Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Everything you need to know before buying real estate is included in our Bulgaria Property Pack

Bulgaria just adopted the euro on January 1, 2026, and the property market is entering a new era of stability and increased foreign interest.

This guide covers everything a foreigner needs to know about buying residential property in Bulgaria right now, including ownership rules, visa requirements, taxes, and mortgage options.

We constantly update this blog post to reflect the latest changes in Bulgarian property law and market conditions.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Bulgaria.

Insights

- Non-EU foreigners can buy apartments in Bulgaria directly, but must set up a Bulgarian company to purchase any property that includes land, which adds about 500 to 1,000 euros in setup costs.

- Bulgaria's mortgage rates for foreigners in January 2026 range from 3.5% to 5%, which remain among the lowest in the EU despite being higher than what locals typically receive at 2.7% to 3.2%.

- The municipal transfer tax in major Bulgarian cities like Sofia, Plovdiv, Varna, and Burgas is set at 3% of the purchase price, making closing costs in these cities predictably higher than in smaller municipalities.

- Annual property tax in Bulgaria is remarkably low at just 0.01% to 0.45% of the assessed value, meaning a typical apartment owner pays between 50 and 200 euros per year before garbage fees.

- Foreign buyers in Bulgaria typically need a 30% to 50% down payment compared to 15% to 20% for Bulgarian residents, making cash purchases more common among international buyers.

- The euro adoption has already caused property prices in Bulgaria to rise 15% to 18% in 2025, with experts forecasting more moderate growth of 6% to 10% annually starting in 2026.

- Over 90% of property listings in Bulgaria were already priced in euros before the official currency switch, so the transition has not fundamentally changed how real estate transactions are conducted.

- Short-term rental properties in Bulgaria trigger tourism registration requirements and a 10% flat tax on rental income for non-residents, which is still lower than most Western European countries.

What can I legally buy and truly own as a foreigner in Bulgaria?

What property types can foreigners legally buy in Bulgaria right now?

Foreigners can freely purchase apartments, condos, and studios in Bulgaria in their own name because these property types do not include direct land ownership.

The most important limitation in Bulgaria is that non-EU citizens cannot own land directly in their personal name, which means buying a house with a garden or any property that includes a plot requires a different approach.

EU and EEA citizens have full rights to purchase land and houses directly, just like Bulgarian nationals, thanks to Bulgaria's EU accession treaty obligations.

For non-EU buyers interested in houses or villas, the standard workaround is to register a Bulgarian limited liability company (called an OOD) that then owns the land, with the foreign buyer owning the company itself.

Finally, please note that our pack about the property market in Bulgaria is specifically tailored to foreigners.

Can I own land in my own name in Bulgaria right now?

Whether you can own land in your own name in Bulgaria depends entirely on your nationality, with EU and EEA citizens having full direct ownership rights while non-EU foreigners face constitutional restrictions.

Non-EU buyers who want to own land in Bulgaria typically establish a Bulgarian company for this purpose, which is a legally sound and commonly used structure that costs around 500 to 1,000 euros to set up with ongoing annual accounting requirements.

Agricultural land, forest land, and vineyards remain completely off-limits to all foreigners regardless of nationality, representing one of the few areas where even EU citizens face restrictions in Bulgaria.

By the way, we cover everything there is to know about the land buying process in Bulgaria here.

As of 2026, what other key foreign-ownership rules or limits should I know in Bulgaria?

As of early 2026, Bulgaria does not impose foreign ownership quotas on apartments or condominiums, meaning there is no limit on how many units in a building can be owned by foreigners.

Bulgaria also has no mandatory government approval process for foreign property purchases, which makes the buying process faster and simpler compared to countries with pre-approval requirements.

However, all property transactions must be registered with the Bulgarian Registry Agency, and buyers need a Bulgarian tax identification number to complete the purchase and pay ongoing property taxes.

The most notable recent change is Bulgaria's euro adoption on January 1, 2026, which eliminates currency exchange risk for eurozone buyers and simplifies pricing since most listings were already denominated in euros.

If you're interested, we go much more into details about the foreign ownership rights in Bulgaria here.

What's the biggest ownership mistake foreigners make in Bulgaria right now?

The single biggest mistake foreign buyers make in Bulgaria is purchasing a house or villa without realizing the deal includes land, which creates a legal problem for non-EU citizens who cannot hold land in their personal name.

When this mistake happens, the transaction can be invalidated or require costly restructuring through a Bulgarian company after the fact, causing delays of several months and additional legal fees of 1,500 to 3,000 euros.

Other classic pitfalls in Bulgaria include skipping independent legal due diligence, not checking for unpaid utility bills or property taxes that transfer to the new owner, and failing to verify that buildings have proper commissioning permits (called Act 16) allowing legal residential use.

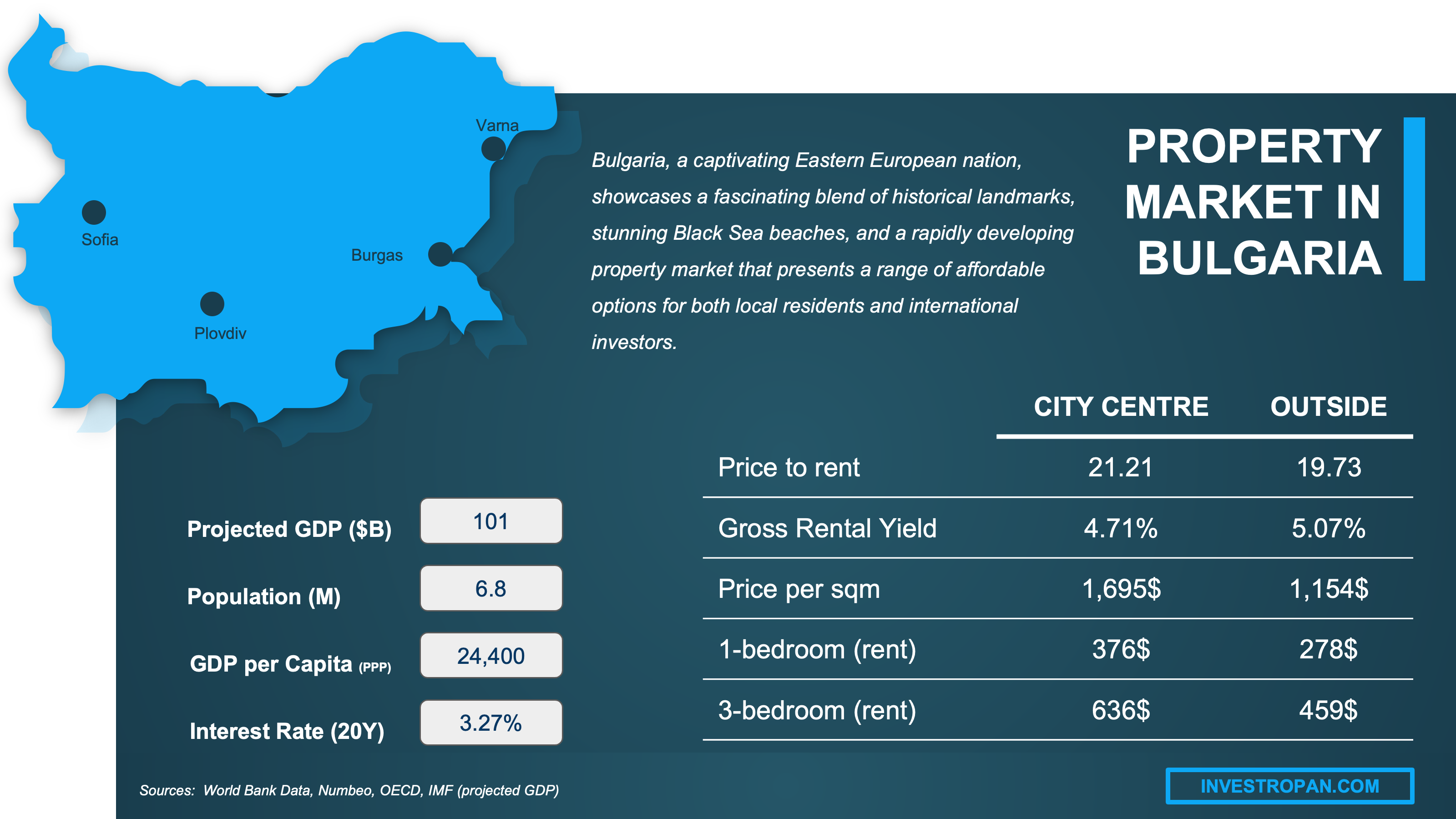

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which visa or residency status changes what I can do in Bulgaria?

Do I need a specific visa to buy property in Bulgaria right now?

You do not need any specific visa or residence permit to purchase property in Bulgaria, and many foreign buyers complete their transactions while visiting on a standard tourist visa or visa-free entry.

The most common administrative hurdle for non-residents is opening a Bulgarian bank account, which some banks may require for the transaction and which has become slightly more complex due to anti-money laundering regulations.

You will need a Bulgarian tax identification number (often obtained via BULSTAT registration for foreigners) before completing the purchase, as this is required for the notarial deed and subsequent property tax declarations.

A typical document set for foreign buyers in Bulgaria includes a valid passport, proof of address in your home country, a Bulgarian tax number, and if you cannot be present at closing, a notarized and apostilled power of attorney authorizing someone to act on your behalf.

Does buying property help me get residency and citizenship in Bulgaria in 2026?

As of early 2026, buying property alone does not automatically grant you residency or citizenship in Bulgaria, though a qualifying real estate investment can support an extended residence permit application.

Bulgaria offers a residence-by-investment pathway that requires a minimum property investment of 600,000 BGN (approximately 310,000 euros), with at least 75% of this amount funded from the buyer's own resources rather than borrowed.

After holding an extended residence permit for five years, you can apply for permanent residency, and after another five years of permanent residency, you become eligible for Bulgarian citizenship through naturalization.

We give you all the details you need about the different pathways to get residency and citizenship in Bulgaria here.

Can I legally rent out property on my visa in Bulgaria right now?

Your visa status does not restrict your ability to own and rent out property in Bulgaria, as property ownership rights and rental income are treated separately from immigration status.

You do not need to live in Bulgaria to rent out your property, and many foreign owners manage their rentals remotely through local property management agencies, especially for short-term vacation rentals.

The key distinction for foreign landlords is between long-term rentals, which are administratively simpler, and short-term rentals like Airbnb, which trigger tourism accommodation registration requirements and additional municipal compliance obligations.

We cover everything there is to know about buying and renting out in Bulgaria here.

Get fresh and reliable information about the market in Bulgaria

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

How does the buying process actually work step-by-step in Bulgaria?

What are the exact steps to buy property in Bulgaria right now?

The standard buying process in Bulgaria follows these steps: choose a property and agree on price, pay a reservation deposit (typically 1,000 to 2,000 euros), conduct due diligence checks, sign a preliminary contract with a larger deposit (usually 10% of the price), gather closing documents, sign the notarial deed before a notary public, and then register the transfer with the Property Registry.

You do not need to be physically present for the entire process because Bulgaria allows purchases via a notarized power of attorney, though you should have your lawyer verify the exact wording and ensure the document is properly apostilled for use in Bulgaria.

The legally binding moment in Bulgarian property transactions is the signing of the preliminary contract with deposit, which creates enforceable obligations on both buyer and seller and typically includes penalty clauses if either party withdraws.

A typical end-to-end timeline from accepted offer to final registration in Bulgaria ranges from four to eight weeks, though this can extend to three months or more for complex transactions involving company structures or mortgage financing.

We have a document entirely dedicated to the whole buying process our pack about properties in Bulgaria.

Is it mandatory to get a lawyer or a notary to buy a property in Bulgaria right now?

A notary is effectively mandatory for property purchases in Bulgaria because the transfer must be completed through a notarial deed, with the notary verifying identities, confirming the seller's ownership rights, and registering the transaction.

The key difference is that a notary in Bulgaria acts as a neutral state-appointed official who authenticates the transaction but does not advocate for either party, while a lawyer works exclusively in your interest to review documents, negotiate terms, and identify legal risks.

Your lawyer engagement should explicitly include a title history check going back at least 10 years, verification of the property's legal status and building permits, confirmation that all taxes and utility bills are paid, and review of any encumbrances registered against the property.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

What checks should I run so I don't buy a problem property in Bulgaria?

How do I verify title and ownership history in Bulgaria right now?

The official authority for verifying title and ownership in Bulgaria is the Registry Agency's Property Register, accessible through their online EPZEU portal, where you can request certificates and extracts showing the property's legal status.

The key document to request is a Certificate of Encumbrances (called "удостоверение за тежести" in Bulgarian), which shows the complete ownership chain, registered mortgages, liens, claims, and any notes affecting the property.

A standard look-back period for ownership history checks in Bulgaria is 10 years, which is typically sufficient to identify any problematic transfers or inherited disputes that could affect your purchase.

Clear red flags that should pause or stop a purchase in Bulgaria include ongoing litigation involving the property, multiple transfers in quick succession, discrepancies between the cadastre records and property register entries, or any registered claims from third parties.

You will find here the list of classic mistakes people make when buying a property in Bulgaria.

How do I confirm there are no liens in Bulgaria right now?

The standard way to confirm there are no liens on a Bulgarian property is to order a Certificate of Encumbrances from the Property Register at the Registry Agency, which provides an official record of all mortgages, attachments, and registered burdens.

One common type of encumbrance to specifically ask about in Bulgaria is unpaid condominium maintenance fees, which may not always appear on the official certificate but can create disputes with building management or other owners after purchase.

The best proof of lien status is an officially issued Certificate of Encumbrances dated within 30 days of your closing, as older certificates may not reflect recently registered claims or newly filed mortgage applications.

How do I check zoning and permitted use in Bulgaria right now?

The authority for checking zoning and permitted use in Bulgaria is the municipal administration where the property is located, which maintains detailed spatial planning documents and can issue certificates confirming a property's legal designation.

The key document to request is a cadastre scheme or sketch from the Geodesy, Cartography and Cadastre Agency, combined with a zoning certificate from the municipality, which together confirm whether the property is legally classified for residential use.

A common pitfall for foreign buyers in Bulgaria is purchasing what appears to be a residential unit that was actually converted from commercial space (like an office or shop) without proper permits, which can create problems with insurance, mortgages, and resale value.

Buying real estate in Bulgaria can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Can I get a mortgage as a foreigner in Bulgaria, and on what terms?

Do banks lend to foreigners for homes in Bulgaria in 2026?

As of early 2026, Bulgarian banks do lend to foreigners for home purchases, though EU citizens and residents with documented EU income have a smoother approval process than non-residents with complex income sources.

Foreign borrowers in Bulgaria typically see loan-to-value ratios of 50% to 70%, which is lower than the 80% to 85% maximum available to Bulgarian residents, meaning you will need a larger down payment of 30% to 50%.

The most common eligibility requirement that determines whether a foreigner qualifies in Bulgaria is proof of stable, documentable income in a recognized currency, with banks generally requiring income of at least 2,000 euros per month and sometimes asking for a local guarantor.

You can also read our latest update about mortgage and interest rates in Bulgaria.

Which banks are most foreigner-friendly in Bulgaria in 2026?

As of early 2026, the banks most commonly cited as foreigner-friendly for mortgages in Bulgaria are DSK Bank, UniCredit Bulbank, and United Bulgarian Bank (UBB), with Eurobank Bulgaria and First Investment Bank (FIBank) also serving international clients.

What makes these banks more foreigner-friendly is their established processes for handling non-standard documentation, including foreign income verification, and their experience with international clients who may need English-language support.

These banks will generally consider lending to non-residents, but approval depends heavily on income documentation quality, with EU-source income being easier to verify than income from countries with less transparent financial systems.

We actually have a specific document about how to get a mortgage as a foreigner in our pack covering real estate in Bulgaria.

What mortgage rates are foreigners offered in Bulgaria in 2026?

As of early 2026, mortgage interest rates for foreigners in Bulgaria typically range from 3.5% to 5% for euro-denominated loans, which is higher than the 2.7% to 3.2% rates that well-qualified Bulgarian residents receive.

Most mortgages in Bulgaria are floating-rate products (about 99% of new loans), with fixed-rate options adding approximately 0.5% to 1% on top of variable rates, though fixed-rate mortgages provide payment certainty that some foreign buyers prefer.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What will taxes, fees, and ongoing costs look like in Bulgaria?

What are the total closing costs as a percent in Bulgaria in 2026?

Total closing costs for a residential property purchase in Bulgaria in 2026 typically run around 5% to 6% of the purchase price, excluding any real estate agent commission you might pay.

If you include a buyer-side agent fee of 2.5% to 3.6%, which is common practice in Bulgaria, your total transaction costs rise to approximately 8% to 10% of the purchase price.

The specific fee categories that make up closing costs in Bulgaria include municipal transfer tax (0.1% to 3% depending on municipality), Property Register registration fee (0.1%), notary fees (0.1% to 1% based on a progressive tariff), and legal fees for due diligence and document preparation.

The single biggest contributor to closing costs in Bulgaria is typically the municipal transfer tax, which in major cities like Sofia, Plovdiv, Varna, and Burgas is set at 3% of the purchase price or the tax valuation, whichever is higher.

If you want to go into more details, we also have a blog article detailing all the property taxes and fees in Bulgaria.

What annual property tax should I budget in Bulgaria in 2026?

As of early 2026, annual property tax for a typical owner-occupied apartment in Bulgaria ranges from 50 to 200 euros (50 to 200 USD), plus a separate garbage collection fee of 100 to 400 euros depending on the municipality.

Annual property tax in Bulgaria is calculated as a percentage of the property's tax valuation (not the market price), with municipal rates ranging from 0.01% to 0.45% of the assessed value, making Bulgaria one of the lowest property tax jurisdictions in the EU.

How is rental income taxed for foreigners in Bulgaria in 2026?

As of early 2026, rental income earned by non-resident foreigners in Bulgaria is taxed at a flat rate of 10% on Bulgarian-source income, which is one of the lowest rental income tax rates in Europe.

Non-resident landlords in Bulgaria typically need to file an annual tax return with the National Revenue Agency, though the exact mechanism may involve withholding if you use a local property management company to handle your rentals.

What insurance is common and how much in Bulgaria in 2026?

As of early 2026, annual home insurance premiums in Bulgaria typically range from 80 to 250 euros (80 to 250 USD) for apartments and 150 to 450 euros for houses or villas, depending on the property size and coverage level.

The most common type of property insurance coverage in Bulgaria is a combined policy covering fire, water damage, natural disasters, and third-party liability, with theft coverage often available as an add-on.

The biggest factor affecting insurance premiums in Bulgaria is the property's location, with coastal and earthquake-prone areas commanding higher rates, and newer buildings with modern construction typically receiving better pricing than older panel-block apartments.

Get the full checklist for your due diligence in Bulgaria

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Bulgaria, we always rely on the strongest methodology we can and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Constitution of Bulgaria | The country's highest legal text defining foreign land ownership boundaries. | We used it to establish the fundamental distinction between what foreigners can own (buildings) versus what faces restrictions (land). We translated constitutional provisions into practical property scenarios. |

| European Council | The official EU institution that adopted the final legal steps for Bulgaria's euro entry. | We used it to confirm the January 2026 euro adoption date and explain how the currency transition affects property transactions. We anchored all 2026 context in this official confirmation. |

| Bulgarian Registry Agency (EPZEU) | The official government portal for Bulgaria's Property Register services. | We used it to explain how title and encumbrance checks work in practice. We described the specific certificates buyers should request to verify ownership. |

| Ministry of Finance (Local Taxes and Fees Act) | The official publication of the law governing municipal property and transfer taxes. | We used it to provide accurate ranges for transfer tax and annual property tax. We converted legal rate bands into practical budget estimates for foreign buyers. |

| Bulgarian Migration Directorate | The official unit of the Ministry of Interior responsible for residence permits. | We used it to clarify that buying property does not automatically grant residency. We anchored all visa and residency guidance in the competent authority's framework. |

| European Mortgage Federation (Hypostat Bulgaria) | A widely recognized cross-country mortgage market reference for European markets. | We used it to establish typical LTV ratios, loan terms, and the floating-rate dominance in Bulgaria's mortgage market. We cross-checked norms against local bank offerings. |

| Bulgarian National Bank | The central bank that publishes official interest rate statistics and monetary policy guidance. | We used it to ground mortgage rate discussions in official data rather than advertisements. We anchored the 2.7% to 3.2% baseline rates in BNB statistical releases. |

| Geodesy, Cartography and Cadastre Agency | The state cadastre authority that issues official property identification documents. | We used it to explain the cadastre's role in defining what a property actually is and where it sits. We described the sketch and scheme documents buyers will encounter. |

| UNECE (Law for Notaries) | A published translation of the law defining the notary's role in Bulgarian property transfers. | We used it to explain why notaries are central to property transactions. We clarified the difference between what notaries do versus what independent lawyers provide. |

| Ministry of Tourism | The official government source on tourism accommodation registration requirements. | We used it to support the short-term rental compliance discussion. We explained that Airbnb-style rentals trigger different obligations than long-term tenancies. |

| CMS Law Country Tax Guide | An established international law firm's summary of Bulgarian tax rules. | We used it to cross-check the 10% rental income tax rate for non-residents. We validated our tax guidance against professional legal sources. |

| PwC Tax Summaries | A recognized professional services firm providing country-specific tax guidance. | We used it to confirm municipal property tax rate ranges. We validated our annual tax cost estimates against established professional sources. |

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of Bulgaria. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.