Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Yes, the analysis of Sofia's property market is included in our pack

If you're wondering what it costs to rent an apartment in Sofia right now, you've come to the right place.

We break down current rental prices in Sofia by apartment size, neighborhood, and tenant type, and we keep this article updated as the market evolves.

All figures reflect what we're seeing in Sofia's rental market as of the first half of 2026, with Bulgaria's euro adoption adding fresh relevance to pricing discussions.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Sofia.

Insights

- Sofia studio rents average around €430 per month in 2026, but jumping to a prime neighborhood like Lozenets can push that figure above €550 even for compact spaces.

- Properties within a 10-minute walk of a Sofia metro station typically rent 15% to 20% faster than similar units farther from transit.

- Sofia's rental vacancy rate sits near 4% citywide in 2026, but drops to just 2% to 3% in sought-after southern districts like Lozenets and Ivan Vazov.

- Furnished apartments in Sofia command a rent premium of roughly €50 to €100 per month over unfurnished units of comparable size and location.

- The euro changeover in January 2026 has prompted some Sofia landlords to round up advertised rents, adding subtle upward pressure to asking prices.

- Year-over-year rent growth in Sofia for 2026 is tracking between 5% and 8%, outpacing general inflation in Bulgaria.

- Adding air conditioning to a Sofia rental typically boosts monthly rent by €30 to €50, making it one of the highest-ROI upgrades for landlords.

- Peak tenant demand in Sofia hits between late August and October, when students and new job starters flood the market looking for apartments.

- Sofia landlords pay a property tax rate of just 0.1875% of the municipal tax valuation, which often results in annual bills under €200 for typical apartments.

- Expats in Sofia gravitate toward Lozenets, Iztok, and Oborishte, where turnkey furnished units and proximity to embassies justify higher rents.

What are typical rents in Sofia as of 2026?

What's the average monthly rent for a studio in Sofia as of 2026?

As of early 2026, the average monthly rent for a studio apartment in Sofia is approximately €430, which translates to around BGN 840 or $450.

Most studio apartments in Sofia rent within a realistic range of €340 to €560 per month (BGN 665 to BGN 1,095, or $360 to $590), depending on the specific unit and its location.

The biggest factors causing Sofia studio rents to vary are neighborhood prestige, whether the unit has been recently renovated, and how close it sits to a metro station or the city center.

What's the average monthly rent for a 1-bedroom in Sofia as of 2026?

As of early 2026, the average monthly rent for a 1-bedroom apartment in Sofia is approximately €580, which works out to around BGN 1,135 or $610.

A realistic range for most 1-bedroom apartments in Sofia falls between €450 and €760 per month (BGN 880 to BGN 1,485, or $475 to $800), with condition and metro access being the main drivers.

For 1-bedroom rentals in Sofia, neighborhoods like Lyulin and Ovcha Kupel tend to have the lowest rents, while prime areas such as Lozenets, Iztok, and Ivan Vazov consistently command the highest prices.

What's the average monthly rent for a 2-bedroom in Sofia as of 2026?

As of early 2026, the average monthly rent for a 2-bedroom apartment in Sofia is approximately €740, which equals around BGN 1,450 or $780.

Most 2-bedroom apartments in Sofia rent within a range of €600 to €1,050 per month (BGN 1,175 to BGN 2,055, or $630 to $1,100), with the wide spread largely explained by unit condition, parking availability, and metro proximity.

In Sofia, the cheapest 2-bedroom rentals are typically found in outer districts like Nadezhda and Krasna Polyana, while the most expensive ones cluster in southern neighborhoods such as Lozenets, Hladilnika, and Boyana.

By the way, you will find much more detailed rent ranges in our property pack covering the real estate market in Sofia.

What's the average rent per square meter in Sofia as of 2026?

As of early 2026, the average rent per square meter in Sofia is approximately €9.50 per month, which equals around BGN 18.60 or $10 per square meter.

Across Sofia's different neighborhoods, rent per square meter ranges realistically from €6 to €15 per month (BGN 12 to BGN 29, or $6.30 to $15.75), depending on whether you're looking at older outer-district stock or renovated prime-area apartments.

Compared to other major Bulgarian cities like Plovdiv or Varna, Sofia's rent per square meter runs about 30% to 50% higher, reflecting the capital's stronger job market and higher incomes.

In Sofia, properties that push rent per square meter above average typically share characteristics like recent renovation, metro walkability, south-facing balconies, and dedicated parking.

How much have rents changed year-over-year in Sofia in 2026?

As of early 2026, rents in Sofia have increased by an estimated 5% to 8% compared to January 2025, with prime neighborhoods closer to the higher end of that range.

The main factors driving rent increases in Sofia this year include strong income growth in services and tech sectors, continued household formation, and the euro changeover prompting some landlords to round up asking prices.

This year's rent growth in Sofia is slightly stronger than the 4% to 6% increase seen in 2024, reflecting tighter supply conditions and sustained demand from young professionals.

What's the outlook for rent growth in Sofia in 2026?

As of early 2026, we project Sofia rents to grow by 4% to 7% over the full year, with prime southern districts like Lozenets and Hladilnika likely at the top of that range.

The key factors supporting this outlook include continued income growth, strong hiring in Sofia's services and tech sectors, and gradual new supply that isn't flooding the market fast enough to cool demand.

Neighborhoods expected to see the strongest rent growth in Sofia during 2026 include Lozenets, Krastova Vada, and Mladost 1, where metro access and modern stock attract competition among tenants.

The main risks that could push Sofia rent growth above or below projections are a sharper-than-expected economic slowdown, a surge in completed construction, or unexpected effects from the euro adoption on household budgets.

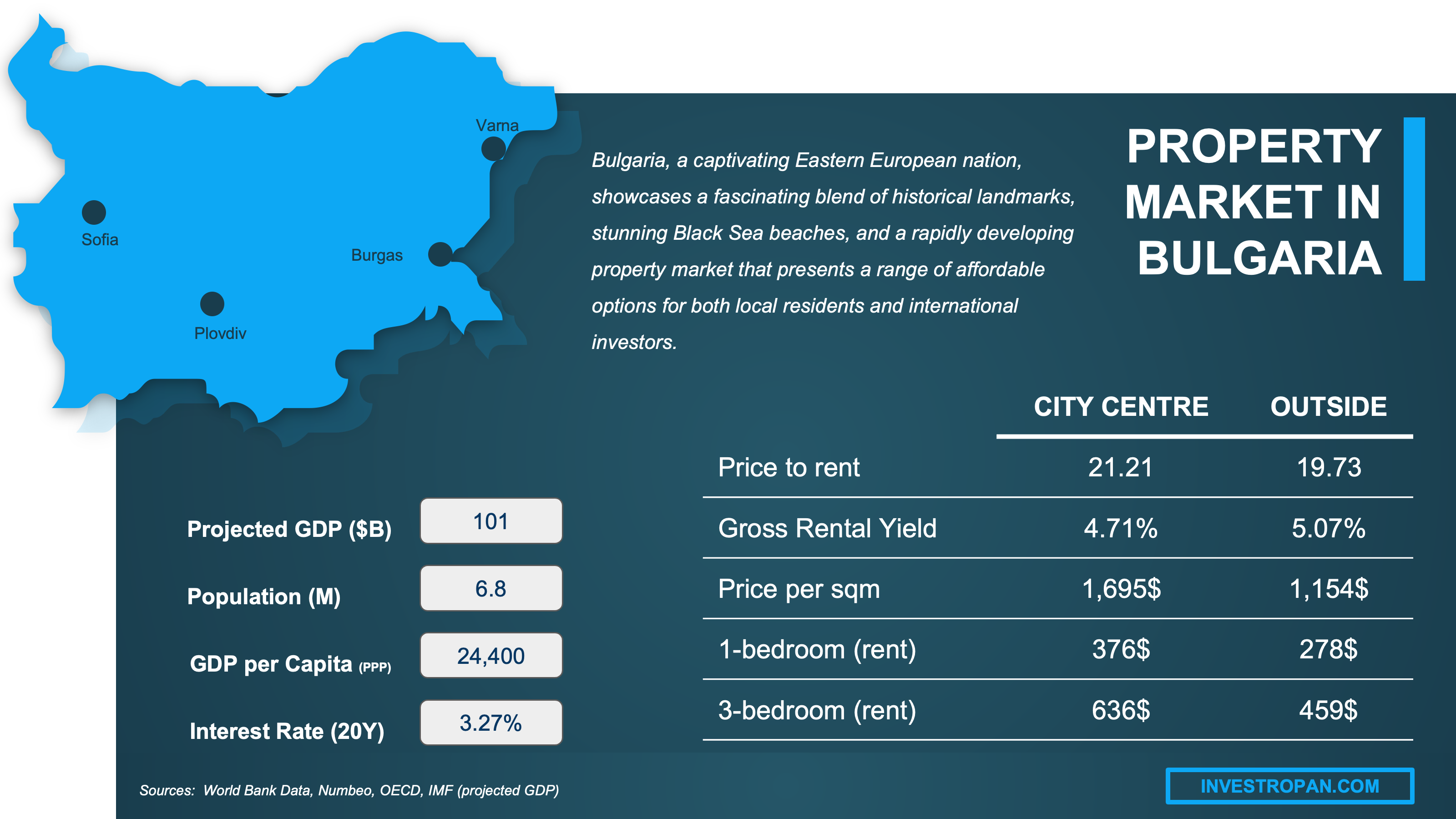

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which neighborhoods rent best in Sofia as of 2026?

Which neighborhoods have the highest rents in Sofia as of 2026?

As of early 2026, the three Sofia neighborhoods with the highest average rents are Lozenets (around €700 to €900 per month for a 1-bedroom, or BGN 1,370 to BGN 1,760 / $735 to $945), Iztok (€650 to €850 per month), and Oborishte near Doctor's Garden (€600 to €800 per month).

These Sofia neighborhoods command premium rents because they combine central locations, tree-lined streets, proximity to embassies and international schools, and a high share of renovated or newer apartments.

The typical tenant renting in these high-rent Sofia neighborhoods is either an expat professional, a senior manager in a multinational company, or a well-established local family seeking prestige and convenience.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Sofia.

Where do young professionals prefer to rent in Sofia right now?

The top three Sofia neighborhoods where young professionals prefer to rent are Lozenets, Hladilnika, and Krastova Vada, all offering a mix of modern apartments, cafes, and quick metro commutes.

Young professionals in these Sofia neighborhoods typically pay between €500 and €750 per month for a 1-bedroom apartment (BGN 980 to BGN 1,470, or $525 to $790), depending on how recently the unit was renovated.

What attracts young professionals to these Sofia areas is the combination of walkable streets with restaurants and co-working spaces, reliable metro access to business hubs, and a lively but not overcrowded atmosphere.

By the way, you will find a detailed tenant analysis in our property pack covering the real estate market in Sofia.

Where do families prefer to rent in Sofia right now?

The top three Sofia neighborhoods where families prefer to rent are Ivan Vazov (near South Park), Vitosha, and Mladost, all offering larger apartments, green spaces, and a calmer residential feel.

Families renting 2-3 bedroom apartments in these Sofia neighborhoods typically pay between €700 and €1,100 per month (BGN 1,370 to BGN 2,150, or $735 to $1,155), with newer buildings at the higher end.

These Sofia neighborhoods attract families because of their combination of spacious units, proximity to parks for children, lower traffic noise, and practical daily amenities like supermarkets and pharmacies.

Near these family-friendly Sofia neighborhoods, top-rated schools include 127 SOU Ivan Denkoglu in Ivan Vazov, Sofia American School accessible from Vitosha, and several well-regarded public schools in Mladost.

Which areas near transit or universities rent faster in Sofia in 2026?

As of early 2026, the three Sofia areas near transit or universities that rent fastest are Studentski Grad (university belt), Mladost 1 (metro plus Business Park Sofia), and Darvenitsa (metro access near universities).

In these high-demand Sofia areas, well-priced apartments typically stay listed for just 10 to 20 days before being rented, compared to 30 days or more in less connected neighborhoods.

The rent premium for Sofia properties within a 10-minute walk of a metro station or major university is typically €50 to €100 per month (BGN 100 to BGN 195, or $50 to $105) above comparable units farther away.

Which neighborhoods are most popular with expats in Sofia right now?

The top three Sofia neighborhoods most popular with expats are Lozenets, Iztok, and Oborishte (especially near Doctor's Garden), where turnkey furnished units and an international atmosphere make settling in easier.

Expats renting in these Sofia neighborhoods typically pay between €650 and €1,000 per month for a furnished 1-2 bedroom apartment (BGN 1,270 to BGN 1,960, or $680 to $1,050).

These Sofia neighborhoods attract expats because of their central locations, proximity to embassies, international schools, English-friendly services, and a high availability of move-in-ready furnished apartments.

The expat communities most represented in these Sofia neighborhoods include professionals from Western Europe, the United States, and increasingly remote workers from other EU countries drawn by Bulgaria's low cost of living.

And if you are also an expat, you may want to read our exhaustive guide for expats in Sofia.

Get fresh and reliable information about the market in Sofia

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Who rents, and what do tenants want in Sofia right now?

What tenant profiles dominate rentals in Sofia?

The top three tenant profiles dominating Sofia's rental market are young professionals (especially in tech and services), students, and early-stage families who are renting before buying.

In Sofia, young professionals represent roughly 40% of active renters, students account for about 30%, and families plus expats together make up the remaining 30% of the rental market.

Young professionals in Sofia typically seek furnished 1-bedroom apartments near metro stations, students look for affordable studios or shared flats near universities, and families prioritize spacious 2-3 bedroom units with parks nearby.

If you want to optimize your cashflow, you can read our complete guide on how to buy and rent out in Sofia.

Do tenants prefer furnished or unfurnished in Sofia?

In Sofia, approximately 65% of actively marketed rentals are furnished, while 35% are unfurnished, reflecting strong demand for move-in-ready apartments.

Furnished apartments in Sofia typically command a rent premium of €50 to €100 per month (BGN 100 to BGN 195, or $50 to $105) compared to unfurnished units of similar size and location.

The tenant profiles that most prefer furnished rentals in Sofia are students, expats, and mobile young professionals who value convenience and don't want the hassle of buying furniture for a temporary stay.

Which amenities increase rent the most in Sofia?

The top five amenities that increase rent the most in Sofia are metro-walkable location, dedicated parking or garage space, a renovated kitchen and bathroom, air conditioning, and an elevator (for upper-floor units).

In Sofia, being within 10 minutes of a metro adds roughly €50 to €80 per month (BGN 100 to BGN 155, or $50 to $85), parking adds €40 to €70, a renovated kitchen and bathroom together add €30 to €60, air conditioning adds €30 to €50, and an elevator adds €20 to €40.

In our property pack covering the real estate market in Sofia, we cover what are the best investments a landlord can make.

What renovations get the best ROI for rentals in Sofia?

The top five renovations that get the best ROI for Sofia rental properties are repainting with modern lighting, bathroom refresh with new fixtures, kitchen cabinet and countertop update, adding or upgrading air conditioning, and a basic "furnish-to-market" package with durable furniture.

In Sofia, repainting costs around €500 to €1,000 (BGN 980 to BGN 1,960, or $525 to $1,050) and can boost rent by €20 to €40 per month, a bathroom refresh runs €1,500 to €3,000 for a €40 to €70 monthly lift, and a kitchen update at €2,000 to €4,000 typically adds €50 to €80 per month.

Renovations with poor ROI that Sofia landlords should avoid include luxury finishes like marble countertops that tenants won't pay extra for, complete structural changes that take months to recoup, and over-personalized design choices that narrow tenant appeal.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How strong is rental demand in Sofia as of 2026?

What's the vacancy rate for rentals in Sofia as of 2026?

As of early 2026, the estimated vacancy rate for rental properties across Sofia is approximately 4%, indicating a relatively tight market where good units don't sit empty for long.

Vacancy rates vary significantly across Sofia neighborhoods, ranging from just 2% to 3% in prime southern areas like Lozenets and Ivan Vazov, up to 5% to 7% in outer districts with older housing stock.

Sofia's current 4% vacancy rate is slightly below the historical average of around 5% to 6%, reflecting sustained demand from job growth and limited new rental supply reaching the market.

Finally please note that you will have all the indicators you need in our property pack covering the real estate market in Sofia.

How many days do rentals stay listed in Sofia as of 2026?

As of early 2026, the average rental property in Sofia stays listed for approximately 20 to 30 days before being rented, though this varies widely by quality and location.

In Sofia, well-priced and renovated units near metro stations rent in 10 to 20 days, average-condition apartments take 20 to 35 days, and overpriced or poorly located units can sit for 35 to 60 days or more.

Compared to one year ago, days-on-market in Sofia has shortened slightly, as demand continues to outpace the flow of quality new listings hitting the market.

Which months have peak tenant demand in Sofia?

The peak months for tenant demand in Sofia are late August through October and again in February through March, when the market sees the highest volume of apartment searches.

These seasonal patterns in Sofia are driven by the academic calendar (students arriving for the fall semester), new job starts after summer, and post-holiday relocations in early spring when people act on New Year moving plans.

The months with the lowest tenant demand in Sofia are typically December (holiday slowdown) and July (vacation season), when fewer people actively search for apartments.

Buying real estate in Sofia can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

What will my monthly costs be in Sofia as of 2026?

What property taxes should landlords expect in Sofia as of 2026?

As of early 2026, Sofia landlords should expect to pay annual property tax of roughly €50 to €300 (BGN 100 to BGN 585, or $50 to $315), depending on the municipal tax valuation of their property.

The range in Sofia property taxes is wide because the tax is calculated as 0.1875% (1.875 per mille) of the municipal tax valuation, which is typically well below market value and varies by location and building type.

Sofia property taxes are calculated by applying the city's set rate to a "tax value" determined by municipal formulas that consider factors like location zone, construction type, and floor area rather than actual sale prices.

Please note that, in our property pack covering the real estate market in Sofia, we cover what exemptions or deductions may be available to reduce property taxes for landlords.

What maintenance budget per year is realistic in Sofia right now?

A realistic annual maintenance budget for a typical Sofia rental property is approximately €600 to €1,200 (BGN 1,175 to BGN 2,350, or $630 to $1,260), depending on the building age and condition.

In Sofia, older panel-block apartments often require closer to 1% of property value annually in maintenance, while newer buildings with monthly management fees typically need 0.6% to 0.9% of value plus the regular building fee.

Most Sofia landlords set aside between 8% and 12% of their annual rental income for maintenance and repairs to cover routine fixes, appliance replacements, and occasional larger expenses.

What utilities do landlords often pay in Sofia right now?

In Sofia, the utilities landlords most commonly pay on behalf of tenants are building maintenance fees and, in some furnished premium units, internet or cable TV subscriptions.

Building maintenance fees in Sofia typically run €20 to €60 per month (BGN 40 to BGN 115, or $20 to $65), while internet/TV packages bundled by landlords add another €10 to €20 per month.

The standard practice in Sofia is for tenants to pay electricity, heating (whether district or individual), and water directly, with landlords covering only building common-area fees and sometimes internet for furnished rentals.

How is rental income taxed in Sofia as of 2026?

As of early 2026, rental income in Sofia (and all of Bulgaria) is taxed at a flat 10% personal income tax rate, applied after a standard 10% statutory expense deduction, meaning you effectively pay tax on 90% of your gross rent.

The main deduction Sofia landlords can claim is the automatic 10% expense allowance, and beyond that, landlords cannot deduct actual expenses like repairs or management fees unless they register as a business, which adds complexity.

A common tax mistake Sofia landlords make is failing to declare rental income at all, which can trigger penalties, or misunderstanding the euro-lev conversion requirements that become relevant with Bulgaria's 2026 euro adoption.

We cover these mistakes, among others, in our list of risks and pitfalls people face when buying property in Sofia.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Sofia, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| National Statistical Institute (NSI) - Average annual rent per m² | NSI is Bulgaria's official statistics agency, so its housing metrics are the closest thing to ground truth. | We used this as the official benchmark for rent levels per square meter. We also used it to sanity-check portal-based asking-rent estimates. |

| NSI - Building permits issued and construction started | It's an official NSI release that tracks new supply entering the pipeline. | We used it to judge whether new housing supply is catching up with demand in Sofia. We then linked supply pressure to the rent-growth outlook. |

| Colliers Bulgaria - Residential Market Overview Sofia (H1 2025) | Colliers is a major global real-estate consultancy with a structured, report-based methodology. | We used it for on-the-ground market context covering demand drivers, supply constraints, and tenant preferences. We used it to cross-check whether our rent ranges feel right for Sofia. |

| Global Property Guide - Rental yields (Sofia) | It's a long-running international property data publisher that discloses how it builds its rent and yield tables. | We used its Sofia rent benchmarks for studio, 1-bed, and 2-bed apartments as a transparent baseline. We then adjusted slightly to January 2026 using inflation and market signals. |

| Global Property Guide - Rent levels (method and update cadence) | It clearly states the rent figures are sourced from local portals and updated on a schedule. | We used it to triangulate portal-based asking rents without relying on a single portal. We used the update timing to frame our January 2026 estimates properly. |

| Eurostat/ECB - HICP actual rentals series | The ECB Data Portal is an official source for harmonized inflation series used across the EU. | We used it as the official inflation lens for how rents move over time. We used it to avoid overreacting to short-term listing noise. |

| FRED - HICP: actual rentals for housing (Bulgaria) | FRED republishes official series in a clean, auditable way with consistent timestamps. | We used it to quantify the recent trend in Bulgaria's rent inflation. We used that trend to translate 2025 rent benchmarks into January 2026 figures. |

| IMF - Bulgaria Article IV Staff Report | The IMF is a top-tier international institution for macroeconomic forecasts and risk scenarios. | We used it to anchor 2026 growth and inflation assumptions that feed into the rent outlook. We used it to explain why demand stays strong through income and consumption trends. |

| Bulgarian National Bank (BNB) - Economic Review 1/2025 | BNB is the central bank, and its review is a primary source for credit and macro conditions. | We used it to frame the credit and wage backdrop that influences household formation and renting. We used it as a cross-check on the demand strength narrative. |

| Sofia Municipal Council ordinance - Immovable property tax rate | It's the municipal-level legal text that sets Sofia's local tax rate. | We used it to state the actual Sofia property tax rate in per-mille terms. We then translated that into a simple annual cost range for typical landlords. |

| Bulgaria Ministry of Finance - Immovable Property Tax overview | It's the government's plain-language explanation of how the tax works nationwide. | We used it to explain the general tax base and national guardrails in simple words. We used it to clarify what municipalities control versus what is fixed by law. |

| National Revenue Agency (NRA) - Buildings and waste guidance | NRA is the official tax authority, so it's reliable for compliance basics. | We used it to explain landlord obligations around local taxes and fees in everyday language. We used it to keep the monthly costs section accurate. |

| PwC Tax Summaries - Bulgaria (individual deductions) | PwC is a major professional services firm and their tax summaries are tightly maintained. | We used it to confirm the standard expense deduction treatment for rental income. We used it to simplify the taxed-on-rental-income explanation with a practical example. |

| Sofiyska Voda - Official water tariff page | It's the operator's tariff page referencing the national regulator decision. | We used it to estimate typical monthly water costs for tenants and landlords. We used it as the official bill reference point rather than forum estimates. |

| Toplofikatsiya Sofia - Prices page (district heating) | It's the city heating utility publishing regulated prices and the decision basis. | We used it to estimate heating-season running costs for apartments on district heating. We used it to explain why heating type matters for rent premiums. |

| Energo-Pro Sales - Electricity prices (regulated market) | It's an energy supplier page that cites the regulator's decision and components. | We used it to ground electricity cost estimates in published tariffs. We used it to explain which utility lines tenants usually pay directly. |

| BTA - Regulated water prices starting Jan 1, 2026 | BTA is Bulgaria's national news agency and is dependable when it reports regulator decisions. | We used it to time-stamp water prices specifically for January 2026. We used it to update costs so the article truly reads as of the first half of 2026. |

| Reuters - Bulgaria adopting the euro | Reuters is a global wire service with strong editorial standards for factual developments. | We used it to frame why January 2026 is a turning point for pricing and contracts. We used it carefully as context rather than as a rent dataset. |

| Global Property Guide - Bulgaria price history | It offers long-term price trend data with transparent methodology and regular updates. | We used it to understand how Sofia property prices have moved relative to rents. We used it to validate yield expectations and premium neighborhood rankings. |

| Bulgaria Ministry of Finance - Personal Income Taxes | It's the government's official explanation of how personal income tax applies to various income types. | We used it to confirm the flat 10% tax rate on rental income. We used it to explain the taxation framework in straightforward terms for landlords. |

Get the full checklist for your due diligence in Sofia

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

Related blog posts