Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Everything you need to know before buying real estate is included in our Bulgaria Property Pack

This guide covers the current rental prices across Bulgaria, from studios to family apartments, with real numbers from Sofia, Plovdiv, and other major cities.

We break down which neighborhoods attract the highest rents, what tenants look for, and what landlords should budget for in 2026.

We constantly update this blog post to reflect the latest market data.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Bulgaria.

Insights

- Sofia's premium districts like Oborishte and Krastova Vada command studio rents above 950 BGN, which is roughly double what you would pay in outer neighborhoods like Lyulin or Nadezhda.

- Bulgaria's official rent inflation runs around 4% to 7% yearly, but asking rents in hot Sofia micro-markets can jump faster due to metro expansions and new office hubs.

- Furnished apartments in Bulgaria typically rent for 10% to 20% more than unfurnished ones, with expats and young professionals driving most of this demand.

- The vacancy rate for long-term rentals in Bulgaria's big cities sits between 3% and 6%, meaning well-priced apartments rarely stay empty for long.

- Building permits in Bulgaria rose in late 2025, signaling more rental supply arriving in 2026 and 2027, which may ease rent growth in districts with heavy construction.

- Studentski Grad in Sofia remains one of the fastest-renting areas, with listings often gone within 7 to 14 days during the late summer and early autumn rush.

- Bulgaria's flat 10% personal income tax applies to rental income, but landlords can deduct a statutory expense allowance before calculating what they owe.

- Annual property taxes in Bulgaria range from 0.01% to 0.45% of the tax value, which keeps holding costs far lower than in most Western European countries.

- Families renting in Sofia often choose Iztok, Ivan Vazov, or Mladost for the combination of larger apartments, green spaces, and access to quality schools.

- The euro adoption timeline for Bulgaria means rents are already mentally priced in euros, so the switch in 2026 is expected to bring more psychological than mechanical changes to pricing.

What are typical rents in Bulgaria as of 2026?

What's the average monthly rent for a studio in Bulgaria as of 2026?

As of early 2026, the average monthly rent for a studio apartment in Bulgaria's major cities is around 650 BGN, which works out to roughly 330 EUR or 345 USD.

The realistic range for most studios in Bulgaria runs from about 550 BGN (280 EUR / 290 USD) on the lower end to around 950 BGN (485 EUR / 510 USD) in premium locations like central Sofia.

The main factors that cause studio rents to vary in Bulgaria include the city (Sofia is priciest), the neighborhood within that city, the building's age and condition, and whether the unit is furnished or unfurnished.

What's the average monthly rent for a 1-bedroom in Bulgaria as of 2026?

As of early 2026, the average monthly rent for a 1-bedroom apartment in Bulgaria's main cities is around 860 BGN, which translates to approximately 440 EUR or 460 USD.

Most 1-bedroom apartments in Bulgaria fall within a range of 700 BGN (360 EUR / 375 USD) to about 1,200 BGN (615 EUR / 645 USD), depending on location and quality.

In Bulgaria, the cheapest 1-bedroom rents tend to be in outer Sofia districts like Lyulin and Nadezhda, or in smaller cities like Ruse, while the highest rents cluster in Sofia's Lozenets, Iztok, and Center neighborhoods.

What's the average monthly rent for a 2-bedroom in Bulgaria as of 2026?

As of early 2026, the average monthly rent for a 2-bedroom apartment in Bulgaria is around 1,270 BGN, equivalent to roughly 650 EUR or 680 USD.

The realistic range for most 2-bedroom apartments in Bulgaria spans from about 1,000 BGN (510 EUR / 535 USD) to around 1,950 BGN (1,000 EUR / 1,050 USD) in Sofia's top neighborhoods.

In Bulgaria, the most affordable 2-bedroom rents appear in districts like Studentski Grad and outer Mladost zones, while the priciest ones are found in Krastova Vada, Oborishte, and Lozenets, where family-sized units often exceed 2,000 BGN.

By the way, you will find much more detailed rent ranges in our property pack covering the real estate market in Bulgaria.

What's the average rent per square meter in Bulgaria as of 2026?

As of early 2026, the average rent per square meter in Bulgaria's major cities is around 15 BGN, which equals roughly 7.70 EUR or 8 USD per square meter per month.

The realistic range across Bulgaria's different neighborhoods runs from about 12 BGN (6 EUR / 6.30 USD) per square meter in less central areas to over 22 BGN (11 EUR / 11.50 USD) in Sofia's premium districts.

Compared to other major cities in the region, Bulgaria's rent per square meter remains notably lower than in Bucharest, Belgrade, or Athens, making it one of Southeastern Europe's more affordable rental markets.

In Bulgaria, properties with newer construction, modern insulation, dedicated parking, and proximity to metro stations typically push rent per square meter well above the average.

How much have rents changed year-over-year in Bulgaria in 2026?

As of early 2026, rents in Bulgaria's major cities have increased by an estimated 4% to 7% compared to the same time last year.

The main factors driving rent changes in Bulgaria this year include continued wage growth, strong tenant demand from IT and shared-services workers, and limited new rental supply in central districts.

This year's rent growth in Bulgaria is broadly similar to 2025's pace, though asking rents in the hottest Sofia neighborhoods have accelerated slightly faster than the city-wide average.

What's the outlook for rent growth in Bulgaria in 2026?

As of early 2026, rent growth in Bulgaria is projected to continue at a moderate mid-single-digit pace, likely in the 4% to 6% range for the year.

The key economic factors likely to influence rent growth in Bulgaria over the coming year include GDP growth of around 3%, inflation near 3.5%, and steady wage increases that support tenant purchasing power.

In Bulgaria, the neighborhoods expected to see the strongest rent growth are those near new metro extensions, major office parks like those in Mladost, and premium central areas like Lozenets and Iztok where supply remains tight.

The main risks that could cause rent growth in Bulgaria to differ from projections include a faster-than-expected increase in new apartment completions, an economic slowdown, or shifts in remote work patterns that reduce Sofia-centric demand.

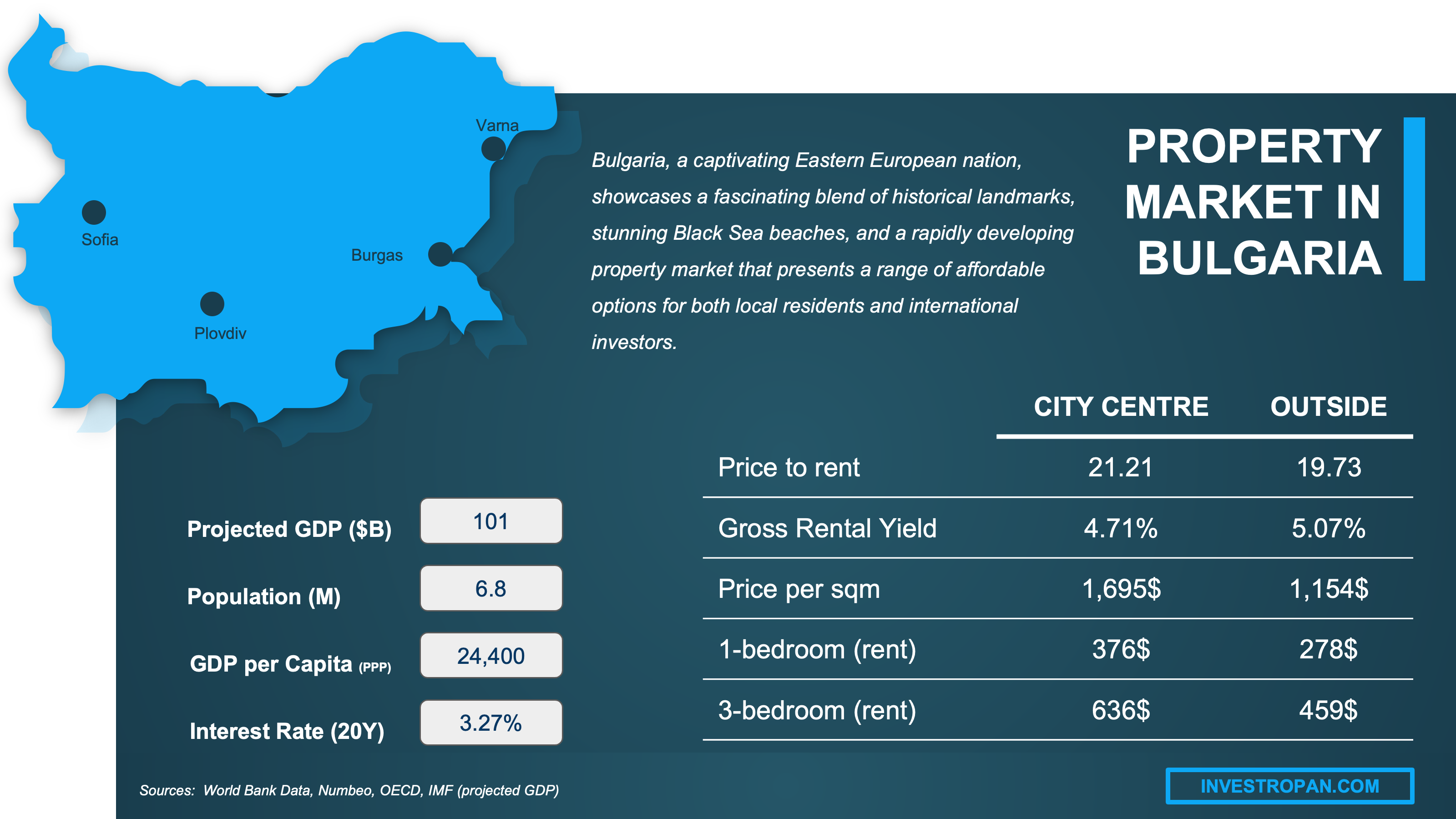

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which neighborhoods rent best in Bulgaria as of 2026?

Which neighborhoods have the highest rents in Bulgaria as of 2026?

As of early 2026, the three Sofia neighborhoods with the highest average rents are Oborishte (studios around 1,175 BGN / 600 EUR / 630 USD), Krastova Vada (studios around 960 BGN / 490 EUR / 515 USD), and Lozenets (studios around 940 BGN / 480 EUR / 505 USD).

These neighborhoods in Bulgaria command premium rents because they offer newer buildings, proximity to embassies and business centers, excellent walkability, and a concentration of upscale restaurants and services.

The typical tenant profile in these high-rent Bulgaria neighborhoods includes expats, diplomats, senior professionals, and well-paid IT workers who prioritize location and quality over cost.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Bulgaria.

Where do young professionals prefer to rent in Bulgaria right now?

The three neighborhoods where young professionals in Bulgaria prefer to rent are Lozenets, Mladost (especially zones near Tech Park), and Center in Sofia.

Young professionals in these Bulgaria neighborhoods typically pay between 900 BGN (460 EUR / 480 USD) and 1,500 BGN (765 EUR / 805 USD) per month for a 1-bedroom apartment.

The specific amenities that attract young professionals to these Bulgaria neighborhoods include metro access, coworking spaces, trendy cafes and restaurants, modern gyms, and a vibrant nightlife scene.

By the way, you will find a detailed tenant analysis in our property pack covering the real estate market in Bulgaria.

Where do families prefer to rent in Bulgaria right now?

The three neighborhoods where families in Bulgaria prefer to rent are Iztok, Ivan Vazov, and Mladost (particularly Mladost 1 and 2) in Sofia.

Families renting 2-3 bedroom apartments in these Bulgaria neighborhoods typically pay between 1,400 BGN (715 EUR / 750 USD) and 2,200 BGN (1,125 EUR / 1,180 USD) per month.

The features that make these neighborhoods attractive to families in Bulgaria include larger apartment layouts, proximity to parks and green spaces, quieter streets, and a strong sense of residential community.

Top-rated schools near these family-friendly Bulgaria neighborhoods include the American College of Sofia, the French Lycee Victor Hugo, and several well-regarded Bulgarian public schools in the Iztok and Ivan Vazov areas.

Which areas near transit or universities rent faster in Bulgaria in 2026?

As of early 2026, the three areas near transit hubs or universities that rent fastest in Bulgaria are Studentski Grad (near Sofia University), Mladost (along the metro line), and Center (near multiple metro stations).

Properties in these high-demand Bulgaria areas typically stay listed for only 7 to 14 days, compared to 25 to 40 days in slower-moving neighborhoods.

The rent premium for properties within walking distance of transit or universities in Bulgaria is typically 50 to 150 BGN (25 to 75 EUR / 26 to 80 USD) per month above comparable units further from these amenities.

Which neighborhoods are most popular with expats in Bulgaria right now?

The three neighborhoods most popular with expats in Bulgaria are Iztok, Lozenets, and Center in Sofia.

Expats renting in these Bulgaria neighborhoods typically pay between 1,100 BGN (560 EUR / 590 USD) and 1,800 BGN (920 EUR / 965 USD) per month for a 1-bedroom or small 2-bedroom apartment.

The features that make these neighborhoods attractive to expats in Bulgaria include walkability, proximity to embassies and international schools, English-speaking services, and a concentration of international restaurants and shops.

The nationalities most represented in these Bulgaria neighborhoods include Western Europeans (especially Germans and British), Americans, and a growing number of digital nomads from across the EU.

And if you are also an expat, you may want to read our exhaustive guide for expats in Bulgaria.

Get fresh and reliable information about the market in Bulgaria

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

Who rents, and what do tenants want in Bulgaria right now?

What tenant profiles dominate rentals in Bulgaria?

The three tenant profiles that dominate the rental market in Bulgaria are young professionals working in IT and business services, students and early-career renters, and expats or project-based contractors.

Young professionals account for roughly 40% of Bulgaria's urban rental demand, students and early-career renters make up about 30%, and expats and contractors represent around 15%, with families and others filling the remainder.

Young professionals in Bulgaria typically seek furnished 1-bedrooms or studios, students look for affordable shared apartments or studios near universities, and expats often prefer larger, well-located 2-bedroom units with modern finishes.

If you want to optimize your cashflow, you can read our complete guide on how to buy and rent out in Bulgaria.

Do tenants prefer furnished or unfurnished in Bulgaria?

In Bulgaria's major cities, roughly 65% of tenants prefer furnished apartments, while about 35% opt for unfurnished units.

The typical rent premium for furnished apartments compared to unfurnished in Bulgaria is around 80 to 150 BGN (40 to 75 EUR / 42 to 80 USD) per month, depending on the quality of furnishings.

The tenant profiles that tend to prefer furnished rentals in Bulgaria include expats, young professionals on shorter contracts, and students who want a move-in-ready solution without upfront furniture costs.

Which amenities increase rent the most in Bulgaria?

The five amenities that increase rent the most in Bulgaria are dedicated parking or a garage, metro proximity, modern heating and cooling systems, a newer building with an elevator, and a renovated kitchen with appliances.

In Bulgaria, dedicated parking can add 100 to 200 BGN (50 to 100 EUR / 53 to 105 USD) per month, metro proximity adds 50 to 100 BGN (25 to 50 EUR), modern HVAC adds 40 to 80 BGN (20 to 40 EUR), a newer building with elevator adds 60 to 120 BGN (30 to 60 EUR), and a renovated kitchen adds 50 to 100 BGN (25 to 50 EUR).

In our property pack covering the real estate market in Bulgaria, we cover what are the best investments a landlord can make.

What renovations get the best ROI for rentals in Bulgaria?

The five renovations that get the best ROI for rental properties in Bulgaria are a kitchen refresh with new appliances, bathroom modernization, window replacement for energy efficiency, fresh paint and lighting upgrades, and improved storage solutions.

In Bulgaria, a kitchen refresh typically costs 2,000 to 5,000 BGN (1,000 to 2,550 EUR / 1,050 to 2,680 USD) and can increase monthly rent by 80 to 150 BGN, a bathroom update costs 1,500 to 4,000 BGN and adds 50 to 100 BGN to rent, window replacement costs 2,000 to 4,500 BGN and adds 40 to 80 BGN, paint and lighting costs 500 to 1,500 BGN and adds 30 to 60 BGN, and storage improvements cost 300 to 800 BGN and add 20 to 40 BGN.

Renovations that tend to have poor ROI and should be avoided by landlords in Bulgaria include luxury finishes that exceed neighborhood standards, swimming pool installations in non-premium areas, and overly personalized design choices that limit tenant appeal.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How strong is rental demand in Bulgaria as of 2026?

What's the vacancy rate for rentals in Bulgaria as of 2026?

As of early 2026, the estimated vacancy rate for long-term rental properties in Bulgaria's major cities is between 3% and 6%.

The vacancy rate across different neighborhoods in Bulgaria ranges from as low as 2% in high-demand areas like Lozenets and Center to around 8% in outer districts with more new-build competition.

The current vacancy rate in Bulgaria is roughly in line with historical averages, though premium central neighborhoods remain tighter than they were five years ago due to sustained demand growth.

Finally please note that you will have all the indicators you need in our property pack covering the real estate market in Bulgaria.

How many days do rentals stay listed in Bulgaria as of 2026?

As of early 2026, the average number of days rentals stay listed in Bulgaria's major cities is around 18 to 25 days for well-priced properties.

The realistic range across different property types and neighborhoods in Bulgaria spans from about 7 days for popular studios in central Sofia to over 50 days for overpriced or poorly located family apartments.

The current days-on-market figure in Bulgaria is slightly shorter than one year ago, reflecting continued strong demand and limited supply growth in the most sought-after neighborhoods.

Which months have peak tenant demand in Bulgaria?

The peak months for tenant demand in Bulgaria are late August through October, driven by students returning to university and professionals starting new jobs after summer.

The specific factors driving seasonal demand patterns in Bulgaria include the academic calendar, typical end-of-summer job relocations, and corporate hiring cycles that concentrate around September.

The months with the lowest tenant demand in Bulgaria are December and January, when holidays slow relocations, though corporate expat moves and "fresh start" renters can still create pockets of activity.

Buying real estate in Bulgaria can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

What will my monthly costs be in Bulgaria as of 2026?

What property taxes should landlords expect in Bulgaria as of 2026?

As of early 2026, landlords in Bulgaria should expect to pay annual property taxes of roughly 50 to 300 BGN (25 to 155 EUR / 26 to 160 USD) for a typical city apartment, depending on the property's tax valuation.

The realistic range of annual property taxes in Bulgaria spans from as low as 30 BGN (15 EUR / 16 USD) for smaller units in lower-value areas to over 500 BGN (255 EUR / 270 USD) for large, high-value properties in Sofia's premium districts.

Property taxes in Bulgaria are calculated by municipalities based on a tax value (not market value), with rates set within a legal band of 0.01% to 0.45% of that assessed value.

Please note that, in our property pack covering the real estate market in Bulgaria, we cover what exemptions or deductions may be available to reduce property taxes for landlords.

What maintenance budget per year is realistic in Bulgaria right now?

A realistic annual maintenance budget for a typical rental property in Bulgaria is around 1,200 to 2,500 BGN (615 to 1,280 EUR / 645 to 1,340 USD), covering routine repairs and building fees.

The realistic range of annual maintenance costs in Bulgaria spans from about 800 BGN (410 EUR / 430 USD) for newer apartments in good condition to over 3,500 BGN (1,790 EUR / 1,880 USD) for older buildings requiring frequent repairs.

Landlords in Bulgaria typically set aside around 8% to 12% of annual rental income for maintenance, which covers both predictable building fees and unexpected repairs.

What utilities do landlords often pay in Bulgaria right now?

The utilities landlords most commonly pay on behalf of tenants in Bulgaria are building entrance and common-area maintenance fees, and sometimes internet or cable in all-inclusive furnished rentals.

Building fees in Bulgaria typically cost 30 to 100 BGN (15 to 50 EUR / 16 to 53 USD) per month, while bundled internet costs around 25 to 50 BGN (13 to 25 EUR / 14 to 27 USD) per month if included.

The common practice in Bulgaria is for tenants to pay electricity, water, heating (notably Toplofikatsia in Sofia), and personal internet directly, with landlords covering only building-level fees unless a different arrangement is specified in the lease.

How is rental income taxed in Bulgaria as of 2026?

As of early 2026, rental income in Bulgaria is taxed as personal income at a flat rate of 10%, but landlords can first deduct a statutory expense allowance to reduce the taxable base.

The main deductions landlords can claim against rental income in Bulgaria include a statutory deduction (typically 10% of gross rent for unfurnished and 20% for furnished properties) plus documented expenses like repairs and building fees.

A common tax mistake specific to Bulgaria that landlords should avoid is failing to declare rental income at all, since the tax authority has been increasing enforcement, and another is confusing the property transfer tax with the annual property tax.

We cover these mistakes, among others, in our list of risks and pitfalls people face when buying property in Bulgaria.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Bulgaria, we always rely on the strongest methodology we can... and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Eurostat Housing in Europe 2025 | Eurostat is the EU's official statistics agency, so it provides comparable, reliable housing data across all member states. | We used it to understand Bulgaria's ownership versus renting patterns and affordability stress signals. We also used it to keep our big-picture context factual rather than relying only on listing portals. |

| Eurostat HICP Database | This is the official EU inflation database with consistent methodology across countries. | We used it to anchor the official rent inflation view via the CPI sub-index for actual rents. We then compared that with market asking-rent medians to estimate the gap between official and market rent movement. |

| ECB Data Portal Actual Rentals | The ECB republishes official Eurostat HICP concepts in a structured central-bank data portal. | We used it to validate what "actual rentals" includes in the official inflation basket. We used that definition to keep our rent-growth estimates consistent with the statistical concept. |

| FRED Bulgaria Rent Series | FRED is a respected public data mirror from the St. Louis Federal Reserve that makes time-series checking easy and verifiable. | We used it as an extra cross-check that the Eurostat rent series exists and is updated as expected. We used it to sanity-check direction and timing versus market asking-rent data. |

| NSI Bulgaria Housing Price Statistics Q3 2025 | NSI is Bulgaria's official national statistics agency. | We used it to frame the broader housing market momentum, which strongly influences rents via investor supply and tenant demand. We used the city-level context for Sofia, Varna, and Plovdiv to tailor our neighborhood demand discussion. |

| NSI Bulgaria Building Permits Q3 2025 | It's an official supply-side indicator directly from the national statistics office. | We used it to estimate near-term rental supply pressure, since more permits today mean more new rentals later. We used it to support the outlook for rent growth section rather than guessing supply conditions. |

| NSI Bulgaria New Dwellings Completed Q2 2025 | It's an official NSI publication with hard counts of completed residential units. | We used it to triangulate whether supply is actually arriving, not just permitted. We used it to explain why some neighborhoods with new builds can have more tenant choice and slightly slower rent growth. |

| ALO.bg Sofia Rental Medians | ALO.bg is a large local listing platform that clearly states it uses the median of active listings. | We used it for concrete neighborhood examples with numbers for studios, 1-beds, 2-beds, and rent per square meter. We used it as our main micro-market dataset and then adjusted slightly to speak as of the first half of 2026. |

| Global Property Guide Bulgaria Rental Yields | Global Property Guide is a long-running international property data provider with a published city-by-city dataset. | We used it to cross-check whether our implied rents are consistent with observed yields. We used it to sanity-check Sofia-level rent ranges against an external benchmark. |

| Bulgarian Properties Market Update End of 2025 | Bulgarian Properties is a major, established real-estate firm in Bulgaria that publishes market commentary and figures. | We used it to corroborate that demand and pricing momentum remained strong into late 2025. We used it to support the tenant-demand narrative and the 2026 outlook assumptions. |

| IMF Bulgaria 2025 Article IV Consultation | The IMF is a top-tier macro institution, and Article IV reports are formal, sourced assessments. | We used it to anchor macro drivers of rents in 2026, including growth, inflation, and wages, instead of relying on guesswork. We used it to keep the outlook section disciplined and tied to fundamentals. |

| European Commission Bulgaria Economic Forecast | The European Commission provides the EU's official forecasting framework for member states. | We used it as a second authoritative macro view to triangulate growth and inflation expectations. We used it to avoid relying on a single institution for the 2026 outlook. |

| Bulgaria Ministry of Finance Immovable Property Tax | It's the government source explaining how municipal property tax works and the legal rate range. | We used it to state property-tax expectations clearly and not confuse them with transaction taxes. We used it to give practical ranges landlords can apply across municipalities. |

| Bulgaria Ministry of Finance Personal Income Taxes | It's the government's top-level description of the personal income tax system. | We used it to frame rental income taxation as personal-income taxation for individuals, not corporate tax. We used it to keep the tax basics correct before adding practical landlord steps. |

| PwC Worldwide Tax Summaries Bulgaria | PwC is a global tax reference used by professionals and is usually careful about statutory rules. | We used it to cross-check the statutory-deduction treatment commonly applied to rental income. We used it as a second-source validation alongside government pages. |

| Reuters Bulgaria Euro Adoption News | Reuters is a major wire service with strong editorial standards and sourcing. | We used it only for the as-of January 2026 practical point on currency context. We did not use it as a primary dataset for rents, just for the timeline context around euro usage. |

Get the full checklist for your due diligence in Bulgaria

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.