Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Yes, the analysis of Sofia's property market is included in our pack

Sofia's property market has entered 2026 with strong momentum, following years of exceptional growth and Bulgaria's historic euro adoption on January 1st.

In this article, we cover everything from current housing prices in Sofia to detailed forecasts for the next decade, and we constantly update this blog post to reflect the latest market data.

Whether you're looking to buy your first apartment in Sofia or invest in rental property, we'll walk you through what's actually happening on the ground.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Sofia.

Insights

- Sofia property prices have tripled since 2015, rising from around €715 per square meter to approximately €2,400 per square meter by January 2026.

- New-build apartments in Sofia command premiums of €2,500 to €4,000 per square meter, outpacing older stock by 30% to 50% due to energy efficiency standards and modern layouts.

- The Krastova Vada neighborhood now ranks among Sofia's priciest districts, with asking prices reaching €3,000 per square meter in top-quality buildings.

- Sofia's metro Line 3 expansion, with 10 new stations opening by 2027, is expected to boost property values by 10% to 15% in connected neighborhoods like Slatina and Geo Milev.

- Bulgaria's euro adoption in January 2026 has already triggered a shift in buyer psychology, with over 90% of Sofia property listings now denominated in euros.

- Rental yields in Sofia have compressed from 6% in 2015 to around 4% to 5% in 2026, as capital appreciation has outpaced rental income growth.

- Sofia's mortgage rates remain among Europe's lowest at 2.6% to 4%, keeping monthly payments roughly 40% below Western European equivalents for similar loan amounts.

- The average apartment size purchased in Sofia has grown from 84 square meters in 2015 to 96 square meters in 2025, reflecting higher incomes and post-pandemic preferences for space.

What are the current property price trends in Sofia as of 2026?

What is the average house price in Sofia as of 2026?

As of early 2026, the estimated average home price in Sofia is approximately €260,000 (roughly BGN 508,000 or $270,000), though this blended figure includes both apartments and houses, with apartments alone averaging closer to €210,000.

When it comes to price per square meter in Sofia, you can expect to pay around €2,400 on average, which translates to about BGN 4,700 or $2,500 per square meter across the city.

If you're wondering what most people actually spend, the realistic price range covering roughly 80% of property purchases in Sofia falls between €100,000 and €450,000 (or BGN 196,000 to BGN 880,000), depending on whether you're buying a smaller apartment in an outer district or a family-sized home in a premium neighborhood.

How much have property prices increased in Sofia over the past 12 months?

Sofia property prices increased by an estimated 18% over the past 12 months (January 2025 to January 2026), making it one of the strongest-performing capital city markets in the European Union.

That 18% average masks some variation by property type: apartments in Sofia rose by approximately 20%, while houses and villas in gated compounds saw more moderate growth of around 12%, partly because the buyer pool thins out at higher price points.

The single biggest factor behind Sofia's price surge has been the chronic mismatch between supply and demand: even as building permits increased, the number of ready-to-move-in homes in desirable neighborhoods simply hasn't kept pace with the city's growing workforce and rising incomes.

Which neighborhoods have the fastest rising property prices in Sofia as of 2026?

As of early 2026, the top three neighborhoods with the fastest rising property prices in Sofia are Krastova Vada, Mladost (especially areas near the business park), and Ovcha Kupel, all of which have outpaced the citywide average.

In terms of annual price growth, Krastova Vada has seen approximately 22% to 25% increases, Mladost around 20% to 22%, and Ovcha Kupel roughly 18% to 20%, driven largely by new metro connectivity and modern housing stock.

The main demand driver for these Sofia neighborhoods is the combination of metro access, proximity to major employers, and the availability of new-build apartments with modern amenities, which are exactly what young professionals and families with higher incomes are seeking.

By the way, you will find much more detailed price ranges across neighborhoods in our property pack covering the real estate market in Sofia.

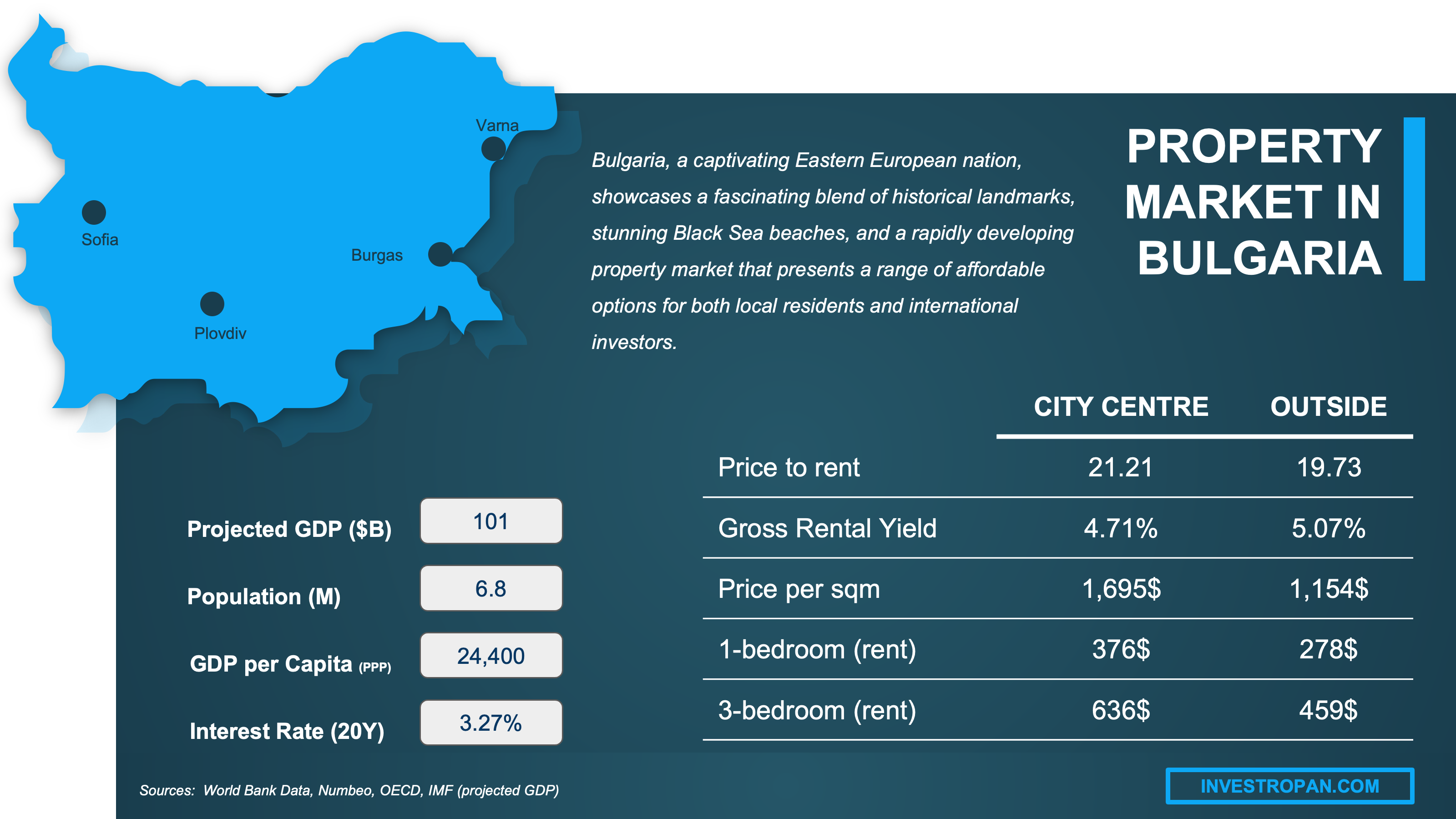

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which property types are increasing faster in value in Sofia as of 2026?

As of early 2026, the ranking of property types by appreciation rate in Sofia goes: new-build apartments (fastest), family-sized apartments with 2 to 3 bedrooms (second), row houses and houses in compounds (third), and older panel-era apartments (slowest but still rising).

The top-performing property type, new-build apartments in Sofia, is appreciating at approximately 20% to 25% annually, with premium developments in sought-after districts commanding even higher growth.

The main reason new-build apartments are outperforming in Sofia is the strong buyer preference for energy-efficient buildings, modern layouts, and included parking, combined with limited supply of quality stock that meets these expectations.

Finally, if you're interested in a specific property type, you will find our latest analyses here:

What is driving property prices up or down in Sofia as of 2026?

As of early 2026, the top three factors driving Sofia property prices are: the concentration of jobs and incomes in the capital (structural demand), Bulgaria's euro adoption which has boosted investor confidence and reduced currency risk, and persistent supply constraints where desirable ready-to-live homes remain scarce.

The single factor with the strongest upward pressure on Sofia property prices is the mismatch between housing supply and demand, because even when building permits increase, the finished inventory in neighborhoods people actually want to live in doesn't expand fast enough.

If you want to understand these factors at a deeper level, you can read our latest property market analysis about Sofia here.

Get fresh and reliable information about the market in Sofia

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What is the property price forecast for Sofia in 2026?

How much are property prices expected to increase in Sofia in 2026?

As of early 2026, Sofia property prices are expected to increase by approximately 7% over the calendar year, which represents a cooling from the 18% growth seen in the previous 12 months but still a solid performance by European standards.

The realistic range of forecasts from different analysts for Sofia property price growth in 2026 spans from a conservative 3% (if affordability constraints bite harder) to an optimistic 10% (if demand remains robust and supply stays tight).

The main assumption underlying most Sofia price forecasts for 2026 is that Bulgaria's economy continues to grow at around 3%, incomes keep rising, and mortgage rates don't spike dramatically, which keeps housing demand supported even as the market normalizes after the pre-euro rush.

We go deeper and try to understand how solid are these forecasts in our pack covering the property market in Sofia.

Which neighborhoods will see the highest price growth in Sofia in 2026?

As of early 2026, the neighborhoods expected to see the highest price growth in Sofia are Ovcha Kupel (benefiting from metro expansion), Mladost (jobs and transport hub), and Krastova Vada (continued premiumization), with emerging interest in Slatina and Geo Milev as new metro stations approach completion.

For these top Sofia neighborhoods, projected price growth in 2026 ranges from 8% to 12%, outperforming the citywide average of 7% thanks to specific infrastructure catalysts and desirable housing stock.

The primary catalyst driving expected growth in these Sofia neighborhoods is the ongoing metro Line 3 expansion, which is adding 10 new stations by 2027 and fundamentally improving commute times from previously less-accessible areas.

One emerging neighborhood in Sofia that could surprise with higher-than-expected growth is Levski G, where the new metro stations opening in 2026 will transform accessibility for a residential area that currently trades at a discount to better-connected districts.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Sofia.

What property types will appreciate the most in Sofia in 2026?

As of early 2026, the property type expected to appreciate the most in Sofia is new-build apartments in the 2 to 3 bedroom range, particularly those in energy-efficient buildings with parking and good metro access.

The projected appreciation for these top-performing new-build apartments in Sofia is approximately 8% to 12% in 2026, outpacing older stock and larger houses due to their alignment with what most buyers can afford and actually want.

The main demand trend driving appreciation for new-build apartments in Sofia is the combination of younger families seeking turnkey homes, rising expectations for build quality and energy efficiency, and the reality that renovating older panel apartments often costs more than buyers expect.

The property type expected to underperform in Sofia in 2026 is unrenovated panel-era apartments in outer districts without metro access, as buyers increasingly avoid the hassle and cost of full renovations when new-build alternatives exist.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How will interest rates affect property prices in Sofia in 2026?

As of early 2026, interest rates are having a supportive effect on Sofia property prices, because Bulgaria's mortgage rates remain among Europe's lowest (typically 2.6% to 4%), keeping monthly payments manageable even as property values have climbed.

The current benchmark for Sofia mortgage rates sits around 3% to 3.5%, and with Bulgaria now in the eurozone, rates are expected to gradually align with ECB policy, meaning modest upward pressure is possible but no dramatic spikes are anticipated.

A 1% increase in mortgage rates typically reduces purchasing power in Sofia by roughly 10% to 12%, meaning a buyer who could afford a €200,000 apartment might only qualify for €175,000 to €180,000, which tends to cool price growth in the entry-level segment first.

You can also read our latest update about mortgage and interest rates in Bulgaria.

What are the biggest risks for property prices in Sofia in 2026?

As of early 2026, the top three biggest risks for Sofia property prices are: an affordability squeeze if incomes don't keep pace with prices, a potential tightening of credit conditions as rates align with the eurozone, and an unexpected surge in housing completions that could temporarily oversupply certain districts.

The single risk with the highest probability of materializing in Sofia is the affordability squeeze, because after years of 15% to 20% annual price growth, the ratio of home prices to local incomes has stretched, and this typically slows transaction volumes before it slows prices.

We actually cover all these risks and their likelihoods in our pack about the real estate market in Sofia.

Is it a good time to buy a rental property in Sofia in 2026?

As of early 2026, the overall assessment is that buying a rental property in Sofia makes sense if you're targeting quality tenants and planning to hold for at least 5 years, but expecting another year of 20% gains would be unrealistic.

The strongest argument in favor of buying a rental property in Sofia now is that rental demand remains robust (especially for 2-bedroom apartments near metro stations and business districts), vacancy rates sit around just 4% citywide, and long-term fundamentals support continued appreciation.

The strongest argument for waiting is that rental yields have compressed to 4% to 5% (down from 6% a decade ago), meaning your short-term cash return is modest, and if rates rise or supply catches up, price growth could slow further before it accelerates again.

If you want to know our latest analysis (results may differ from what you just read), you can read our assessment on whether now is a good time to buy a property in Sofia.

You'll also find a dedicated document about this specific question in our pack about real estate in Sofia.

Buying real estate in Sofia can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Where will property prices be in 5 years in Sofia?

What is the 5-year property price forecast for Sofia as of 2026?

As of early 2026, the estimated cumulative property price growth in Sofia over the next 5 years is approximately 30%, which would bring a €200,000 apartment today to around €260,000 by early 2031.

The range of 5-year forecasts for Sofia spans from a conservative 20% (if economic headwinds materialize) to an optimistic 45% (if growth and migration trends exceed expectations), reflecting genuine uncertainty about macro conditions.

That 30% cumulative growth translates to a projected average annual appreciation rate of about 5.4% per year over the next 5 years in Sofia, which is more moderate than recent history but still healthy by European capital city standards.

The key assumption most forecasters rely on for their 5-year Sofia property predictions is that Bulgaria's economy continues to expand at 2.5% to 3.5% annually, Sofia remains the dominant job magnet, and no major financial crisis disrupts credit availability.

Which areas in Sofia will have the best price growth over the next 5 years?

The estimated top three areas in Sofia expected to have the best price growth over the next 5 years are Ovcha Kupel (metro-driven transformation), Mladost (established job hub with ongoing investment), and the emerging Slatina/Geo Milev corridor (where new metro stations will open by 2027).

The projected 5-year cumulative price growth for these top-performing Sofia areas ranges from 35% to 50%, outperforming the citywide average thanks to specific infrastructure catalysts and improving accessibility.

This differs from the shorter 1-year forecast because infrastructure effects compound over time: a new metro station might add 5% in year one but continue lifting values as the neighborhood's reputation catches up to its improved connectivity.

The currently undervalued area in Sofia with the best potential for outperformance over 5 years is the Iliyantsi/Nadezhda direction, where planned metro extensions and intermodal transport hubs could unlock value that isn't yet priced in.

What property type will give the best return in Sofia over 5 years as of 2026?

As of early 2026, the property type expected to give the best total return over 5 years in Sofia is quality 2-bedroom apartments in well-connected districts, because they offer the deepest pool of both buyers and renters when you eventually exit.

The projected 5-year total return (appreciation plus rental income) for these top-performing 2-bedroom apartments in Sofia is approximately 50% to 60%, combining roughly 30% capital growth with 4% to 5% annual rental yields.

The main structural trend favoring 2-bedroom apartments over the next 5 years in Sofia is demographic: young professionals forming households, families upsizing from studios, and the ongoing urban migration into the capital all concentrate demand in this sweet spot.

For buyers seeking the best balance of return and lower risk over 5 years in Sofia, new-build apartments in proven districts like Lozenets, Mladost 1, or Ivan Vazov offer strong liquidity, predictable maintenance costs, and resilient demand even if the market softens.

How will new infrastructure projects affect property prices in Sofia over 5 years?

The estimated top three major infrastructure projects expected to impact Sofia property prices over the next 5 years are: the Metro Line 3 expansion adding 10 new stations by 2027, the new intermodal hub at Obelya connecting metro, rail, and bus networks, and ongoing road improvements linking southern residential areas to the city center.

The typical price premium for properties near completed metro stations in Sofia ranges from 10% to 20% compared to similar properties without metro access, and this premium tends to build gradually as the neighborhood's reputation improves.

The specific Sofia neighborhoods that will benefit most from these infrastructure developments are Slatina, Geo Milev, and Levski (from metro Line 3), Obelya (from the intermodal hub), and southern Vitosha-side districts if planned road upgrades proceed.

How will population growth and other factors impact property values in Sofia in 5 years?

The estimated projected population growth rate for Sofia is modest at around 0.5% to 1% annually, but its impact on property values will be amplified because Sofia attracts workers, students, and internal migrants from across Bulgaria, concentrating housing demand in the capital.

The demographic shift with the strongest influence on Sofia property demand over the next 5 years is the rise of smaller, higher-income households: young professionals and couples who want quality apartments rather than the larger family homes their parents bought.

Migration patterns, both domestic (rural-to-urban) and international (returning diaspora and EU workers), are expected to sustain Sofia property values because the city remains Bulgaria's only true economic magnet with diverse employment opportunities.

The property types and areas that will benefit most from these demographic trends in Sofia are 1 to 2 bedroom apartments in metro-accessible districts like Lozenets, Mladost, and Krastova Vada, where the target buyer profile is concentrated.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What is the 10 year property price outlook in Sofia?

What is the 10-year property price prediction for Sofia as of 2026?

As of early 2026, the estimated cumulative property price growth in Sofia over the next 10 years is approximately 60%, meaning a €200,000 apartment today could be worth around €320,000 by early 2036.

The range of 10-year forecasts for Sofia spans from a conservative 35% (if growth disappoints and external shocks occur) to an optimistic 100% (if Bulgaria's convergence with Western European income levels accelerates), reflecting the inherent uncertainty in long-term predictions.

That 60% cumulative growth translates to a projected average annual appreciation rate of about 4.8% per year over the next 10 years in Sofia, which assumes a gradual normalization from recent high-growth years toward a sustainable long-term pace.

The biggest uncertainty factor in making 10-year property price predictions for Sofia is whether Bulgaria's economic convergence with the EU continues smoothly, or whether external shocks (recessions, geopolitical events, financial crises) disrupt the trajectory.

What long-term economic factors will shape property prices in Sofia?

The estimated top three long-term economic factors that will shape Sofia property prices over the next decade are: sustained income and productivity growth (Sofia's ability to pay), the stability of the interest rate environment under eurozone membership, and housing supply responsiveness (whether construction can keep pace with demand).

The single long-term economic factor with the most positive impact on Sofia property values will be continued income convergence with Western Europe, because as Bulgarian wages approach EU averages, purchasing power for housing rises correspondingly.

The single long-term economic factor posing the greatest structural risk to Sofia property values is a potential construction boom that finally delivers enough supply to satisfy demand, which would shift pricing power from sellers to buyers and compress appreciation rates.

You'll also find a much more detailed analysis in our pack about real estate in Sofia.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Sofia, we always rely on the strongest methodology we can and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| National Statistical Institute (NSI) | Bulgaria's official producer of house price indices and economic statistics. | We used it as the baseline for official price growth data. We also cross-checked private sector numbers against NSI figures for plausibility. |

| Eurostat HPI Compliance Report | Explains how Bulgaria's official HPI is constructed and validated against EU rules. | We used it to understand what the official index covers. We translated index growth into practical buyer expectations for Sofia. |

| Bulgarian National Bank (BNB) | The central bank publishes authoritative data on credit, rates, and housing market conditions. | We used it to interpret mortgage and lending conditions. We grounded our 2026 forecast assumptions on BNB's affordability analysis. |

| European Central Bank (ECB) | The primary source for eurozone interest rates that now directly affect Bulgaria. | We used it to frame the interest rate environment. We translated rate scenarios into housing demand impacts. |

| IMF Bulgaria Country Page | Top-tier international institution with standardized macro forecasts for Bulgaria. | We used it for GDP and inflation expectations. We applied these projections as the macro foundation for our 5 and 10 year scenarios. |

| European Commission Economic Forecast | The EU's official forecast hub for member state economies. | We used it to cross-check growth and inflation assumptions against the IMF. We treated it as a second opinion so our forecast isn't dependent on one source. |

| Reuters | Highly reputable wire service covering EU policy decisions and euro transition news. | We used it to explain the euro adoption effect on buyer psychology. We incorporated it as macro backdrop for 2025-2026 pricing dynamics. |

| Colliers Bulgaria | Major global real estate consultancy with published methodology and Sofia market coverage. | We used it to describe Sofia's house and compound segment. We anchored villa, house, and row house pricing with their data. |

| Bulgarian Properties | One of Bulgaria's largest agencies with structured market commentary and transaction data. | We used it to triangulate new-build pricing and supply signals. We set realistic 2026 growth ranges based on their analysis. |

| BTA (Bulgarian Telegraph Agency) | Bulgaria's national news agency with attributed data on neighborhood pricing. | We used it to put specific euro-per-sqm figures on Sofia neighborhoods. We anchored our neighborhood section with their reported prices. |

| Bulgarian National Radio (BNR) | National broadcaster citing named data providers for transaction statistics. | We used it to validate late-2025 Sofia price growth speed. We extrapolated cautiously to January 2026 estimates. |

| European Commission Metro Project Page | Official EU project documentation for funded infrastructure in Sofia. | We used it to identify where transport upgrades support demand. We justified why districts near new stations outperform over time. |

| Metropolitan Sofia | The metro operator and planning authority with authoritative network development plans. | We used it as local ground truth for long-run connectivity changes. We supported 5-10 year neighborhood upside projections with their data. |

| Novinite (Sofia News Agency) | Bulgaria's English-language news source with detailed property market reporting. | We used it for recent market developments and expert commentary. We incorporated their reporting on rental yields and metro expansion timelines. |

| Global Property Guide | International property research platform with standardized cross-country comparisons. | We used it to contextualize Sofia's growth rate versus EU peers. We validated price per sqm figures against their database. |

| Trading Economics | Aggregates official statistics with historical data and forecasting tools. | We used it to track Bulgaria's House Price Index trends. We cross-referenced their data with NSI primary sources. |

Get the full checklist for your due diligence in Sofia

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

If you want to go deeper, you can read the following: