Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Everything you need to know before buying real estate is included in our Bulgaria Property Pack

Bulgaria just joined the eurozone on January 1, 2026, and that's reshaping everything about its property market.

Housing prices in Bulgaria have been climbing fast, with official data showing around 15% growth year-over-year heading into 2026.

We constantly update this blog post to reflect the latest housing prices in Bulgaria and what they mean for buyers right now.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Bulgaria.

So, is now a good time?

As of early 2026, the answer is "rather yes" for buying property in Bulgaria, but only if you buy carefully and don't expect the same rapid gains we've seen over the past two years.

The strongest signal is that Bulgaria's central bank has put strict caps on mortgage lending (85% loan-to-value, 50% debt-to-income), which significantly reduces the risk of a credit-fueled crash.

Another strong signal is that euro adoption just happened on January 1, 2026, which tends to boost buyer confidence and cross-border interest in the market.

Other supporting signals include rising construction permits in major cities like Sofia and Plovdiv, mortgage rates still in the high-2% range, and continued job growth in urban centers.

The best strategy right now is to focus on well-located apartments in Sofia, Plovdiv, Varna, or Burgas with good transport links, buy slightly below market value, and plan for rental income rather than quick flips.

This is not financial or investment advice, we don't know your personal situation, and you should always do your own research before making any property purchase.

Is it smart to buy now in Bulgaria, or should I wait as of 2026?

Do real estate prices look too high in Bulgaria as of 2026?

As of early 2026, Bulgaria's property prices are running about 15% above where they were a year ago, which is well above what income growth and rental yields would normally support, suggesting some degree of overheating.

One clear signal that prices look stretched in Bulgaria is that sellers in secondary locations and older buildings are starting to accept negotiations, whereas six months ago they could hold firm on asking prices.

Another sign to watch is that time-on-market for overpriced listings in cities like Sofia and Varna has been creeping up, meaning buyers are becoming pickier even though demand remains strong overall.

You can also read our latest update regarding the housing prices in Bulgaria.

Does a property price drop look likely in Bulgaria as of 2026?

As of early 2026, the likelihood of a meaningful property price drop in Bulgaria over the next 12 months is low, mainly because the banking regulator has already tightened mortgage rules to prevent overheating.

The plausible range for Bulgaria property prices over the next year is somewhere between a 5% decline (if the economy stumbles) and a 10% gain (if euro-driven demand stays strong), with flattening being the most likely scenario.

The single most important factor that could trigger a price drop in Bulgaria would be a sharp rise in unemployment or a recession, since that would immediately reduce the number of qualified buyers under the strict debt-to-income rules.

However, this scenario looks unlikely in early 2026 because Bulgaria's economy is still growing, EU funds are flowing, and the euro transition has boosted business confidence.

Finally, please note that we cover the price trends for next year in our pack about the property market in Bulgaria.

Could property prices jump again in Bulgaria as of 2026?

As of early 2026, the likelihood of another price surge in Bulgaria is medium, because the euro adoption effect could still trigger a wave of buying from people who delayed their purchase.

If demand stays strong and supply remains constrained, Bulgaria property prices could realistically rise another 8% to 12% over the next 12 months, especially in Sofia and the coastal cities.

The single biggest demand-side trigger that could push Bulgaria prices higher would be a flood of EU-based buyers who now find it easier to transact in euros and compare Bulgarian prices to other eurozone markets.

Please also note that we regularly publish and update real estate price forecasts for Bulgaria here.

Are we in a buyer or a seller market in Bulgaria as of 2026?

As of early 2026, Bulgaria's property market is still seller-leaning overall, but the balance has shifted slightly toward buyers compared to the peak frenzy of 2024.

Bulgaria doesn't publish a standard "months of inventory" figure, but based on listing turnover in Sofia and other major cities, the effective supply sits around 3 to 4 months, which typically favors sellers but allows some negotiation room.

The share of listings with price reductions in Bulgaria has been creeping up in secondary locations and for older apartments, suggesting that sellers in those segments are losing leverage while prime city properties still command full asking prices.

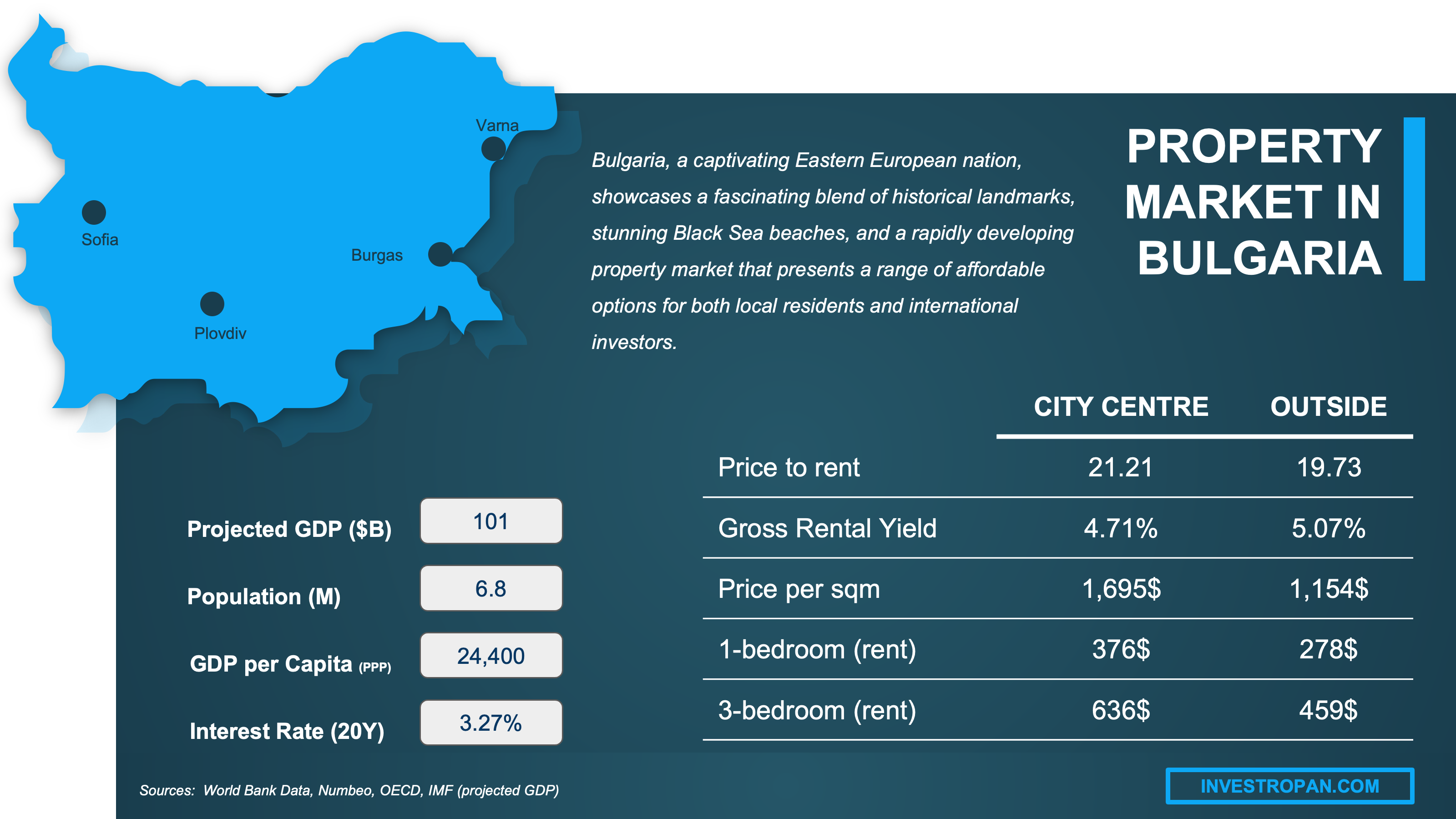

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Are homes overpriced, or fairly priced in Bulgaria as of 2026?

Are homes overpriced versus rents or versus incomes in Bulgaria as of 2026?

As of early 2026, homes in Bulgaria appear somewhat overpriced when comparing purchase costs to local incomes, but still look reasonable compared to rents, thanks to low mortgage rates keeping monthly payments manageable.

The price-to-rent ratio in Bulgaria sits around 20 to 25 in major cities like Sofia, which is stretched compared to a "balanced" benchmark of around 15 to 18, meaning buying is less attractive than renting purely on cash flow.

The price-to-income multiple in Bulgaria now requires roughly 10 to 12 years of average household income to buy a typical Sofia apartment, which is high by historical standards but not extreme by European capital city comparisons.

Finally please note that you will have all the indicators you need in our property pack covering the real estate market in Bulgaria.

Are home prices above the long-term average in Bulgaria as of 2026?

As of early 2026, Bulgaria property prices are clearly above their long-term average, with the market having risen significantly since the post-2008 crash bottom and now sitting near cycle highs.

The recent 12-month price change in Bulgaria of around 15% is roughly three times faster than the pre-pandemic average pace of 4% to 6% annual growth, which signals an unusually hot market.

When adjusted for inflation, Bulgaria property prices have now recovered past their pre-2008 peak in many urban areas, though they remain well below what markets like Prague or Warsaw have achieved on a per-square-meter basis.

Get fresh and reliable information about the market in Bulgaria

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What local changes could move prices in Bulgaria as of 2026?

Are big infrastructure projects coming to Bulgaria as of 2026?

As of early 2026, the biggest price-relevant infrastructure project in Bulgaria is the Sofia Metro Line 3 expansion, which is expected to boost property values by 5% to 15% in neighborhoods gaining new stations.

The Sofia Metro Line 3 project has secured EU Recovery and Resilience Facility funding, with construction ongoing and new stations expected to open progressively through 2027 and 2028, making it a concrete catalyst rather than just a plan.

For the latest updates on the local projects, you can read our property market analysis about Bulgaria here.

Are zoning or building rules changing in Bulgaria as of 2026?

The most important zoning change being discussed in Bulgaria involves amendments to the Spatial Development Act, which would streamline building permits and change how design professionals get authorized.

As of early 2026, these rule changes could have a mixed effect on Bulgaria property prices: faster permits may eventually increase supply (good for buyers), while stricter professional standards could raise construction costs (supporting prices for compliant new builds).

The areas most affected by these rule changes in Bulgaria would be fast-growing districts around Sofia like Vitosha, Mladost, and the southern ring, where developers are most active and permit bottlenecks currently slow projects.

Are foreign-buyer or mortgage rules changing in Bulgaria as of 2026?

As of early 2026, the direction of mortgage rules in Bulgaria has already shifted toward tightening, with BNB caps now firmly in place, while foreign-buyer rules remain relatively open, especially for EU citizens after euro adoption.

Bulgaria hasn't introduced new foreign-buyer taxes or bans, and the euro transition has actually made the market more accessible for EU-based buyers who can now transact without currency conversion hassles.

The most significant mortgage rule already in effect in Bulgaria includes the 85% maximum loan-to-value, 50% maximum debt-to-income ratio, and 30-year maximum loan term, which together prevent the riskiest lending that could destabilize the market.

You can also read our latest update about mortgage and interest rates in Bulgaria.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

Will it be easy to find tenants in Bulgaria as of 2026?

Is the renter pool growing faster than new supply in Bulgaria as of 2026?

As of early 2026, renter demand in Bulgaria's major cities is still growing slightly faster than new rental supply, though the gap is narrowing as more apartment completions come to market.

The best signal for renter demand in Bulgaria is internal migration toward Sofia, Plovdiv, Varna, and Burgas, where universities, tech jobs, and services keep pulling young professionals who rent before buying.

New apartment completions in Bulgaria are rising, with NSI data showing strong permit volumes in the same districts where renters concentrate, meaning landlords should expect more competition but not an oversupply crisis.

Are days-on-market for rentals falling in Bulgaria as of 2026?

As of early 2026, well-priced rental apartments in Bulgaria's prime urban areas typically lease within two to four weeks, and this time-to-let has stayed relatively stable rather than falling dramatically.

The difference in days-on-market between best areas and weaker areas in Bulgaria is significant: a modern apartment near Sofia's Studentski Grad or Mladost might lease in two weeks, while a dated unit in a peripheral district can sit for two to three months.

One reason days-on-market stays short in Bulgaria's best rental areas is the combination of limited quality supply and steady tenant turnover from students, young professionals, and expats concentrated in urban centers.

Are vacancies dropping in the best areas of Bulgaria as of 2026?

As of early 2026, vacancy rates in Bulgaria's best rental areas like Lozenets, Oborishte, and central Sofia remain tight at around 3% to 5%, and similar patterns hold for Varna's Chayka district and Plovdiv's Kapana neighborhood.

These best areas in Bulgaria typically run 2 to 3 percentage points below the overall city vacancy rate, because they attract tenants willing to pay premium rents for location, building quality, and transport access.

One practical sign that Bulgaria's best rental areas are tightening is that landlords in Mladost and Studentski Grad are now able to raise rents at lease renewal without losing tenants, something that wasn't consistently possible two years ago.

By the way, we've written a blog article detailing what are the current rent levels in Bulgaria.

Buying real estate in Bulgaria can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Am I buying into a tightening market in Bulgaria as of 2026?

Is for-sale inventory shrinking in Bulgaria as of 2026?

As of early 2026, it's hard to say definitively whether for-sale inventory in Bulgaria is shrinking because the country doesn't publish a clean national listings count, but permit data suggests future supply is building rather than collapsing.

Based on construction pipeline data and listing turnover in major cities, we estimate Bulgaria's effective months-of-supply sits around 3 to 5 months, which is tighter than a balanced market (typically 6 months) but not critically low.

The most likely reason inventory feels tight in Bulgaria is that strong price growth has encouraged some owners to hold rather than sell, while new construction hasn't yet delivered enough units to offset demand in prime locations.

Are homes selling faster in Bulgaria as of 2026?

As of early 2026, well-priced homes in Bulgaria's major cities are selling within 30 to 60 days on average, and this pace has held steady rather than accelerating further from the rapid turnover seen in 2024.

Year-over-year, median days-on-market in Bulgaria appears roughly flat to slightly longer, as tighter mortgage rules have reduced the pool of buyers who can close quickly without significant negotiation.

Are new listings slowing down in Bulgaria as of 2026?

As of early 2026, we don't see clear evidence that new for-sale listings in Bulgaria are slowing down dramatically, as permit activity remains strong and developers continue bringing projects to market in Sofia, Plovdiv, Varna, and Burgas.

The seasonal pattern for new listings in Bulgaria typically sees a slowdown in December and January, with activity picking up in spring, and the current level appears consistent with this normal rhythm rather than unusually low.

Is new construction failing to keep up in Bulgaria as of 2026?

As of early 2026, new construction in Bulgaria is responding to demand with strong permit volumes, but the gap between permits issued and actual livable completions means supply still lags behind what buyers want in the most desirable areas.

NSI data shows Bulgaria issued permits for thousands of new dwellings in 2025, particularly concentrated in Sofia, Plovdiv, Varna, and Burgas, though actual construction starts fluctuate quarter to quarter.

The biggest bottleneck limiting new construction in Bulgaria is the combination of labor shortages in skilled trades and rising material costs, which slow the pace from permit to completion even when financing is available.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

Will it be easy to sell later in Bulgaria as of 2026?

Is resale liquidity strong enough in Bulgaria as of 2026?

As of early 2026, resale liquidity in Bulgaria is generally good for apartments in major cities like Sofia, Plovdiv, Varna, and Burgas, where correctly priced properties find buyers within one to three months.

The median days-on-market for resale homes in Bulgaria sits around 45 to 75 days for well-priced city apartments, which is reasonable compared to a "healthy liquidity" benchmark of under 90 days.

The property characteristic that most improves resale liquidity in Bulgaria is location near public transport (especially metro stations in Sofia), combined with modern energy efficiency features that help buyers qualify under strict mortgage debt-to-income rules.

Is selling time getting longer in Bulgaria as of 2026?

As of early 2026, selling time in Bulgaria has increased slightly compared to the fastest period in 2024, as tighter credit rules have reduced the number of buyers who can move quickly.

The current median days-on-market in Bulgaria ranges from about 30 days for prime Sofia apartments to 90 days or more for older properties or those in less connected areas, with holiday homes sometimes taking even longer.

One clear reason selling time can lengthen in Bulgaria is when sellers price based on peak 2024 comparables rather than current buyer affordability, which is now constrained by the 50% debt-to-income mortgage cap.

Is it realistic to exit with profit in Bulgaria as of 2026?

As of early 2026, the likelihood of selling with a profit in Bulgaria is medium to high if you hold for at least 3 to 5 years, buy in a prime location, and don't overpay at purchase.

The minimum holding period in Bulgaria that most often makes exiting with profit realistic is around 4 to 5 years, which gives enough time for modest price appreciation to cover transaction costs and any renovation investments.

The total round-trip cost in Bulgaria (buying plus selling) typically runs about 6% to 10% of the property value, which equals roughly 6,000 to 10,000 euros on a 100,000 euro apartment, or about 12,000 to 20,000 BGN (now equivalent in euros post-adoption).

The single factor that most increases profit odds in Bulgaria is buying below market value by targeting motivated sellers, off-market deals, or properties that need cosmetic improvements in high-demand areas like Lozenets, Mladost, or Varna's sea-view districts.

Get the full checklist for your due diligence in Bulgaria

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Bulgaria, we always rely on the strongest methodology we can ... and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| Bulgaria National Statistical Institute (NSI) | It's the official producer of Bulgaria's national house price index used for policy reporting. | We used NSI's definition to stay consistent about what "prices" mean. We also anchored the latest official trendline for Bulgaria's residential market. |

| NSI Building Permits Data | It's official pipeline data showing what supply is likely coming next. | We used it to judge whether new supply is accelerating or falling behind demand. We also used the district breakdown to pinpoint construction pressure. |

| Bulgarian National Bank (BNB) | It's the banking regulator describing binding lending standards. | We used it to assess whether credit-fueled overheating is being capped. We translated LTV/DSTI limits into what they mean for buyers in 2026. |

| BTA News Agency | It's a national wire service that clearly attributes price numbers to NSI. | We used it as a quick, dated "latest read" on the official index. We treat NSI as the source of truth and BTA as a pointer to release timing. |

| Council of the European Union | This is the EU's official legal confirmation of Bulgaria's euro changeover date. | We used it to frame euro adoption as a locked-in demand driver. We also explained why buyer psychology shifts even before fundamentals do. |

| Reuters | Reuters is a global wire service with strong fact-checking standards. | We used it for context on the euro transition moment and sentiment. We don't use it for price indices but for timing and behavioral effects. |

| ECB Data Portal (Property Prices) | It's a central bank statistical portal with comparable property indicators across countries. | We used it to cross-check Bulgaria's housing cycle versus broader Europe. We avoid "local-only" bias by keeping trend interpretation consistent. |

| ECB Data Portal (Mortgage Rates) | It's the standardized interest-rate dataset used across Europe. | We used it as the backbone source for mortgage-rate direction in Bulgaria. We judged whether affordability pressure comes from rates, prices, or both. |

| FRED/BIS Residential Property Prices | It's a standardized BIS-linked historical series for comparing cycles over decades. | We used it to check whether 2026 looks like a "2007-style" blow-off or a different pattern. We use it for cycle context, not neighborhood pricing. |

| FRED/Eurostat HICP Rentals | It's a transparent gateway republishing official Eurostat-style series with consistent history. | We used it to ground rent inflation trends as a proxy for rental-market tightness. We combined it with local leasing insights from consultancies. |

| Colliers Bulgaria | Colliers is a major global real estate consultancy with transparent methodology. | We used it for micro-market texture that official stats don't provide. We also used it for named-location examples around Sofia where supply is clustering. |

| European Commission (Sofia Metro) | It's an EU institution describing funded infrastructure with budget and scope. | We used it to identify a real, funded infrastructure catalyst. We connected it to neighborhoods that benefit from metro expansion. |

| Global Property Guide | It's a transparent secondary compiler that attributes mortgage-rate data to BNB. | We used it to produce a reader-friendly mortgage-rate estimate. We still treat BNB/ECB as primary but use this to communicate simply. |

| Bulgarian Properties | It's a leading local agency with detailed yield and market commentary. | We used it for practical yield estimates and neighborhood-level insights. We cross-referenced their data with official sources for consistency. |

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of Bulgaria. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.