Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Yes, the analysis of Sofia's property market is included in our pack

Sofia has become one of Europe's most affordable capital cities for property investment, with prices that have tripled over the past decade yet still remain far below other EU capitals.

Bulgaria officially adopted the euro on January 1, 2026, which has created new pricing dynamics and renewed interest from foreign buyers looking for value in the eurozone.

This guide breaks down every Sofia neighborhood you need to know about, with real price data, rental yields, and practical insights for making a smart purchase decision.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Sofia.

We constantly update this blog post to reflect the latest market changes in Sofia, so you always have access to current information.

What's the Current Real Estate Market Situation by Area in Sofia?

Which areas in Sofia have the highest property prices per square meter in 2026?

As of early 2026, the three Sofia neighborhoods with the highest property prices per square meter are Doktorski Pametnik (Doctor's Garden), Iztok, and Yavorov, where asking prices regularly exceed 3,500 euros per square meter.

In these premium Sofia neighborhoods, typical prices range from about 3,200 euros per square meter in the lower end of Iztok to over 5,000 euros per square meter for top-quality renovated apartments in Doktorski Pametnik.

Each of these expensive Sofia areas commands high prices for different reasons:

- Doktorski Pametnik: extremely limited supply, historic buildings, and proximity to embassies and cultural institutions.

- Iztok: large apartments with green surroundings, popular with diplomats and senior professionals.

- Yavorov: low housing stock combined with walkable access to the city center and South Park.

Which areas in Sofia have the most affordable property prices in 2026?

As of early 2026, the most affordable Sofia neighborhoods for property buyers are Lyulin (various sub-quarters), Obelya, Nadezhda, and parts of Druzhba, where prices typically stay below 1,900 euros per square meter.

In these budget-friendly Sofia areas, you can find apartments ranging from about 1,200 euros per square meter in Obelya to around 1,800 euros per square meter in better-located parts of Lyulin near metro stations.

The main trade-offs in these lower-priced Sofia neighborhoods include older panel-block construction in Lyulin, longer commute times from Obelya unless you live near the metro, and less developed retail and dining options in parts of Nadezhda compared to central districts.

You can also read our latest analysis regarding housing prices in Sofia.

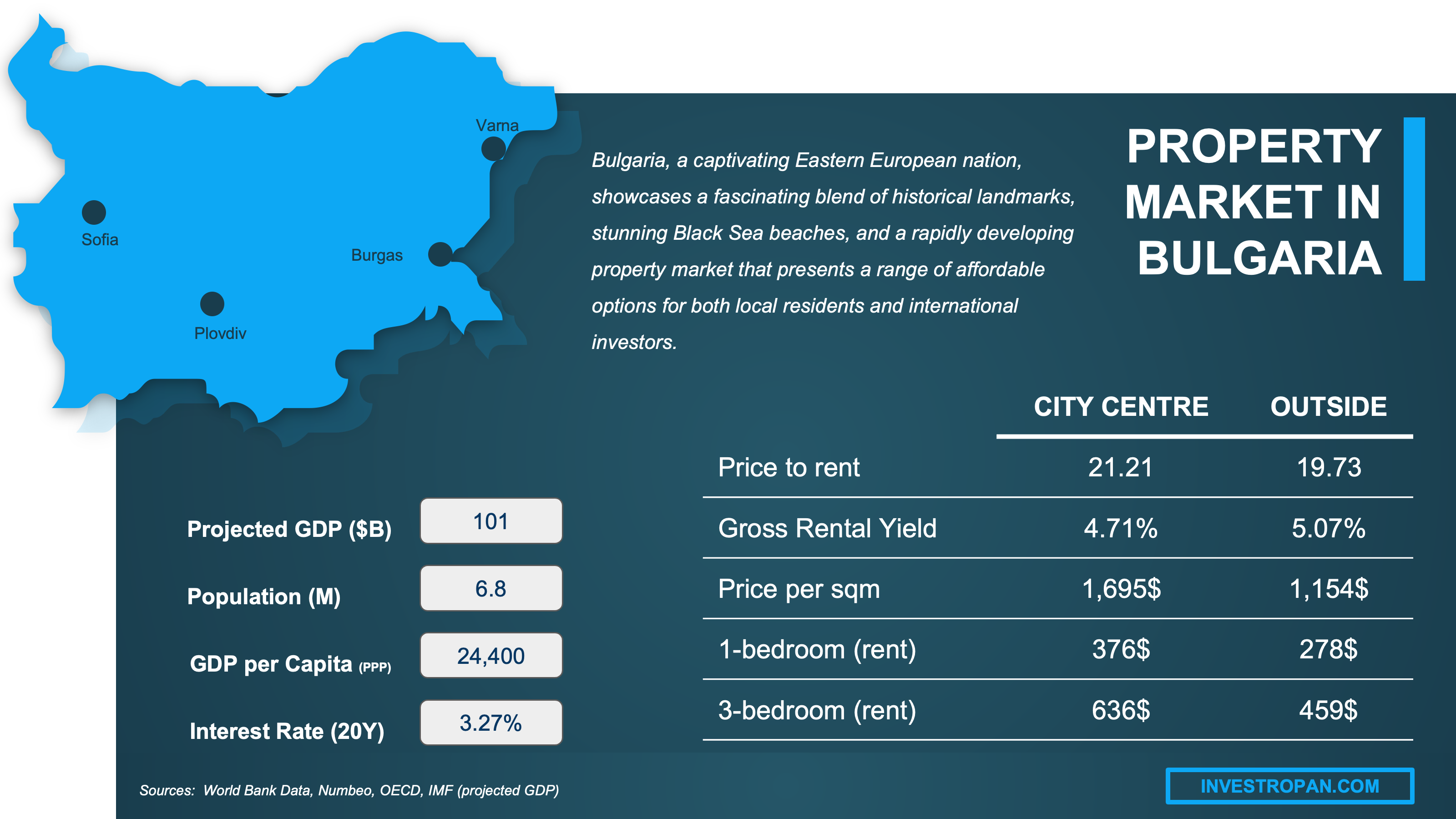

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of Bulgaria. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.

Which Areas in Sofia Offer the Best Rental Yields?

Which neighborhoods in Sofia have the highest gross rental yields in 2026?

As of early 2026, the Sofia neighborhoods delivering the highest gross rental yields are Studentski Grad at around 5.5% to 7%, Mladost 1-4 at roughly 5% to 6%, Ovcha Kupel near 5%, and metro-adjacent parts of Lyulin at about 5% to 5.5%.

Across Sofia as a whole, typical gross rental yields for investment apartments range from about 4% to 5%, with the city average sitting around 4.2% according to recent data.

These high-yield Sofia neighborhoods outperform others for specific reasons:

- Studentski Grad: constant student and young professional tenant demand keeps vacancies extremely low.

- Mladost 1-4: proximity to major office parks and tech companies creates stable corporate tenant flow.

- Ovcha Kupel: university access and new metro connections attract budget-conscious renters year-round.

- Lyulin (metro-adjacent): affordable rents combined with easy metro commutes appeal to working families.

Finally, please note that we cover the rental yields in Sofia here.

Make a profitable investment in Sofia

Better information leads to better decisions. Save time and money. Download our guide.

Which Areas in Sofia Are Best for Short-Term Vacation Rentals?

Which neighborhoods in Sofia perform best on Airbnb in 2026?

As of early 2026, the Sofia neighborhoods performing best on Airbnb are Centar (especially around Serdika and Vitosha Boulevard), Oborishte near Doktorski Pametnik, and metro-connected parts of Lozenets, with occupancy rates averaging 55% to 70% and nightly rates around 50 to 70 euros.

Top-performing Airbnb properties in these Sofia neighborhoods typically generate between 700 and 1,200 euros per month in revenue, with the best-managed listings in prime central locations reaching up to 1,400 euros monthly during peak season.

Each of these Sofia short-term rental hotspots succeeds for different reasons:

- Centar (Serdika/Vitosha area): guests can walk to major sights, restaurants, and nightlife within minutes.

- Oborishte: cultural attractions, embassies, and a sophisticated neighborhood feel attract premium travelers.

- Lozenets (metro parts): appeals to business travelers and families wanting a quieter base with easy transit.

By the way, we also have a blog article detailing whether owning an Airbnb rental is profitable in Sofia.

Which tourist areas in Sofia are becoming oversaturated with short-term rentals?

The Sofia areas showing early signs of short-term rental oversaturation are the tightest core of Centar around NDK and Vitosha Boulevard, central blocks near Serdika station, and parts of Oborishte where studio supply has grown quickly.

In these potentially oversaturated Sofia zones, the density of active short-term rental listings has increased by roughly 15% to 20% over the past two years, with over 1,500 active listings now competing in the greater central Sofia area.

The main indicator of oversaturation in these Sofia neighborhoods is that average occupancy rates have started declining even as nightly rates stay flat, meaning more hosts are competing for the same pool of guests without being able to raise prices.

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which Areas in Sofia Are Best for Long-Term Rentals?

Which neighborhoods in Sofia have the strongest demand for long-term tenants?

The Sofia neighborhoods with the strongest long-term tenant demand are Studentski Grad, Mladost 1-4, Lozenets, and Ivan Vazov, where well-priced apartments typically rent within two to three weeks of listing.

In these high-demand Sofia rental areas, vacancy rates run between 2% and 4%, with properties near metro stations or major employers renting even faster, sometimes within days of becoming available.

Different tenant profiles drive demand in each of these Sofia neighborhoods:

- Studentski Grad: university students and recent graduates seeking affordable furnished apartments.

- Mladost 1-4: tech workers and corporate employees commuting to nearby business parks.

- Lozenets: expats and senior professionals wanting walkable access to restaurants and green spaces.

- Ivan Vazov: families attracted by South Park proximity and established neighborhood character.

The key amenity that makes these Sofia neighborhoods attractive to long-term tenants is metro accessibility, which reduces commute stress and consistently ranks as the top priority for renters in Sofia surveys.

Finally, please note that we provide a very granular rental analysis in our property pack about Sofia.

What are the average long-term monthly rents by neighborhood in Sofia in 2026?

As of early 2026, average monthly rents in Sofia range from about 430 euros for a studio in Studentski Grad to over 1,500 euros for a quality two-bedroom apartment in premium neighborhoods like Lozenets or Iztok.

In Sofia's most affordable rental neighborhoods like Lyulin or Nadezhda, entry-level one-bedroom apartments typically rent for between 400 and 550 euros per month, making them accessible for young professionals and students.

In mid-range Sofia neighborhoods such as Mladost or Ovcha Kupel, a decent one-bedroom apartment costs around 550 to 750 euros per month, while two-bedroom units range from 750 to 1,000 euros monthly.

In Sofia's most expensive rental areas like Lozenets, Ivan Vazov, and Iztok, quality one-bedroom apartments rent for 700 to 1,000 euros per month, and two-bedroom units command between 950 and 1,600 euros monthly depending on condition and building.

You may want to check our latest analysis about the rents in Sofia here.

Get fresh and reliable information about the market in Sofia

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Which Are the Up-and-Coming Areas to Invest in Sofia?

Which neighborhoods in Sofia are gentrifying and attracting new investors in 2026?

As of early 2026, the Sofia neighborhoods showing clear gentrification signals and attracting new investors are Zona B-5 and B-18 (edge-of-core blocks), Hadzhi Dimitar, parts of Poduyane, and Geo Milev, where renovation activity and cafe openings have accelerated noticeably.

These gentrifying Sofia neighborhoods have experienced annual price appreciation of roughly 12% to 18% over the past two years, outpacing the city average as buyers anticipate future metro access and continued urban improvement.

Which areas in Sofia have major infrastructure projects planned that will boost prices?

The Sofia areas with major infrastructure projects expected to boost property prices are neighborhoods along the Metro Line 3 extensions, including Geo Milev, Slatina, Hadzhi Dimitar, Levski, and parts of Ovcha Kupel where new stations are under construction.

The specific projects driving these expectations include the EU-funded Metro Line 3 extension adding 6 new stations through Slatina to Tsarigradsko Shose by 2027, and the Vladimir Vazov corridor extension adding 3 stations to the Levski neighborhood by mid-2026.

Historically in Sofia, properties within a 10-minute walk of newly opened metro stations have seen price increases of 15% to 25% in the two years following station opening, with the strongest gains in previously underserved areas.

You'll find our latest property market analysis about Sofia here.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Which Areas in Sofia Should I Avoid as a Property Investor?

Which neighborhoods in Sofia with lots of problems I should avoid and why?

The Sofia neighborhoods that property investors should approach with caution include remote parts of Fakulteta, isolated sections of Filipovtsi, and poorly maintained blocks in outer Nadezhda where infrastructure and tenant demand remain weak.

Each of these problematic Sofia areas has specific issues:

- Outer Fakulteta: limited public transport, low-income demographics, and weak rental demand.

- Filipovtsi: industrial adjacency, poor walkability, and minimal retail or service infrastructure.

- Remote Nadezhda blocks: aging panel buildings far from metro with high maintenance costs.

For these Sofia neighborhoods to become viable investment options, they would need significant metro expansion, major urban renewal programs, or substantial new employment centers nearby to shift tenant demand patterns.

Buying a property in the wrong neighborhood is one of the mistakes we cover in our list of risks and pitfalls people face when buying property in Sofia.

Which areas in Sofia have stagnant or declining property prices as of 2026?

As of early 2026, the Sofia areas showing the weakest price performance are remote panel-block zones far from metro stations, certain industrial-adjacent blocks in Krasna Polyana, and outer sections of Nadezhda where prices have grown only 3% to 5% annually compared to the citywide 12% to 16% average.

These underperforming Sofia areas have essentially experienced flat real price growth when adjusted for inflation, meaning investors who bought there three years ago have barely kept pace with the broader market.

The underlying causes of stagnation differ by area:

- Remote Lyulin sub-quarters: oversupply of similar panel apartments competing for the same budget renters.

- Krasna Polyana (industrial parts): noise, pollution concerns, and lack of green space limit buyer interest.

- Outer Nadezhda: poor walkability scores and distance from metro make it hard to attract quality tenants.

Buying real estate in Sofia can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Which Areas in Sofia Have the Best Long-Term Appreciation Potential?

Which areas in Sofia have historically appreciated the most recently?

The Sofia areas that have appreciated most strongly over the past five to ten years are Doktorski Pametnik, Ivan Vazov, Lozenets, and Iztok, where scarcity and high-income demand have driven prices well above citywide growth rates.

Here is how these top-performing Sofia neighborhoods have appreciated:

- Doktorski Pametnik: roughly 180% to 200% total appreciation over ten years, or about 11% to 12% annually.

- Ivan Vazov: approximately 150% to 170% total appreciation over ten years, driven by park proximity.

- Lozenets: around 140% to 160% total appreciation, benefiting from expat demand and metro access.

- Iztok: about 130% to 150% total appreciation, supported by diplomatic community and green surroundings.

The main driver behind this above-average appreciation in Sofia's premium neighborhoods is structural scarcity, meaning there is almost no land for new development, so existing quality properties become increasingly valuable as demand grows.

By the way, you will find much more detailed trends and forecasts in our pack covering there is to know about buying a property in Sofia.

Which neighborhoods in Sofia are expected to see price growth in coming years?

The Sofia neighborhoods expected to see the strongest price growth in coming years are Geo Milev, Slatina, Hadzhi Dimitar, and metro-adjacent parts of Ovcha Kupel, all benefiting from confirmed infrastructure improvements.

Projected annual price growth for these high-potential Sofia neighborhoods:

- Geo Milev: expected 10% to 15% annually as Metro Line 3 stations open in 2027.

- Slatina: projected 8% to 12% annually with new metro connectivity transforming accessibility.

- Hadzhi Dimitar: anticipated 8% to 10% annually as the Vladimir Vazov extension completes in 2026.

- Ovcha Kupel (metro parts): expected 7% to 10% annually with improved intermodal connections.

The single most important catalyst for future price growth in these Sofia neighborhoods is the completion of Metro Line 3 extensions, which will fundamentally change commute times and make previously undervalued areas much more attractive to both renters and buyers.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What Do Locals and Expats Really Think About Different Areas in Sofia?

Which areas in Sofia do local residents consider the most desirable to live?

Local Sofia residents consistently rank Ivan Vazov, Lozenets, Yavorov, and Doktorski Pametnik as the most desirable neighborhoods to live in, valuing their combination of green spaces, walkability, and established neighborhood character.

Each desirable Sofia neighborhood appeals to locals for specific qualities:

- Ivan Vazov: direct access to South Park and a strong sense of family-friendly community.

- Lozenets: excellent restaurants, cafes, and a modern urban lifestyle within walking distance.

- Yavorov: quiet residential streets with easy access to the city center and cultural venues.

- Doktorski Pametnik: prestige, historic architecture, and proximity to Sofia's cultural heart.

These locally-preferred Sofia neighborhoods tend to attract established Bulgarian families, successful professionals, and long-term residents who prioritize quality of daily life over investment returns.

Local preferences in Sofia largely align with what foreign investors target, though locals often place more value on school quality and neighborhood community, while foreigners tend to focus more on rental yield potential and metro access.

Which neighborhoods in Sofia have the best reputation among expat communities?

The Sofia neighborhoods with the best reputation among expats are Lozenets, Iztok, Izgrev, and the southern villa zones of Boyana and Dragalevtsi, all offering a combination of green space, international community feel, and modern amenities.

Expats prefer these Sofia neighborhoods for specific reasons:

- Lozenets: walkable lifestyle, good restaurants, and easy access to international schools.

- Iztok/Izgrev: larger apartments, embassy proximity, and a quieter residential atmosphere.

- Boyana/Dragalevtsi: mountain views, detached houses, and proximity to nature for families.

The typical expat profile in these popular Sofia neighborhoods includes diplomatic staff in Iztok, tech company executives in Lozenets, and international school families in Boyana, each drawn by different lifestyle priorities.

Which areas in Sofia do locals say are overhyped by foreign buyers?

The Sofia areas that locals most commonly describe as overhyped by foreign buyers are generic "City Center" blocks, parts of Vitosha Boulevard, and some aggressively marketed new developments in outer Mladost.

Locals believe these Sofia areas are overvalued for specific reasons:

- Generic Centar blocks: foreigners pay premium prices for "central" addresses that are actually noisy and traffic-heavy.

- Vitosha Boulevard: tourists love it, but locals find it commercial and prefer quieter parallel streets.

- Outer Mladost new builds: slick marketing hides weak walkability and long commutes to actual amenities.

What foreign buyers typically see in these areas that locals do not value as highly is the "central location" label or modern finishes, while locals know that street-level livability and neighborhood character matter more for actual quality of life in Sofia.

By the way, we've written a blog article detailing the experience of buying a property as a foreigner in Sofia.

Which areas in Sofia are considered boring or undesirable by residents?

Sofia residents commonly describe outer panel-block districts like distant parts of Lyulin, Nadezhda, Druzhba 2, and Krasna Polyana as boring or undesirable, primarily due to their monofunctional residential character and distance from cultural life.

Residents find these Sofia areas less appealing for specific reasons:

- Outer Lyulin: repetitive Soviet-era architecture and limited dining or entertainment options.

- Distant Nadezhda: feels disconnected from Sofia's energy despite being within city limits.

- Druzhba 2: primarily residential with few walkable amenities or neighborhood character.

- Krasna Polyana: industrial adjacency and lack of green spaces make it feel utilitarian.

Don't lose money on your property in Sofia

100% of people who have lost money there have spent less than 1 hour researching the market. We have reviewed everything there is to know. Grab our guide now.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Sofia, we always rely on the strongest methodology we can, and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why It's Authoritative | How We Used It |

|---|---|---|

| National Statistical Institute of Bulgaria | Official producer of Bulgaria's EU-compliant house price index. | We used it as our baseline for understanding what Sofia property prices are actually doing at the national level. We treated NSI data as the reality check against listing-based neighborhood estimates. |

| Eurostat Housing Price Statistics | EU's official statistics authority for cross-country housing comparisons. | We used it to put Bulgaria's price growth in European context and avoid relying on local anecdotes. We also used Eurostat's methodology guidance to validate our approach. |

| European Central Bank | Primary source for Bulgaria's euro adoption decision and conversion rate. | We used it to understand how the currency switch affects property pricing psychology. We write assuming euro adoption is in effect as of January 2026. |

| Colliers Bulgaria | Major global real estate consultancy with structured Sofia market research. | We used their reports for market structure insights, especially the split between new-build and existing homes. We also used Colliers to understand how prime versus mass segments behave differently. |

| Global Property Guide | Long-running international dataset compiler citing national statistical sources. | We used it as a cross-check on growth rates and yield estimates. We treated it as secondary to official sources but valuable for triangulation. |

| European Commission (Metro Line 3) | Official EU project page with confirmed funding and timeline details. | We used it to identify infrastructure-backed corridors where accessibility improvements will support prices. We only make infrastructure claims backed by official project documentation. |

| AirDNA | Leading short-term rental analytics provider used widely by investors. | We used it to quantify Airbnb economics including occupancy rates, average daily rates, and revenue. We then combined this data with our location analysis for neighborhood-level insights. |

| Fakti.bg | Mainstream Bulgarian media outlet citing major property portal datasets. | We used it specifically for named neighborhood price bands like Doktorski Pametnik and Iztok. We treated it as listing-derived and media-reported, then validated with spot checks. |

| Imoti.info | Large Bulgarian listing marketplace with consistent price and size data. | We used it to compute implied prices per square meter and typical rent levels from real listings in specific neighborhoods. We treated it as a calibration layer, not a transaction database. |

| Bulgaria Registry Agency (EPZEU) | Official portal for Bulgaria's Property Register services and certificates. | We used it to ground our advice on ownership verification and due diligence workflow. This is essential for foreign buyers checking what they're actually buying. |

Get the full checklist for your due diligence in Sofia

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

Related blog posts