Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Yes, the analysis of Sofia's property market is included in our pack

If you're thinking about buying property in Sofia, Bulgaria in 2026, you're probably wondering whether the market is still hot, whether prices will keep climbing, and whether foreigners can actually get a mortgage.

This article covers the current housing prices in Sofia, including days-on-market, neighborhood trends, rental yields, and the real challenges foreigners face when buying property in Bulgaria's capital.

We constantly update this blog post to reflect the latest data, so you're always working with fresh numbers.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Sofia.

How's the real estate market going in Sofia in 2026?

What's the average days-on-market in Sofia in 2026?

As of early 2026, the estimated average days-on-market for residential properties in Sofia is around 35 to 55 days for well-priced apartments, with the overall market average sitting closer to 45 days when you include properties that are priced a bit too optimistically.

The realistic range of days-on-market that covers most typical listings in Sofia runs from about 20 to 35 days for sought-after turnkey apartments in prime districts like Lozenets or Ivan Vazov, up to 70 or 90 days for older stock or properties with unclear paperwork.

Compared to one or two years ago, the current days-on-market in Sofia has stretched slightly because prices have climbed so fast that buyers are taking a bit more time to commit, though the market is still moving much faster than the European average thanks to strong domestic demand and limited quality supply.

Are properties selling above or below asking in Sofia in 2026?

As of early 2026, the estimated average sale-to-asking price ratio for residential properties in Sofia is around 99%, meaning most homes sell at about 1% below the listed asking price.

Roughly 30% to 40% of properties in Sofia sell at or above asking price, while the remaining 60% to 70% sell below asking, and we're reasonably confident in this range because it aligns with the fast absorption rates reported by agents and the sustained price momentum measured by NSI.

In Sofia, bidding wars and above-asking sales are most common in sought-after southern neighborhoods like Lozenets, Ivan Vazov, and Iztok, as well as for new-build apartments near metro stations or with parking, because these are exactly the features that are in short supply relative to demand.

By the way, you will find much more detailed data in our property pack covering the real estate market in Sofia.

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of Bulgaria. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

What kinds of residential properties can I realistically buy in Sofia?

What property types dominate in Sofia right now?

The estimated breakdown of the most common residential property types available for sale in Sofia is roughly 75% to 80% apartments (including both older panel-era blocks and newer mid-rise developments), with houses, townhouses, and gated compound units making up the remaining 20% to 25%.

Apartments represent by far the largest share of the market in Sofia, accounting for the vast majority of transactions and active listings.

Apartments became so dominant in Sofia because the city was built up during the socialist era with mass housing projects, and even after the transition, most new construction has continued to focus on apartment blocks since land in central locations is scarce and urban density remains the practical default for the capital.

If you want to know more, you should read our dedicated analyses:

Are new builds widely available in Sofia right now?

The estimated share of new-build properties among all residential listings currently available in Sofia is around 25% to 35%, though availability varies significantly by neighborhood and price segment.

As of early 2026, the neighborhoods and districts in Sofia with the highest concentration of new-build developments include Vitosha, Krastova Vada, Manastirski Livadi, Malinova Dolina, parts of Mladost, and the edges of Studentski Grad, where developers have focused activity due to available land and growing demand from young professionals and families.

Get fresh and reliable information about the market in Sofia

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Which neighborhoods are improving fastest in Sofia in 2026?

Which areas in Sofia are gentrifying in 2026?

As of early 2026, the top neighborhoods in Sofia currently showing the clearest signs of gentrification include Hadzhi Dimitar, Poduyane, parts of Zona B-5 and Zona B-18, and pockets of Nadezhda and Obelya where older housing stock is being renovated and new infill projects are appearing.

The visible changes that indicate gentrification is underway in these areas of Sofia include the arrival of specialty coffee shops and coworking spaces (especially in Hadzhi Dimitar), facade renovations on older buildings, and a noticeable demographic shift toward younger professionals moving in from more expensive central districts.

The estimated price appreciation in those gentrifying neighborhoods of Sofia over the past two to three years has ranged from 25% to 40%, which is above the citywide average, as these areas started from a lower base and are catching up to the established premium districts.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Sofia.

Where are infrastructure projects boosting demand in Sofia in 2026?

As of early 2026, the top areas in Sofia where major infrastructure projects are currently boosting housing demand include the corridor along Metro Line 3 (especially toward Levski G and Hadzhi Dimitar), as well as neighborhoods around new or planned metro stations in Slatina and Geo Milev.

The specific infrastructure projects driving that demand in Sofia are primarily the Metro Line 3 extension toward Levski G, which has been a priority for the city, along with ongoing road and public transport improvements in southern districts like Vitosha and Krastova Vada.

The estimated timeline for completion of those major projects in Sofia is that the Line 3 extension to Levski G was expected to be operational by late 2025, meaning early-2026 buyers are already seeing the accessibility benefits, while other metro extensions are planned to roll out over the next three to five years.

The typical price impact on nearby properties once such infrastructure projects are announced versus completed in Sofia is an initial bump of 5% to 10% after announcement, followed by a further 10% to 20% premium once the project is operational and the convenience becomes real for residents.

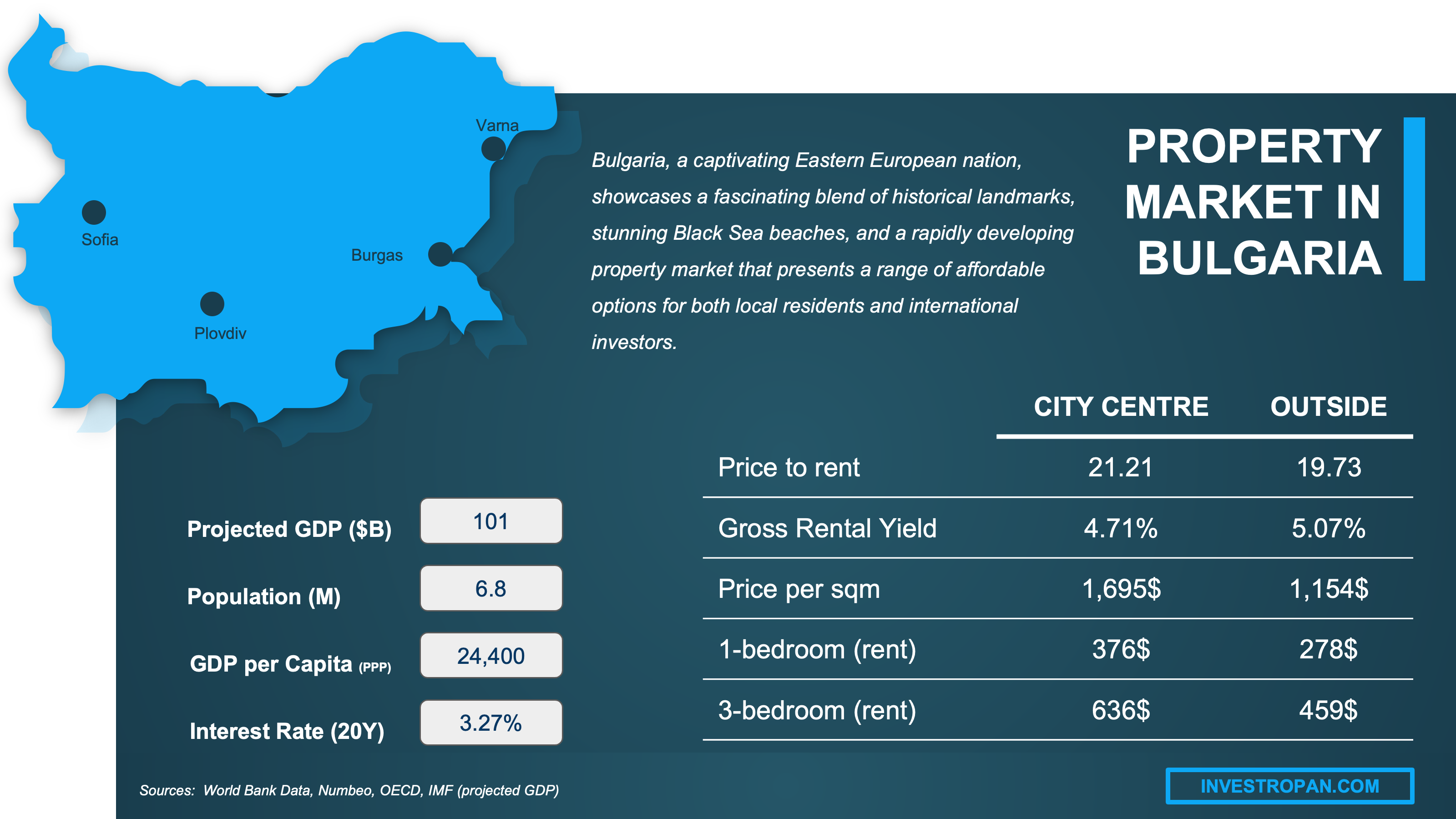

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

What do locals and insiders say the market feels like in Sofia?

Do people think homes are overpriced in Sofia in 2026?

As of early 2026, the estimated general sentiment among locals and market insiders is split: longtime residents often say homes feel overpriced after the rapid run-up of 2024 and 2025, while active buyers and agents point to fast absorption and steady demand as evidence that prices are still supported by fundamentals.

The specific evidence or metrics locals typically cite when arguing homes are overpriced in Sofia include the fact that prices have roughly doubled since 2020, that affordability for first-time local buyers has become stretched, and that the euro changeover on January 1, 2026 has added price-rounding anxieties to the conversation.

The counterarguments commonly given by those who believe prices are fair in Sofia include the fact that mortgage rates remain among Europe's lowest (around 2.5% to 3.5%), that supply of quality apartments is genuinely limited, and that strong wage growth in sectors like IT and services has kept pace with price increases.

The price-to-income ratio in Sofia is roughly 1.2 average monthly salaries per square meter as of early 2026, which is higher than it was five years ago but still more affordable than most other European capitals, according to data from Bulgarian Properties and NSI.

What are common buyer mistakes people regret in Sofia right now?

The estimated most frequently cited buyer mistake that people regret making in Sofia is buying based on the neighborhood's reputation without checking the specific building's maintenance status, ownership structure, and paperwork (especially the Act 16 completion certificate), because two buildings on the same street can differ dramatically in quality and legal clarity.

The second most common buyer mistake people mention regretting in Sofia is underestimating the importance of heating systems and insulation, since winter utility bills can vary enormously between well-insulated new builds and older panel blocks without upgrades, which affects both comfort and resale value.

If you want to go deeper, you can check our list of risks and pitfalls people face when buying property in Sofia.

It's because of these mistakes that we have decided to build our pack covering the property buying process in Sofia.

Get the full checklist for your due diligence in Sofia

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

How easy is it for foreigners to buy in Sofia in 2026?

Do foreigners face extra challenges in Sofia right now?

The estimated overall difficulty level foreigners face when buying property in Sofia compared to local buyers is moderate: the process is open and legally straightforward for apartments, but foreigners encounter more paperwork, longer timelines, and some extra steps that locals can skip.

The specific legal restrictions that apply to foreign buyers in Sofia relate mainly to land: under Bulgaria's Constitution (Article 22), non-EU citizens cannot directly own land, so buying a house with land typically requires setting up a Bulgarian company, while apartments (which include shared land rights in the building) are fully accessible to all foreigners.

The practical challenges foreigners most commonly encounter in Sofia include navigating notary procedures in Bulgarian without fluent local representation, understanding which documents need legalization or apostille, and the fact that most banks require in-person visits and Bulgarian-language documentation even when the mortgage product technically exists for non-residents.

We will tell you more in our blog article about foreigner property ownership in Sofia.

Do banks lend to foreigners in Sofia in 2026?

As of early 2026, mortgage financing is available for foreign buyers in Sofia, with several major Bulgarian banks explicitly offering products for non-residents, though the approval process is stricter and requires more documentation than for local borrowers.

The typical loan-to-value ratios foreign buyers can expect in Sofia are around 50% to 70% (meaning a down payment of 30% to 50%), with interest rates for foreigners ranging from approximately 3.5% to 5% for euro-denominated loans, which is higher than the 2.5% to 3.2% rates available to well-qualified Bulgarian residents.

The documentation and income requirements banks typically demand from foreign applicants in Sofia include proof of income (often requiring translation and legalization), bank statements, a valid passport, proof of address in the home country, and a Bulgarian bank account, with the mortgage approval process usually taking four to eight weeks.

You can also read our latest update about mortgage and interest rates in Bulgaria.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How risky is buying in Sofia compared to other nearby markets?

Is Sofia more volatile than nearby places in 2026?

As of early 2026, the estimated price volatility of Sofia compared to nearby comparable markets like Bucharest, Belgrade, and Athens is lower in terms of sudden swings, because Sofia's market has been driven mainly by domestic demand and steady fundamentals rather than speculative foreign capital or tourism cycles.

The historical price swings Sofia has experienced over the past decade compared to those nearby markets include a massive boom-and-bust cycle: prices surged about 300% from 2000 to 2008, then crashed 30% to 40% during the global financial crisis, and have been steadily recovering since 2014, with prices now exceeding the 2008 peak by a significant margin.

If you want to go into more details, we also have a blog article detailing the updated housing prices in Sofia.

Is Sofia resilient during downturns historically?

The estimated historical resilience of Sofia property values during past economic downturns is moderate: the city did experience a severe correction after 2008, but it also recovered faster and more completely than Bulgaria's coastal resort markets, thanks to its diversified economy and role as the national capital.

During the most recent major downturn (the 2008-2012 crisis), property prices in Sofia dropped by approximately 38% to 40% from the peak, and recovery took about seven to eight years, with prices finally exceeding the 2008 peak around 2017-2018.

The property types and neighborhoods in Sofia that have historically held value best during downturns are central apartments in established districts like Lozenets, Ivan Vazov, and Oborishte, as well as quality new builds with good transport access, because these are the segments where demand remains stable even when the broader market softens.

Get to know the market before you buy a property in Sofia

Better information leads to better decisions. Get all the data you need before investing a large amount of money. Download our guide.

How strong is rental demand behind the scenes in Sofia in 2026?

Is long-term rental demand growing in Sofia in 2026?

As of early 2026, the estimated growth trend for long-term rental demand in Sofia is positive and steady, driven by continued job growth in sectors like IT and business services, internal migration to the capital, and the fact that high purchase prices are keeping many would-be buyers in the rental market longer.

The tenant demographics driving long-term rental demand in Sofia are primarily young professionals working in tech and services, university students (Sofia has over 100,000 enrolled students), and a growing number of expats from Western Europe and Israel who are relocating for work or lifestyle reasons.

The neighborhoods in Sofia with the strongest long-term rental demand right now include Studentski Grad (for its proximity to universities and affordable rents), Lozenets and the city center (for young professionals), and Mladost (for its access to business parks and the airport).

You might want to check our latest analysis about rental yields in Sofia.

Is short-term rental demand growing in Sofia in 2026?

The regulatory changes or restrictions currently affecting short-term rental operations in Sofia are relatively light compared to cities like Barcelona or Amsterdam, with no citywide ban or strict licensing regime in place, though landlords must register rentals and comply with standard tax obligations.

As of early 2026, the estimated growth trend for short-term rental demand in Sofia is positive, supported by rising tourist arrivals and the city's growing appeal as a budget-friendly European destination with good flight connections.

The current estimated average occupancy rate for short-term rentals in Sofia is around 55% to 65% annually, with higher rates during peak periods and events, according to STR analytics platforms.

The guest demographics driving short-term rental demand in Sofia are a mix of budget-conscious tourists from Western Europe, business travelers attending conferences and corporate events, and a growing segment of digital nomads attracted by Sofia's low cost of living and fast internet.

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in Sofia.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What are the realistic short-term and long-term projections for Sofia in 2026?

What's the 12-month outlook for demand in Sofia in 2026?

As of early 2026, the estimated 12-month demand outlook for residential property in Sofia is positive but cooling from the frenzy of 2025, with most analysts expecting continued buyer interest but more price sensitivity and slightly longer negotiation times.

The key economic and political factors most likely to influence demand in Sofia over the next 12 months are the adjustment period following Bulgaria's euro adoption on January 1, 2026, ongoing wage growth in the services sector, and the trajectory of mortgage rates as the Bulgarian National Bank aligns more closely with ECB policy.

The forecasted price movement for Sofia over the next 12 months is an increase of approximately 5% to 10%, down from the double-digit growth of 2024 and 2025, as the market transitions from a speculative pre-euro boom to more fundamentals-driven appreciation.

By the way, we also have an update regarding price forecasts in Bulgaria.

What's the 3-5 year outlook for housing in Sofia in 2026?

As of early 2026, the estimated 3-5 year outlook for housing prices and demand in Sofia is positive, with most analysts expecting continued but more moderate growth of around 3% to 7% annually, driven by Sofia's role as Bulgaria's economic hub and ongoing infrastructure improvements.

The major development projects and urban plans expected to shape Sofia over the next 3-5 years include further metro line extensions, the completion of the Hemus highway (connecting Sofia to Varna), and continued densification of southern and eastern neighborhoods where new-build supply is concentrated.

The single biggest uncertainty that could alter the 3-5 year outlook for Sofia is the trajectory of mortgage rates and credit availability, since any significant tightening of lending conditions could quickly cool demand given how much prices have already risen.

Are demographics or other trends pushing prices up in Sofia in 2026?

As of early 2026, the estimated impact of demographic trends on housing prices in Sofia is significant and upward, primarily because internal migration continues to draw workers and families from smaller Bulgarian cities to the capital, even as Bulgaria's overall population declines.

The specific demographic shifts most affecting prices in Sofia are the concentration of young professionals in IT, finance, and services (sectors where wages have grown faster than the national average), plus a steady inflow of returnees from the Bulgarian diaspora who are buying property as a hedge or second home.

The non-demographic trends also pushing prices in Sofia include the rise of remote work (which has increased demand for larger apartments with dedicated workspaces), the preference for new builds with modern energy efficiency (especially after the 2022-2023 energy price shocks), and investment flows from Bulgarians treating real estate as an inflation hedge.

These demographic and trend-driven price pressures are expected to continue in Sofia for at least the next five to ten years, unless there is a major economic shock or a dramatic reversal in migration patterns, because the underlying drivers (job concentration, limited supply, and urbanization) are structural rather than cyclical.

What scenario would cause a downturn in Sofia in 2026?

As of early 2026, the estimated most likely scenario that could trigger a housing downturn in Sofia is a combination of significantly higher mortgage rates (for example, if ECB policy tightens sharply) and a cooling of domestic income growth, which would squeeze affordability and reduce buyer demand.

The early warning signs that would indicate such a downturn is beginning in Sofia include a sustained rise in days-on-market beyond 60-70 days for typical listings, a visible increase in price reductions on portal listings, and a slowdown in new project launches by major developers.

Based on historical patterns, a potential downturn in Sofia could realistically see prices drop by 15% to 25% in a moderate scenario, similar to the early 2010s, though a repeat of the 30% to 40% crash seen after 2008 would likely require a much more severe global shock combined with a local credit crunch.

Make a profitable investment in Sofia

Better information leads to better decisions. Save time and money. Download our guide.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Sofia, we always rely on the strongest methodology we can and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| National Statistical Institute (NSI) - Housing price statistics | NSI is Bulgaria's official statistics agency and provides the cleanest baseline for actual transaction prices. | We used it to anchor the latest official price momentum for Sofia versus other Bulgarian cities. We then translated those growth rates into what a buyer should expect in early 2026. |

| Colliers Bulgaria - Residential Market Overview H1 2025 | Colliers is a global real estate consultancy with published methodology and regular market reporting. | We used it to describe what's being built in Sofia and how supply is structured. We then mapped that to what you can realistically buy as a non-professional individual. |

| Bulgarian News Agency (BTA) - Sofia market coverage | BTA is Bulgaria's national news agency and is generally careful about citing identifiable sources and numbers. | We used it as a concrete benchmark for selling speed in Sofia. We then adjusted to an early-2026 estimate by triangulating with official price momentum and supply indicators. |

| European Central Bank (ECB) - Euro adoption decision | The ECB is the primary authority for euro-area membership decisions and the conversion rate. | We used it to confirm the early-2026 context of Bulgaria's euro adoption. We then explained what this tends to change for buyers in Sofia regarding pricing psychology and financing. |

| President of Bulgaria - Constitution (Article 22) | This is an official publication of the Constitution, which is the legal foundation for foreign ownership rules. | We used it to clearly separate apartments from land in foreigner ownership constraints. We then turned that into practical guidance for structuring a purchase. |

| imot.bg - Average prices by neighborhood | It's one of the biggest listing portals in Bulgaria and publishes transparent asking-price stats by neighborhood. | We used it to describe neighborhood-level price dispersion inside Sofia. We then paired it with NSI transaction data to explain why asking prices can mislead. |

| Metropolitan Sofia - Line 3 extension update | Metropolitan EAD is the core operator for Sofia metro expansion and provides official project updates. | We used it to identify where accessibility improvements are most likely to shift demand. We then linked those corridors to specific neighborhoods to watch in early 2026. |

| UniCredit Bulbank - Non-resident mortgage product | It's a primary-source bank product page showing that non-residents can access mortgage products in Bulgaria. | We used it to answer "do banks lend to foreigners?" with a verifiable yes. We then explained the practical friction points for foreign buyers. |

| Global Property Guide - Bulgaria analysis | Global Property Guide provides comprehensive, regularly updated property market analysis with consistent methodology across countries. | We used it to cross-check price trends, rental yields, and historical context for Sofia. We then incorporated their affordability and yield metrics into our estimates. |

| AirDNA - Sofia short-term rental snapshot | AirDNA is a widely used STR data provider with consistent methodology across cities. | We used it to estimate occupancy and revenue direction for short-term rentals in Sofia. We then compared it against official tourism data to avoid over-trusting platform-only numbers. |

Related blog posts