Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Everything you need to know before buying real estate is included in our Bulgaria Property Pack

Buying property in Bulgaria as a foreigner comes with extra costs that can catch you off guard if you don't plan ahead.

We constantly update this blog post to reflect the latest taxes, fees, and regulations affecting foreign buyers in Bulgaria.

Below, you'll find everything you need to budget properly and avoid surprises at closing.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Bulgaria.

Overall, how much extra should I budget on top of the purchase price in Bulgaria in 2026?

How much are total buyer closing costs in Bulgaria in 2026?

As of early 2026, total buyer closing costs in Bulgaria typically range from 5% to 8% of the purchase price, which means on a BGN 200,000 property (around EUR 102,000 or USD 110,000), you should expect to pay roughly BGN 10,000 to BGN 16,000 (EUR 5,100 to EUR 8,200 or USD 5,500 to USD 8,800) in additional fees and taxes.

If you keep expenses to the bare legal minimum by avoiding an agent and handling paperwork yourself in a low-tax municipality, your closing costs in Bulgaria can drop to around 3% to 4% of the purchase price, or about BGN 6,000 to BGN 8,000 (EUR 3,100 to EUR 4,100 or USD 3,300 to USD 4,400) on that same BGN 200,000 property.

On the high end, if you're buying in a municipality with the maximum 4% acquisition tax and using both a real estate agent and a lawyer for full due diligence, your total closing costs in Bulgaria can reach 9% to 10% of the purchase price, meaning BGN 18,000 to BGN 20,000 (EUR 9,200 to EUR 10,200 or USD 9,900 to USD 11,000) on that BGN 200,000 purchase.

The main factors that determine whether your closing costs in Bulgaria fall at the low or high end include which municipality you're buying in (Sofia, Varna, and Burgas charge higher acquisition taxes than smaller towns), whether you use a real estate agent (adding 2.5% to 3% plus VAT), and how much legal support you need for title checks and document translation.

What's the usual total % of fees and taxes over the purchase price in Bulgaria?

The usual total percentage of fees and taxes over the purchase price in Bulgaria sits around 6% to 7% for most standard residential transactions.

This realistic range covers the majority of foreign buyers, with the low end around 5% for straightforward purchases in lower-tax municipalities and the high end reaching 8% to 10% when agents, lawyers, and maximum municipal rates all apply.

Of that total percentage, government taxes (mainly the municipal acquisition tax at 2% to 4% and the 0.1% registry fee) typically account for roughly half, while the other half goes to professional service fees including notary costs, agent commissions, and legal support.

By the way, you will find much more detailed data in our property pack covering the real estate market in Bulgaria.

What costs are always mandatory when buying in Bulgaria in 2026?

As of early 2026, the mandatory costs when buying property in Bulgaria include the municipal property acquisition tax (2% to 4% depending on the municipality), the notary fee (tariff-based, roughly 0.4% to 1.2% of the price plus 20% VAT on the fee), and the Property Register state fee (0.1% of the transaction value).

Beyond these required costs, optional but highly recommended expenses for foreign buyers in Bulgaria include hiring an independent lawyer for title verification and due diligence (typically EUR 300 to EUR 1,000), certified translation and interpreter services at signing (EUR 100 to EUR 400), and a technical property inspection for older buildings or houses.

Don't lose money on your property in Bulgaria

100% of people who have lost money there have spent less than 1 hour researching the market. We have reviewed everything there is to know. Grab our guide now.

What taxes do I pay when buying a property in Bulgaria in 2026?

What is the property transfer tax rate in Bulgaria in 2026?

As of early 2026, the property transfer tax rate in Bulgaria (called the municipal property acquisition tax) ranges from 2% to 4% of the property's value, with most major cities like Sofia, Varna, Plovdiv, and Burgas charging around 3%.

Foreigners buying property in Bulgaria do not pay any extra transfer taxes beyond what Bulgarian citizens pay, since the municipal acquisition tax is based on the transaction itself rather than the buyer's nationality.

VAT on residential property purchases in Bulgaria applies mainly to new-build properties sold by VAT-registered developers at 20%, but most resale homes are VAT-exempt, and when VAT does apply, it's usually included in the sale price rather than added as a separate closing cost.

Bulgaria does not have a separate stamp duty in the UK sense, and the closest equivalents are the municipal acquisition tax and the state registration fee for the Property Register, both of which are already included in the closing cost calculations above.

Are there tax exemptions or reduced rates for first-time buyers in Bulgaria?

Bulgaria does not offer broad, nationwide first-time buyer exemptions or reduced transfer tax rates for residential property purchases, since the municipal acquisition tax is set by local ordinance within the legal framework and municipalities rarely grant automatic discounts.

If you buy property through a company instead of as an individual in Bulgaria, the municipal acquisition tax and notary mechanics still apply to the transaction, but the main differences appear later in corporate income tax on rental profits, VAT registration obligations, and ongoing accounting requirements.

The key tax difference between buying a new-build versus a resale property in Bulgaria is VAT: new constructions from VAT-registered developers typically include 20% VAT in the price, while resale homes are generally VAT-exempt.

Since Bulgaria doesn't have a formal first-time buyer relief program, there's no specific documentation or conditions to meet, though you should always confirm with the local municipality whether any special ordinances apply to your purchase area.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Which professional fees will I pay as a buyer in Bulgaria in 2026?

How much does a notary or conveyancing lawyer cost in Bulgaria in 2026?

As of early 2026, notary fees in Bulgaria are tariff-based and typically cost around 0.4% to 1.2% of the property price plus 20% VAT on the notary fee, which means on a BGN 200,000 property (EUR 102,000 or USD 110,000) you'll pay roughly BGN 1,500 to BGN 3,000 (EUR 750 to EUR 1,500 or USD 825 to USD 1,650) for notary services.

Notary fees in Bulgaria follow a sliding tariff scale set by law, meaning higher-value properties pay a lower percentage, while conveyancing lawyers typically charge either a fixed fee (BGN 600 to BGN 2,000 or EUR 300 to EUR 1,000) for straightforward deals or around 0.5% to 1% for more complex transactions.

Translation and interpreter services for foreign buyers in Bulgaria typically cost BGN 100 to BGN 300 (EUR 50 to EUR 150 or USD 55 to USD 165) for an interpreter at the notary signing, plus BGN 200 to BGN 800 (EUR 100 to EUR 400 or USD 110 to USD 440) for certified document translations depending on how many pages need official certification.

A tax advisor in Bulgaria is optional for simple buy-and-hold purchases but recommended if you plan to rent out the property or use a company structure, with typical consultation fees ranging from BGN 300 to BGN 1,000 (EUR 150 to EUR 500 or USD 165 to USD 550) for a focused session or BGN 1,000 to BGN 3,000 (EUR 500 to EUR 1,500) for ongoing structuring advice.

We have a whole part dedicated to these topics in our our real estate pack about Bulgaria.

What's the typical real estate agent fee in Bulgaria in 2026?

As of early 2026, the typical real estate agent fee in Bulgaria is around 2.5% to 3% of the property price plus 20% VAT, which on a BGN 200,000 property (EUR 102,000 or USD 110,000) works out to roughly BGN 6,000 to BGN 7,200 (EUR 3,000 to EUR 3,700 or USD 3,300 to USD 4,000) including VAT.

In Bulgaria, it is common for buyers to pay the agent fee, though in some transactions the fee is split between buyer and seller or absorbed by the seller, so you should confirm who pays what in writing before viewing properties.

The realistic low-to-high range for agent fees in Bulgaria runs from about 2% (for negotiated or competitive situations) up to 3.5% plus VAT (when dealing with premium agencies or exclusive listings), making it one of the most significant negotiable costs in a Bulgarian property purchase.

How much do legal checks cost (title, liens, permits) in Bulgaria?

Legal checks in Bulgaria, including title search, liens verification, and permits review, typically cost BGN 400 to BGN 1,500 (EUR 200 to EUR 750 or USD 220 to USD 825) when handled as part of a lawyer's due diligence package, though some lawyers include basic checks in their standard conveyancing fee.

If you need a bank mortgage in Bulgaria, the property valuation fee typically costs BGN 300 to BGN 800 (EUR 150 to EUR 400 or USD 165 to USD 440) for standard apartments, with houses and more complex properties costing more.

The most critical legal check you should never skip in Bulgaria is verifying clear title and checking for encumbrances at the Property Register, since document inconsistencies and unrecorded changes are common issues that can create serious problems after purchase.

Buying a property with hidden issues is something we mention in our list of risks and pitfalls people face when buying real estate in Bulgaria.

Get the full checklist for your due diligence in Bulgaria

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What hidden or surprise costs should I watch for in Bulgaria right now?

What are the most common unexpected fees buyers discover in Bulgaria?

The most common unexpected fees buyers discover in Bulgaria include higher-than-expected taxes when the municipal tax valuation exceeds the contract price (since costs are calculated on whichever is higher), document clean-up costs when property papers have inconsistencies, and the new waste collection fee structure that changed in January 2026 under the "polluter pays" system.

Yes, you could inherit unpaid property taxes or debts when purchasing in Bulgaria, which is why proper due diligence should include obtaining certificates confirming the seller has no outstanding local tax liabilities tied to the property before closing.

Scams with fake listings or fake fees do occur in Bulgaria, typically involving pressure to pay "reservation" deposits to unauthorized parties or sellers without proper authority, and your best protection is to pay all transaction fees through the official notary process and verify identities through a lawyer and Property Register checks.

Fees that are usually not disclosed upfront in Bulgaria include agent VAT (when quotes don't clearly state "including VAT"), translation and certification bundles, extra legal work required when property documents are messy, and the timing of post-purchase municipal fees like property tax and the new waste fee.

In our property pack covering the property buying process in Bulgaria, we go into details so you can avoid these pitfalls.

Are there extra fees if the property has a tenant in Bulgaria?

If the property you're buying in Bulgaria has a tenant, expect extra costs of around BGN 400 to BGN 1,500 (EUR 200 to EUR 800 or USD 220 to USD 880) for additional legal work reviewing the lease terms, handling formal notices, and potentially negotiating vacant possession.

When you purchase a tenanted property in Bulgaria, you inherit the existing lease agreement, meaning you step into the previous landlord's obligations and must honor the lease terms until they naturally expire or are legally terminated.

Terminating an existing lease immediately after purchase in Bulgaria is generally not possible unless the lease agreement contains specific early termination clauses or you can negotiate a mutual agreement with the tenant, often involving compensation.

A sitting tenant in Bulgaria typically affects the property's market value and negotiating position in your favor, since many buyers prefer vacant properties, which can give you leverage to negotiate a 5% to 10% discount depending on how long the lease runs.

If you want to optimize your rental strategy, you can read our complete guide on how to buy and rent out in Bulgaria.

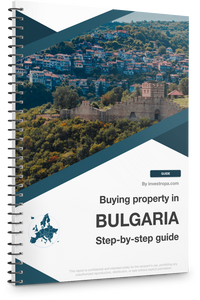

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which fees are negotiable, and who really pays what in Bulgaria?

Which closing costs are negotiable in Bulgaria right now?

The closing costs that are negotiable in Bulgaria include the real estate agent fee (both the rate and who pays), lawyer fees (scope and pricing structure), translation costs (per-page versus package deals), and which party covers small administrative certificates and documents.

The closing costs that are fixed by law and cannot be negotiated in Bulgaria include the municipal property acquisition tax (set by municipal ordinance within the 2% to 4% legal band), the Property Register state fee (0.1%), and the notary tariff fee (set by official tariff, though the notary cannot waive it).

On negotiable fees in Bulgaria, buyers can realistically achieve savings of 10% to 30% by shopping around for lawyers, negotiating agent commission splits with sellers, or bundling translation services, which on a typical transaction could save you BGN 1,000 to BGN 3,000 (EUR 500 to EUR 1,500).

Can I ask the seller to cover some closing costs in Bulgaria?

The likelihood of a seller agreeing to cover some closing costs in Bulgaria depends heavily on market conditions and property demand, but in a balanced or buyer-friendly market, you have a reasonable chance of negotiating this concession.

The specific closing costs sellers in Bulgaria are most commonly willing to cover include sharing or fully paying the real estate agent commission, covering some administrative document fees, or offering a price reduction that effectively reimburses your costs rather than paying them directly.

Sellers in Bulgaria are more likely to accept covering closing costs when their property has been listed for a long time, when the market is slow, when the property needs repairs, or when they're motivated by circumstances like relocation or inheritance.

Is price bargaining common in Bulgaria in 2026?

As of early 2026, price bargaining is common and expected in Bulgaria's residential property market, with most sellers listing properties with some negotiation margin built into their asking price.

Buyers in Bulgaria typically negotiate 3% to 7% below the asking price on average, which on a BGN 200,000 property (EUR 102,000 or USD 110,000) means potential savings of BGN 6,000 to BGN 14,000 (EUR 3,000 to EUR 7,000 or USD 3,300 to USD 7,700), though hot properties in prime Sofia or coastal locations may only allow 0% to 3% while stale listings or fixer-uppers can see discounts of 7% to 12%.

Don't sign a document you don't understand in Bulgaria

Buying a property over there? We have reviewed all the documents you need to know. Stay out of trouble - grab our comprehensive guide.

What monthly, quarterly or annual costs will I pay as an owner in Bulgaria?

What's the realistic monthly owner budget in Bulgaria right now?

The realistic monthly owner budget for a typical apartment in Bulgaria (excluding any mortgage) ranges from BGN 150 to BGN 500 (EUR 80 to EUR 250 or USD 85 to USD 275) to cover all regular ownership costs.

The main recurring expense categories that make up this monthly budget in Bulgaria include building maintenance and common area fees, utilities (electricity, water, heating), and building sinking fund contributions for future repairs.

The realistic low-to-high range for monthly owner costs in Bulgaria runs from about BGN 150 (EUR 80 or USD 85) for a modest panel-block apartment with low fees up to BGN 500 or more (EUR 250+ or USD 275+) for a larger apartment in a modern complex with elevators, security, and managed amenities, while houses typically cost even more since maintenance isn't shared.

The monthly cost that tends to vary the most in Bulgaria is heating, especially for properties connected to district heating systems where winter bills can spike significantly, or for homes relying on electricity or gas for warmth.

You can see how this budget affect your gross and rental yields in Bulgaria here.

What is the annual property tax amount in Bulgaria in 2026?

As of early 2026, annual property tax in Bulgaria for residential properties typically ranges from BGN 100 to BGN 400 (EUR 50 to EUR 200 or USD 55 to USD 220) for small to average apartments, while larger apartments and houses may pay BGN 300 to BGN 1,200 (EUR 150 to EUR 600 or USD 165 to USD 660) per year.

The realistic low-to-high range for annual property taxes in Bulgaria depends heavily on the property's tax valuation (not market value), with modest apartments paying under BGN 150 (EUR 75) while large villas or houses in desirable areas can pay BGN 1,000+ (EUR 500+) annually, plus separate waste collection fees that changed in January 2026.

Property tax in Bulgaria is calculated based on the tax valuation (a formula-based assessment, not market value) using per-mille rates set by each municipality within legal limits, meaning the same-sized property can have different tax bills in different cities.

Some exemptions and reductions for property tax in Bulgaria exist for primary residences and certain property types, though these vary by municipality, and foreigners generally don't face different rates than Bulgarian citizens for the same property.

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of Bulgaria. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

If I rent it out, what extra taxes and fees apply in Bulgaria in 2026?

What tax rate applies to rental income in Bulgaria in 2026?

As of early 2026, rental income in Bulgaria is taxed at a flat 10% personal income tax rate, which applies to both Bulgarian residents and foreign property owners earning rental income from Bulgarian properties.

Landlords in Bulgaria can deduct expenses from rental income through a statutory expense deduction mechanism (commonly described as a 10% flat deduction for certain rental income categories), which reduces the taxable amount and brings the effective tax closer to about 9% of gross rent in straightforward cases.

After applying the standard deduction, the realistic effective tax rate for typical landlords in Bulgaria lands around 9% of gross rental income, though those with higher documented expenses or different rental structures may see slightly different results.

Foreign property owners in Bulgaria generally pay the same 10% flat tax rate on Bulgarian-source rental income as residents, though the withholding and payment mechanics may differ, and tax treaties between Bulgaria and your home country could affect how you claim relief on taxes already paid.

Do I pay tax on short-term rentals in Bulgaria in 2026?

As of early 2026, short-term rentals in Bulgaria are subject to the same 10% flat income tax as long-term rentals, plus an additional tourist tax that municipalities charge per guest per overnight stay, ranging from BGN 0.20 to BGN 3.00 (EUR 0.10 to EUR 1.50 or USD 0.11 to USD 1.65) depending on the location.

Short-term rental income in Bulgaria is taxed at the same 10% rate as long-term rentals, but the key differences are the additional tourist tax obligation, potential VAT implications if you operate at scale or meet certain categorization thresholds, and more complex record-keeping requirements for per-night stays.

If you want to optimize your rental strategy, you can read our complete guide on how to buy and rent out in Bulgaria.

Get to know the market before buying a property in Bulgaria

Better information leads to better decisions. Get all the data you need before investing a large amount of money. Download our guide.

If I sell later, what taxes and fees will I pay in Bulgaria in 2026?

What's the total cost of selling as a % of price in Bulgaria in 2026?

As of early 2026, the total cost of selling a residential property in Bulgaria typically ranges from 3% to 6% of the sale price, depending on whether you use an agent and how much legal or administrative support you need.

The realistic low-to-high range for total selling costs in Bulgaria runs from about 2% to 3% if you sell privately without an agent and handle paperwork yourself, up to 5% to 6% or slightly more when using a full-service agency and lawyer for a complex transaction.

The specific cost categories that typically make up selling expenses in Bulgaria include the real estate agent commission (often the largest piece at 2% to 3% plus VAT), legal and administrative fees, energy certificate costs if not already obtained, and any negotiated "seller pays" items agreed with the buyer.

The single largest contributor to selling expenses in Bulgaria is usually the real estate agent commission, which at 2.5% to 3% plus VAT can account for more than half of all selling costs when you use an agency to market and sell your property.

What capital gains tax applies when selling in Bulgaria in 2026?

As of early 2026, capital gains from selling property in Bulgaria are taxed at the flat 10% personal income tax rate, applied to the positive difference between your sale price and acquisition price.

Exemptions to capital gains tax in Bulgaria are available under specific circumstances outlined in the Income Taxes on Natural Persons Act, commonly linked to how long you've owned the property and how many properties you've sold in the tax year, so you should verify your exact situation with an advisor since the details matter.

Foreigners selling property in Bulgaria do not pay a higher capital gains rate than residents; non-residents are simply taxed on Bulgarian-source gains at the same 10% rate, though tax treaties with your home country may provide relief to avoid double taxation.

Capital gains in Bulgaria are calculated as the sale price minus the documented acquisition price, and in many cases sellers can reduce the taxable gain by applying statutory deductions outlined in the tax law, making it important to keep all purchase documentation for when you eventually sell.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Bulgaria, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Bulgaria Ministry of Finance - Laws in English | The Bulgarian government publishes official English versions of core tax laws here. | We used it to anchor every tax rule in primary legislation. We cross-checked secondary explanations against the official PDFs listed there. |

| Local Taxes and Fees Act (official PDF) | This is the official statute governing municipal property acquisition tax and annual property tax. | We used it for the legal tax ranges set by Bulgarian law. We then translated those legal ranges into practical budget estimates for buyers. |

| Bulgarian Registry Agency - Property Register Portal | The official portal for Bulgaria's Property Register and related services. | We used it to confirm the Registry Agency's role in property registration. We used it to justify registry fee budgeting as a mandatory closing step. |

| Bulgarian Notary Chamber - Tariffs | The professional body for notaries in Bulgaria sets official tariff-based pricing. | We used it to confirm that notary costs follow tariff logic. We paired it with calculators to produce realistic budget ranges. |

| PwC Worldwide Tax Summaries - Bulgaria | PwC's summaries are widely used and kept current for compliance planning. | We used it to triangulate the flat personal tax rate and rental income treatment. We used it as a second reference alongside Bulgarian legislation. |

| RSM Bulgaria - Real Estate Transfer Guide | RSM is a large international tax advisory firm with compliance-driven explanations. | We used it to cross-check how VAT applies to new versus resale buildings. We used it to keep the VAT discussion accurate but buyer-friendly. |

| NPLA.bg - Real Estate Transaction Calculator | A specialist legal reference that explicitly cites the tariffs and ordinances it uses. | We used it to triangulate realistic fee amounts from official tariff structures. We used it to translate tariff tables into practical budgeting ranges. |

| Danailova, Todorov & Partners | A Bulgarian law firm providing detailed guidance on real estate purchase procedures. | We used it to verify agent fee practices and transaction procedures. We used it to confirm which costs buyers typically face in Bulgaria. |

| Schoenherr - Bulgaria Waste Fee Analysis | A leading CEE law firm analyzing Bulgaria's 2026 waste fee reform. | We used it to explain the January 2026 waste fee changes. We used it to warn buyers about potential ongoing cost variations. |

| UNECE - Law for Notaries and Notarial Activity | A published English text of Bulgarian notarial law used in international legal contexts. | We used it to confirm the formal role of notaries in title transfer. We used it to justify why notary costs are effectively mandatory. |

Get fresh and reliable information about the market in Bulgaria

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.