Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Everything you need to know before buying real estate is included in our Bulgaria Property Pack

Bulgaria has become one of Europe's most talked-about property markets, especially now that the country has officially adopted the euro as of January 1, 2026.

In this article, we cover the current housing prices in Bulgaria, what has been driving them up, and where they might be heading in the coming years.

We constantly update this blog post to reflect the latest data and market shifts, so you always have fresh information.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Bulgaria.

Insights

- Bulgaria's property prices grew about 15% year-on-year in early 2025, ranking the country second in the entire European Union for house price growth according to Eurostat data.

- Sofia remains by far the most expensive city in Bulgaria with prices around 2,250 euros per square meter, which is still roughly half of what you would pay in most other European capitals.

- The euro adoption on January 1, 2026 has already reduced currency risk for foreign buyers, and early data suggests transaction activity picked up noticeably in the final months of 2025.

- Mortgage rates in Bulgaria remain among the lowest in the EU, currently hovering between 2.6% and 4%, which continues to fuel strong buyer demand especially in major cities.

- New-build apartments in Sofia, Varna, and Plovdiv are appreciating faster than older stock because buyers are willing to pay a premium for energy efficiency, modern layouts, and parking.

- Neighborhoods along Sofia's expanding metro lines, such as Krastova Vada and Mladost, have seen price growth outpace the city average by 2 to 4 percentage points annually.

- Rural Bulgaria still offers properties for as little as 300 to 500 euros per square meter, creating a massive price gap compared to Sofia that attracts budget-conscious buyers.

- Our 5-year forecast for Bulgaria points to cumulative price growth of around 45%, which translates to roughly 7.7% per year on average if economic conditions remain stable.

What are the current property price trends in Bulgaria as of 2026?

What is the average house price in Bulgaria as of 2026?

As of early 2026, the national average property price in Bulgaria sits at approximately 1,400 euros per square meter (around 1,530 US dollars), though this figure masks significant variation between big cities and rural areas.

To put this in perspective, a typical 80-square-meter apartment in Bulgaria would cost you roughly 112,000 euros, but prices in Sofia can easily push that figure above 180,000 euros while rural homes might cost under 40,000 euros for similar space.

The realistic price range that covers about 80% of property purchases in Bulgaria falls between 800 and 2,500 euros per square meter (roughly 870 to 2,730 US dollars), with most transactions clustering around the 1,000 to 1,800 euro range in urban areas.

How much have property prices increased in Bulgaria over the past 12 months?

Property prices in Bulgaria increased by an estimated 13% over the past 12 months as of the first half of 2026, following an exceptionally strong 15.1% year-on-year growth recorded in the first quarter of 2025.

The realistic range of price increases across different property types in Bulgaria over the past 12 months spans from about 10% for older panel apartments to nearly 18% for new-build developments in prime Sofia locations.

The single most significant factor driving this price movement has been Bulgaria's euro adoption, which triggered a wave of local buyers converting savings into property as an inflation hedge while also attracting increased foreign investment capital.

Which neighborhoods have the fastest rising property prices in Bulgaria as of 2026?

As of early 2026, the top three neighborhoods with the fastest rising property prices in Bulgaria are Krastova Vada and Manastirski Livadi in Sofia (both benefiting from metro expansion and new-build concentration), and Levski in Varna (driven by strong lifestyle demand and limited prime land).

The approximate annual price growth for these top neighborhoods ranges from 16% to 20%, with Krastova Vada leading at around 20%, Manastirski Livadi at 18%, and Varna's Levski district at about 16%.

The main demand driver explaining why these neighborhoods are experiencing the fastest price growth in Bulgaria is the combination of improved transport connectivity (especially metro access in Sofia), concentration of quality new-build stock, and proximity to major employment centers.

By the way, you will find much more detailed price ranges across neighborhoods in our property pack covering the real estate market in Bulgaria.

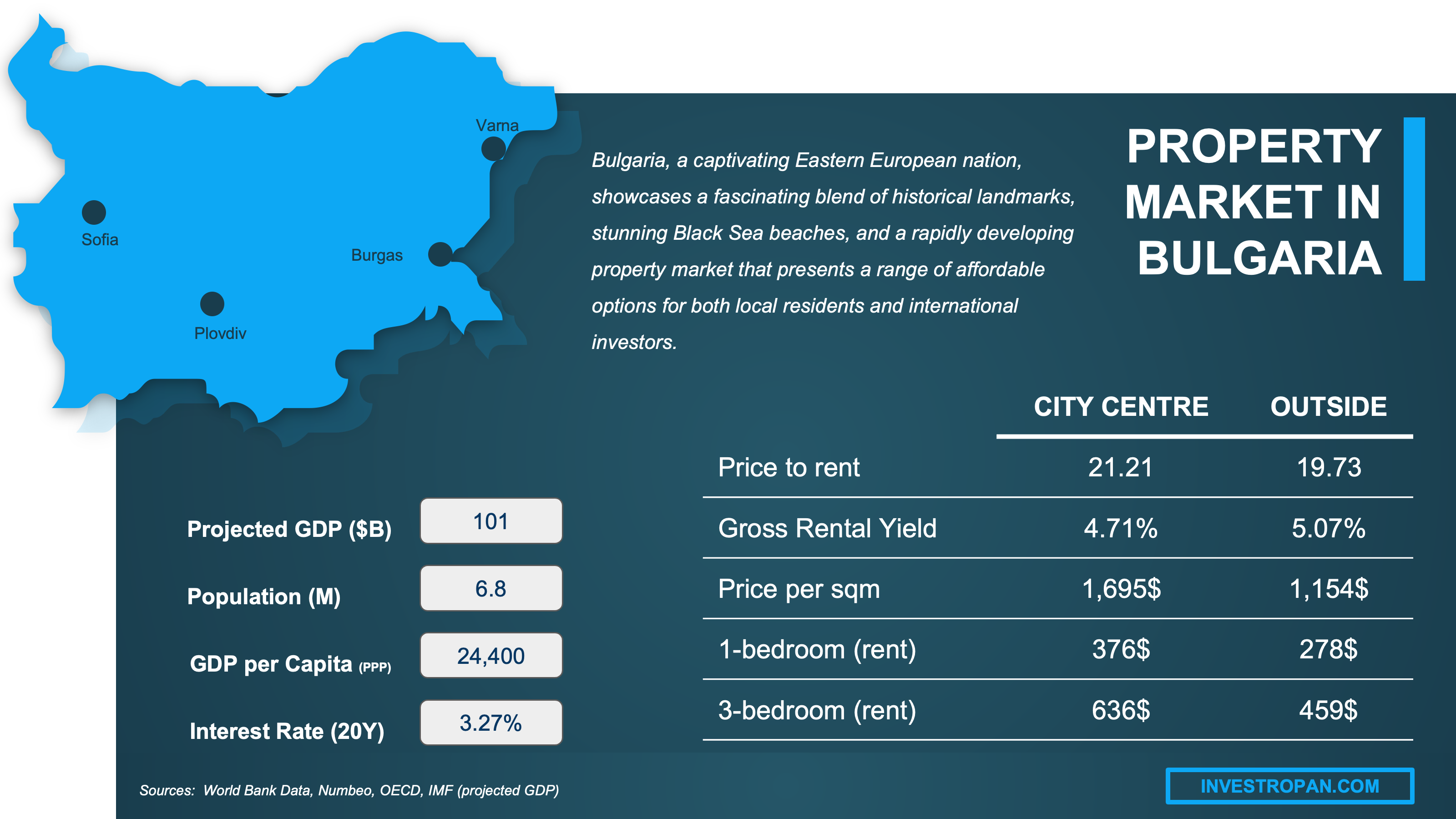

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

Which property types are increasing faster in value in Bulgaria as of 2026?

As of early 2026, the ranking of property types by value appreciation rate in Bulgaria places new-build apartments first (around 15% annual growth), followed by suburban houses and row houses in organized compounds (12 to 14%), and then well-located smaller apartments in rental hotspots (10 to 12%).

The approximate annual appreciation for the top-performing property type in Bulgaria, which is new-build apartments in major cities like Sofia, Varna, and Plovdiv, stands at around 15%.

The main reason new-build apartments are outperforming other property types in Bulgaria is that buyers are willing to pay a premium for energy efficiency, modern amenities like elevators and parking, and layouts that meet contemporary living standards.

Finally, if you're interested in a specific property type, you will find our latest analyses here:

What is driving property prices up or down in Bulgaria as of 2026?

As of early 2026, the top three factors driving property prices in Bulgaria are the country's recent euro adoption (which has boosted confidence and foreign investment), strong wage growth and employment levels (which increase buying power), and persistently tight supply of quality housing in major cities.

The single factor with the strongest upward pressure on property prices in Bulgaria is wage and income growth, which has been running at around 10 to 12% annually in nominal terms, directly translating into higher purchasing capacity for local buyers.

If you want to understand these factors at a deeper level, you can read our latest property market analysis about Bulgaria here.

Get fresh and reliable information about the market in Bulgaria

Don't base significant investment decisions on outdated data. Get updated and accurate information with our guide.

What is the property price forecast for Bulgaria in 2026?

How much are property prices expected to increase in Bulgaria in 2026?

As of early 2026, property prices in Bulgaria are expected to increase by approximately 8% over the full year, representing a moderation from the exceptional 15% growth seen in 2025.

The realistic range of forecasts from different analysts for property price growth in Bulgaria in 2026 spans from 6% (conservative scenario assuming credit tightening) to 10% (optimistic scenario with continued strong foreign investment).

The main assumption underlying most price increase forecasts for Bulgaria is that income growth will remain solid at around 8 to 10% and mortgage rates will stay low in the 3% range, supporting buyer demand without triggering overheating concerns.

We go deeper and try to understand how solid are these forecasts in our pack covering the property market in Bulgaria.

Which neighborhoods will see the highest price growth in Bulgaria in 2026?

As of early 2026, the neighborhoods expected to see the highest price growth in Bulgaria are Sofia's southern growth corridor (Krastova Vada, Hladilnika, Malinova Dolina, Vitosha), Plovdiv's expanding districts (Smirnenski, Trakiya), and Varna's lifestyle zones (Levski, Briz).

The projected price growth percentage for these top neighborhoods in Bulgaria ranges from 10% to 14%, outpacing the national average by 2 to 6 percentage points.

The primary catalyst driving expected growth in these neighborhoods is the combination of metro and transport infrastructure improvements in Sofia, new-build development concentration, and strong demand from young professionals and families seeking modern housing.

One emerging neighborhood in Bulgaria that could surprise with higher-than-expected growth is Bistritsa on Sofia's outskirts, where suburban compound development is accelerating as remote work trends boost demand for larger homes with outdoor space.

By the way, we've written a blog article detailing what are the current best areas to invest in property in Bulgaria.

What property types will appreciate the most in Bulgaria in 2026?

As of early 2026, the property type expected to appreciate the most in Bulgaria is new-build apartments in major cities, particularly energy-efficient units with parking and modern layouts in Sofia, Varna, and Plovdiv.

The projected appreciation percentage for this top-performing property type in Bulgaria is around 10 to 12% for 2026, supported by strong buyer preference and limited quality supply.

The main demand trend driving appreciation for new-build apartments in Bulgaria is the growing middle class seeking homes that meet European standards for energy efficiency and comfort, especially as euro adoption increases purchasing confidence.

The property type expected to underperform in Bulgaria during 2026 is older panel-block apartments ("panelki") in peripheral locations, as buyers increasingly prioritize quality over rock-bottom prices and renovation costs rise.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How will interest rates affect property prices in Bulgaria in 2026?

As of early 2026, the impact of interest rates on property prices in Bulgaria is expected to be supportive, as mortgage rates remain among the lowest in the EU and the euro adoption has stabilized long-term financing conditions.

The current benchmark mortgage rates in Bulgaria range from 2.6% to 4%, and the expected direction is stable to slightly converging toward eurozone averages (around 3% to 3.5%) as Bulgarian banks gradually align their pricing with European benchmark indices like EURIBOR.

A 1% increase in interest rates typically reduces property affordability in Bulgaria by about 10%, which could translate into a 3 to 5% slowdown in price growth as some buyers get priced out of the market.

You can also read our latest update about mortgage and interest rates in Bulgaria.

What are the biggest risks for property prices in Bulgaria in 2026?

As of early 2026, the three biggest risks for property prices in Bulgaria are a sharper-than-expected economic slowdown in the eurozone (which would hurt export-dependent employment), sudden credit tightening by banks implementing stricter EU-wide risk rules, and localized oversupply in specific new-build corridors.

The single risk with the highest probability of materializing in Bulgaria is localized oversupply in certain Sofia districts where multiple large developments are completing simultaneously, which could cause temporary price stagnation in those specific areas even as the broader market rises.

We actually cover all these risks and their likelihoods in our pack about the real estate market in Bulgaria.

Is it a good time to buy a rental property in Bulgaria in 2026?

As of early 2026, the overall assessment is that it remains a reasonably good time to buy a rental property in Bulgaria, particularly in major cities with strong renter demand, though buyers should be realistic about yields and selective about location.

The strongest argument in favor of buying a rental property now in Bulgaria is that rental demand remains structurally strong in Sofia, Varna, and Plovdiv due to internal migration, student populations, and the growing number of remote workers choosing Bulgaria for its low cost of living and fast internet.

The strongest argument for waiting before buying a rental property in Bulgaria is that the exceptional price growth of 2024-2025 has compressed yields, and a period of price moderation in 2026-2027 could offer better entry points for patient investors.

If you want to know our latest analysis (results may differ from what you just read), you can read our assessment on whether now is a good time to buy a property in Bulgaria.

You'll also find a dedicated document about this specific question in our pack about real estate in Bulgaria.

Buying real estate in Bulgaria can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Where will property prices be in 5 years in Bulgaria?

What is the 5-year property price forecast for Bulgaria as of 2026?

As of early 2026, the estimated cumulative property price growth expected over the next 5 years in Bulgaria is approximately 45%, assuming continued economic stability and income convergence within the eurozone.

The range of 5-year forecasts for Bulgaria spans from about 30% cumulative growth (conservative scenario with slower eurozone recovery) to 60% (optimistic scenario with accelerated income convergence and sustained foreign investment).

The projected average annual appreciation rate over the next 5 years in Bulgaria is around 7.7%, which represents a moderation from the 2024-2025 spike but remains strong by European standards.

The key assumption most forecasters rely on for their 5-year property price predictions in Bulgaria is that wage growth will continue at 6 to 8% annually in real terms, supporting purchasing power without triggering affordability crises in major cities.

Which areas in Bulgaria will have the best price growth over the next 5 years?

The estimated top three areas in Bulgaria expected to have the best price growth over the next 5 years are Sofia's southern growth ring (Krastova Vada, Vitosha, Malinova Dolina, and nearby settlements like Bistritsa and Pancharevo), Varna's lifestyle districts (Levski, Briz, Chayka), and Plovdiv's expanding residential zones (Smirnenski, Trakiya, Karshiaka).

The projected 5-year cumulative price growth for these top-performing areas in Bulgaria ranges from 55% to 70%, compared to the national average of around 45%.

This 5-year outlook is consistent with the shorter-term forecast but adds emphasis on Sofia-area suburban compounds and settlements, as remote work trends and metro expansion make previously "too far" locations increasingly attractive to families.

The currently undervalued area in Bulgaria with the best potential for outperformance over 5 years is Ruse, where prices remain around 1,000 euros per square meter despite the city's strategic Danube location and improving infrastructure connections to Bucharest.

What property type will give the best return in Bulgaria over 5 years as of 2026?

As of early 2026, the property type expected to give the best total return over 5 years in Bulgaria is mid-market new-build apartments in major cities, combining solid appreciation potential with consistent rental income.

The projected 5-year total return (appreciation plus rental income) for this top-performing property type in Bulgaria is approximately 65 to 75%, assuming 45% capital growth plus cumulative rental yields of 20 to 30%.

The main structural trend favoring new-build apartments over the next 5 years in Bulgaria is the ongoing quality upgrade of housing stock, as an increasingly affluent population demands modern standards and older panel apartments become harder to sell.

For buyers seeking the best balance of return and lower risk over 5 years in Bulgaria, small rentable apartments (studios and one-bedrooms) near universities and employment centers offer more stable cash flow and easier liquidity than larger properties.

How will new infrastructure projects affect property prices in Bulgaria over 5 years?

The estimated top three major infrastructure projects expected to impact property prices in Bulgaria over the next 5 years are the Sofia Metro expansion (adding 10 new stations and extending to Studentski Grad and Tsarigradsko Shose by 2027), the continued development of Bulgaria's highway network connecting Sofia to the Black Sea coast, and EU-funded improvements to regional rail connections.

The typical price premium for properties near completed infrastructure projects in Bulgaria ranges from 10% to 20%, with metro station proximity commanding the highest premiums (up to 25% within 500 meters of a station in Sofia).

The specific neighborhoods in Bulgaria that will benefit most from these infrastructure developments are Sofia's Mladost, Slatina, and Studentski Grad (metro extensions), the ring-road adjacent areas like Obelya (intermodal hub), and corridor towns between Sofia and coastal cities.

How will population growth and other factors impact property values in Bulgaria in 5 years?

The projected population growth rate for Bulgaria overall is slightly negative (around -0.5% annually), but this masks strong internal migration toward Sofia, Plovdiv, and Varna, which is expected to push property values in these cities up by supporting consistent demand.

The demographic shift with the strongest influence on property demand in Bulgaria is the concentration of higher-income professionals and young families in major urban centers, driving demand for larger, quality apartments and suburban houses.

Migration patterns are expected to affect property values in Bulgaria through continued rural-to-urban flows and a growing inflow of remote workers and digital nomads from Western Europe attracted by low costs and EU membership, particularly boosting rental demand in Sofia and coastal cities.

The property types and areas that will benefit most from these demographic trends in Bulgaria are two-bedroom and three-bedroom apartments in Sofia's family-friendly neighborhoods (Mladost, Studentski Grad, Vitosha), and suburban houses in Sofia-area compounds for families seeking more space.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

What is the 10 year property price outlook in Bulgaria?

What is the 10-year property price prediction for Bulgaria as of 2026?

As of early 2026, the estimated cumulative property price growth expected over the next 10 years in Bulgaria is approximately 110%, meaning properties could roughly double in value if economic convergence within the eurozone proceeds as expected.

The range of 10-year forecasts for Bulgaria spans from about 70% cumulative growth (conservative scenario assuming periods of stagnation) to 150% (optimistic scenario with accelerated income convergence and strong foreign investment flows).

The projected average annual appreciation rate over the next 10 years in Bulgaria is around 7.6% compounded, reflecting a gradual normalization from recent highs while maintaining solid long-term momentum.

The biggest uncertainty factor in making 10-year property price predictions for Bulgaria is the pace of income convergence with Western European levels, as this directly determines how much purchasing power local buyers will have and how attractive Bulgaria remains to foreign investors.

What long-term economic factors will shape property prices in Bulgaria?

The estimated top three long-term economic factors that will shape property prices in Bulgaria over the next decade are income convergence within the eurozone (as Bulgarian wages gradually approach EU averages), ongoing urbanization toward Sofia and secondary cities, and the quality upgrade of housing stock as older panel buildings become obsolete.

The single long-term economic factor with the most positive impact on property values in Bulgaria will be income convergence, as Bulgaria's GDP per capita is projected to rise from around 17,000 euros currently toward 25,000 euros or higher by 2036, directly boosting housing affordability capacity.

The single long-term economic factor posing the greatest structural risk to property values in Bulgaria is demographic decline, as the country's working-age population continues to shrink, potentially limiting demand growth in smaller cities and rural areas even as major urban centers thrive.

You'll also find a much more detailed analysis in our pack about real estate in Bulgaria.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Bulgaria, we always rely on the strongest methodology we can and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| National Statistical Institute (NSI) Bulgaria | Bulgaria's official statistics office publishing transaction-based housing price indices. | We used it as the primary source for national and city-level price growth rates. We also referenced its quarterly change tables to identify which cities were accelerating fastest. |

| NSI House Price Index Methodology | Official explanation of what the Bulgarian HPI measures and how it's compiled. | We used it to clarify what "price growth" means in the Bulgarian context. We ensured our article stays accurate while remaining accessible to non-technical readers. |

| Eurostat Housing Price Statistics | The EU's official statistical authority standardizing cross-country HPI comparisons. | We used it to benchmark Bulgaria's property cycle against the broader EU context. We cross-checked that Bulgaria's inflation-adjusted story fits European patterns. |

| Eurostat HPI Compliance Monitoring for Bulgaria | An EU audit-style review of how Bulgaria's HPI is produced. | We used it to strengthen confidence that the official index follows EU rules. We justified relying on NSI/Eurostat data as the backbone for historical and current trends. |

| Council of the EU (Consilium) | The EU Council's official record of the legal decision enabling Bulgaria's euro adoption. | We used it to anchor our January 2026 context around the currency change. We explained why financing conditions and buyer psychology shifted. |

| EUR-Lex Council Decision 2025/1407 | The binding legal text in the EU Official Journal confirming Bulgaria's euro adoption date. | We used it to be precise about the euro adoption date without relying on hearsay. We referenced it when discussing interest rates and risk premiums. |

| Reuters | A top-tier global news wire with strong fact-checking and clear event dating. | We used it to confirm what actually happened by January 2026. We framed near-term sentiment and transition effects on property markets. |

| AP News | A major international newsroom providing independent verification of key events. | We used it as a second confirmation of Bulgaria's euro adoption timing. We explained the changeover month effects on pricing behavior. |

| Bulgarian National Bank Macroeconomic Forecast | The central bank is the most authoritative source for Bulgaria's official macro assumptions. | We used it to build the 2026-2027 housing demand backdrop with income and growth data. We kept our forecasts consistent with official baseline scenarios. |

| BNB Economic Review | The central bank's detailed analysis of credit conditions, rates, and monetary transmission. | We used it to explain why Bulgarian mortgage rates can stay sticky even when ECB rates move. We connected lending growth with housing price momentum. |

| IMF Bulgaria Country Page | A top international institution with transparent macroeconomic projections. | We used it to triangulate 2026 growth and inflation expectations. We stress-tested whether a soft landing or re-acceleration was more plausible. |

| ECB Convergence Report | The ECB is a primary source for euro accession assessments and eurozone monetary context. | We used it to explain why euro adoption reduced currency risk premia before January 2026. We provided context for mortgage pricing expectations. |

Get the full checklist for your due diligence in Bulgaria

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

If you want to go deeper, you can read the following: