most affordable Bulgaria neighborhoods like Sofia's Studentski Grad, Plovdiv's Trakia, or Varna's Vladislav Varnenchik, entry-level furnished one-bedroom apartments typically rent for 400 to 550 euros per month, making them accessible for students and entry-level workers.

Mid-range neighborhoods in Bulgaria such as Sofia's Mladost, Vitosha district, or Plovdiv's Karshiaka area see typical one-bedroom rents between 600 and 850 euros per month, with two-bedroom units ranging from 850 to 1,100 euros depending on building age and amenities.

In Bulgaria's most expensive rental neighborhoods like Sofia's Lozenets, Ivan Vazov, and Oborishte, high-end furnished one-bedroom apartments command 900 to 1,200 euros monthly, while premium two-bedroom units in these areas reach 1,200 to 1,600 euros per month.

You may want to check our latest analysis about the rents in Bulgaria here.

Get fresh and reliable information about the market in Bulgaria

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Which Are the Up-and-Coming Areas to Invest in Bulgaria?

Which neighborhoods in Bulgaria are gentrifying and attracting new investors in 2026?

As of early 2026, the gentrifying neighborhoods attracting new investors in Bulgaria include Sofia's Krastova Vada and Hladilnika (spillover from expensive Lozenets), Malinova Dolina (new-build corridor near tech demand), Plovdiv's Kapana arts district, and the central Sofia area between boulevards Vassil Levski and Dondukov where historic homes are being replaced by modern developments.

These gentrifying Bulgaria neighborhoods have experienced annual price appreciation between 10% and 18% over the past two years, with Kapana in Plovdiv seeing particularly strong momentum due to its transformation into a cultural hub and the ongoing restoration of historic buildings combined with new creative spaces.

Which areas in Bulgaria have major infrastructure projects planned that will boost prices?

The areas in Bulgaria with major infrastructure projects expected to boost property prices include Sofia neighborhoods along planned metro line extensions (Mladost, Lyulin, and airport connections), Plovdiv's expanding business park corridor, and Burgas with its airport modernization and port development.

Sofia's metro expansion project will add new stations in developing neighborhoods including Mladost and Lyulin while improving airport connections, and historically, properties within 500 meters of new Sofia metro stations have experienced value appreciation of 15% to 25% within three years of station opening.

Historically, major infrastructure completions in Bulgaria have delivered price increases of 10% to 20% in directly affected areas, with the strongest gains going to properties that gain meaningful commute time savings rather than those simply "near" a project that doesn't change daily life for residents.

You'll find our latest property market analysis about Bulgaria here.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Which Areas in Bulgaria Should I Avoid as a Property Investor?

Which neighborhoods in Bulgaria with lots of problems I should avoid and why?

The neighborhoods in Bulgaria that investors should generally approach with extreme caution include the Sunny Beach and Sveti Vlas resort complexes (oversupply and seasonality), remote outer-city districts with poor transport links, and areas with aging panel-block housing where maintenance funds are depleted.

Here are the specific problems affecting these challenging Bulgaria neighborhoods:

- Sunny Beach/Sveti Vlas: Extreme seasonality means four months of income versus eight months of vacancy and fees.

- Golden Sands resort area: High competition, party-tourist reputation, and brutal off-season emptiness.

- Remote Sofia districts (far Lyulin, Obelya edges): Poor transport makes tenant acquisition difficult and resale slow.

- Older Bansko complexes: High management fees, aging infrastructure, and oversupply compress returns.

For any of these Bulgaria neighborhoods to become viable investment options, they would need either significant reduction in competing supply (unlikely in resort areas), major infrastructure improvements connecting them to economic centers (expensive and slow), or a fundamental shift in tourism patterns creating year-round demand where seasonality currently dominates.

Buying a property in the wrong neighborhood is one of the mistakes we cover in our list of risks and pitfalls people face when buying property in Bulgaria.

Which areas in Bulgaria have stagnant or declining property prices as of 2026?

As of early 2026, the areas in Bulgaria showing price stagnation or recent declines include Ruse (which recorded a 3.1% quarterly price drop in Q2 2025 according to NSI data), some panel-housing districts in Sofia's northern periphery, and older resort complexes in Sunny Beach where resale prices have struggled to keep pace with newer competing inventory.

In these underperforming Bulgaria areas, prices have either stagnated with 0% to 2% annual growth or experienced modest declines of 2% to 5% over the past one to two years, significantly underperforming the 15% to 18% annual growth seen in Sofia, Plovdiv, and Varna during the same period.

The underlying causes of price weakness differ by area in Bulgaria:

- Ruse: Population decline, limited job growth, and fewer investors despite Danube location and Romania proximity.

- Northern Sofia periphery (parts of Nadezhda, Vrabnitsa): Poor metro access and aging housing stock depress demand.

- Older Sunny Beach complexes: High fees, deferred maintenance, and oversupply make resale difficult.

- Remote village properties: Extremely limited buyer pool means sellers wait months or years for offers.

Buying real estate in Bulgaria can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Which Areas in Bulgaria Have the Best Long-Term Appreciation Potential?

Which areas in Bulgaria have historically appreciated the most recently?

The areas in Bulgaria that have appreciated most strongly over the past five to ten years are Sofia's central and southern districts (particularly Lozenets, Ivan Vazov, and Oborishte), Varna's premium coastal neighborhoods like Chayka and the Greek Quarter, Plovdiv's center and Kapana area, and Burgas city which has consistently posted double-digit annual gains.

Here's the approximate appreciation these top-performing Bulgaria areas have achieved:

- Sofia (citywide): Prices tripled since 2015, reaching roughly 200% total appreciation over ten years.

- Varna: Annual growth of 15% to 21% in recent years, with premium areas like Morska Gradina leading.

- Plovdiv: Acceleration to 15% to 17% annual growth in 2024-2025, with Kapana area outperforming.

- Burgas: Consistent 14% to 16% annual increases, benefiting from lower base prices attracting investors.

The main driver behind above-average appreciation in these Bulgaria areas has been the combination of strong domestic wage growth (Bulgarian GDP per capita increased 417% over two decades), limited quality housing supply in desirable locations, low mortgage rates around 2.5% to 3%, and pre-euro adoption psychology pushing buyers to convert savings into property.

By the way, you will find much more detailed trends and forecasts in our pack covering there is to know about buying a property in Bulgaria.

Which neighborhoods in Bulgaria are expected to see price growth in coming years?

The neighborhoods in Bulgaria expected to see the strongest price growth in coming years include Sofia's Mladost and Malinova Dolina (metro expansion beneficiaries), Plovdiv's Kapana and center-adjacent areas (cultural tourism momentum), Varna's Briz district (new development corridor), and Burgas's Lazur and Zornitsa neighborhoods (undervalued relative to fundamentals).

Here are the projected annual growth rates for these high-potential Bulgaria neighborhoods:

- Mladost (Sofia): Expected 8% to 12% annually as metro extensions complete and tech employment grows.

- Kapana (Plovdiv): Projected 7% to 10% annually driven by cultural tourism and gentrification momentum.

- Briz (Varna): Anticipated 6% to 9% growth as new developments attract professionals seeking value.

- Lazur/Zornitsa (Burgas): Forecast 6% to 10% as city economy strengthens and airport improvements complete.

The single most important catalyst expected to drive future price growth in these Bulgaria neighborhoods is the combination of Bulgaria's euro adoption providing currency stability for foreign investors, continued expansion of Sofia's metro system improving accessibility, and the ongoing migration of tech companies and remote workers to Bulgaria's affordable cities.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What Do Locals and Expats Really Think About Different Areas in Bulgaria?

Which areas in Bulgaria do local residents consider the most desirable to live?

The areas that local Bulgarian residents consider most desirable to live include Sofia's Lozenets, Ivan Vazov, and Oborishte neighborhoods, Varna's Chayka and Sea Garden area, and Plovdiv's center-adjacent zones near Kapana and the Old Town.

Here's what makes each of these areas most desirable to locals in Bulgaria:

- Lozenets (Sofia): South Park access, trendy cafes, and excellent schools create family appeal.

- Ivan Vazov (Sofia): Architectural character, walkability, and quiet residential streets attract professionals.

- Chayka (Varna): Sea Garden proximity combined with established residential feel appeals to families.

- Plovdiv center: Cultural richness, restaurant scene, and historic charm draw lifestyle-focused residents.

These locally-preferred Bulgaria neighborhoods typically attract upper-middle-class Bulgarian families, successful professionals, and business owners who prioritize quality of life, school access, and green space over pure investment returns or rental income potential.

Local preferences in Bulgaria largely align with what foreign investors target in terms of premium neighborhoods, but locals often place more value on school quality and family infrastructure while foreign buyers may overweight short-term rental potential or proximity to tourist attractions.

Which neighborhoods in Bulgaria have the best reputation among expat communities?

The neighborhoods with the best reputation among expat communities in Bulgaria are Sofia's Lozenets, Ivan Vazov, and Oborishte cluster, Plovdiv's center near Kapana, and Varna's Sea Garden and Greek Quarter areas.

Here's why expats prefer these specific Bulgaria neighborhoods over other options:

- Lozenets/Ivan Vazov/Oborishte (Sofia): Walkable lifestyle, English-friendly services, and proximity to international schools.

- Kapana area (Plovdiv): Artistic vibe, affordable quality of life, and strong digital nomad community.

- Sea Garden/Greek Quarter (Varna): Beach access, summer lifestyle, and established expat social networks.

The expat profile in these popular Bulgaria neighborhoods tends to be remote workers and digital nomads (especially in Plovdiv), retired Europeans seeking affordable coastal living (Varna), and corporate professionals and diplomats in Sofia's premium districts who value proximity to international schools and embassy services.

Which areas in Bulgaria do locals say are overhyped by foreign buyers?

The areas in Bulgaria that locals commonly consider overhyped by foreign buyers are Sunny Beach and the Sveti Vlas resort complexes, ski resort apartments in Bansko marketed as "rental investments," and some heavily-promoted new-build projects in Sofia's outskirts with aggressive sales tactics.

Here's why locals believe these Bulgaria areas are overvalued by foreign buyers:

- Sunny Beach/Sveti Vlas: Locals see extreme seasonality and oversupply that marketing materials minimize.

- Bansko resort complexes: High management fees and low annual occupancy undercut projected returns.

- Outer Sofia new-builds: Distance from jobs and transit makes "affordable" locations impractical for real life.

Foreign buyers typically see "beachfront investment opportunity" and "ski resort passive income" potential in these Bulgaria areas, while locals understand the brutal seasonality, oversupply dynamics, and management fee erosion that make actual returns far lower than the sales pitch suggests.

By the way, we've written a blog article detailing the experience of buying a property as a foreigner in Bulgaria.

Which areas in Bulgaria are considered boring or undesirable by residents?

The areas in Bulgaria that residents commonly consider boring or undesirable include large "sleeping districts" in Sofia's northern periphery like distant parts of Lyulin and Nadezhda, car-dependent suburbs far from metro lines, and older panel-housing areas with poor maintenance and limited amenities.

Here's why residents find these Bulgaria areas boring or undesirable:

- Far Lyulin/Nadezhda (Sofia): Long commutes, few restaurants or cafes, and purely residential character.

- Car-dependent outer suburbs: No walkable amenities and traffic congestion to reach anything interesting.

- Poorly-maintained panel blocks: Aging infrastructure, unreliable elevators, and depressing common areas.

- Remote village properties: Beautiful in photos but isolated from jobs, healthcare, and social connections.

Don't lose money on your property in Bulgaria

100% of people who have lost money there have spent less than 1 hour researching the market. We have reviewed everything there is to know. Grab our guide now.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Bulgaria, we always rely on the strongest methodology we can ... and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why It's Authoritative | How We Used It |

|---|---|---|

| National Statistical Institute (NSI) | Bulgaria's official government statistics agency for housing price data. | We used NSI data to anchor overall price trends and city-by-city comparisons. We cross-checked private market claims against official methodology. |

| Global Property Guide | Respected international property research with transparent yield methodology. | We used their rental yield data for Bulgarian cities and Sofia submarkets. We cross-checked yields against typical rent bands in our database. |

| AirDNA | Leading short-term rental analytics platform with transparent market metrics. | We used AirDNA to quantify occupancy, average daily rates, and revenue for Sofia, Varna, and Bansko. We identified oversaturation patterns from their data. |

| Bulgarian National Bank (BNB) | Central bank's official analysis of credit conditions and economic drivers. | We used BNB data to understand mortgage dynamics and income growth impacts. We framed risk factors using their macroeconomic analysis. |

| Colliers Bulgaria | Major global real estate consultancy with published research standards. | We used Colliers reports for supply trends and buyer preference insights. We avoided overfitting conclusions from listing data alone. |

| Eurostat | EU's official statistics agency providing cross-country comparable data. | We used Eurostat's housing price indices to place Bulgaria in European context. We validated that Bulgaria's 156% price growth claim was accurate. |

| Bulgarian Parliament (Constitution) | Primary legal text defining property rights and foreign ownership rules. | We used constitutional provisions to explain foreign buyer restrictions. We clarified apartment versus land ownership distinctions. |

| BIS/FRED Property Price Index | Standardized international time series for macro research comparisons. | We used this to place Bulgaria's property cycle in historical context. We confirmed recent growth is sustained, not a one-quarter anomaly. |

| Imoti.net | One of Bulgaria's largest property portals with real-time listing data. | We used listing prices to validate neighborhood-level price ranges. We tracked rental velocity to identify high-demand areas. |

| Expat.com Forums | Active community of Bulgaria expats sharing real experiences. | We used forum discussions to understand which areas are overhyped. We validated local sentiment about resort investments and problem areas. |

Get the full checklist for your due diligence in Bulgaria

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.