All sources have been thoroughly verified for credibility. Furthermore, an industry specialist has reviewed and approved the final article.

Everything you need to know is included in our Bulgaria Property Pack

Are you thinking of investing in property in the land of Roses? Are you curious if the prices are at an optimal point?

People hold diverse opinions regarding market timing. The Bulgarian real estate agent you know may suggest that it's currently a good time to buy property, but your childhood friend living in Sofia suggests waiting for a couple more months.

At Investropa, when we create articles or update our pack of documents related to the real estate market in Bulgaria, we facts and data that are backed by evidence, not just opinions or rumors.

We have carefully studied official reports and statistics from government websites, and we now have a trustworthy database with important information. Here's what we discovered, which can help you decide if it's a good idea to purchase real estate in Bulgaria.

Happy reading time!

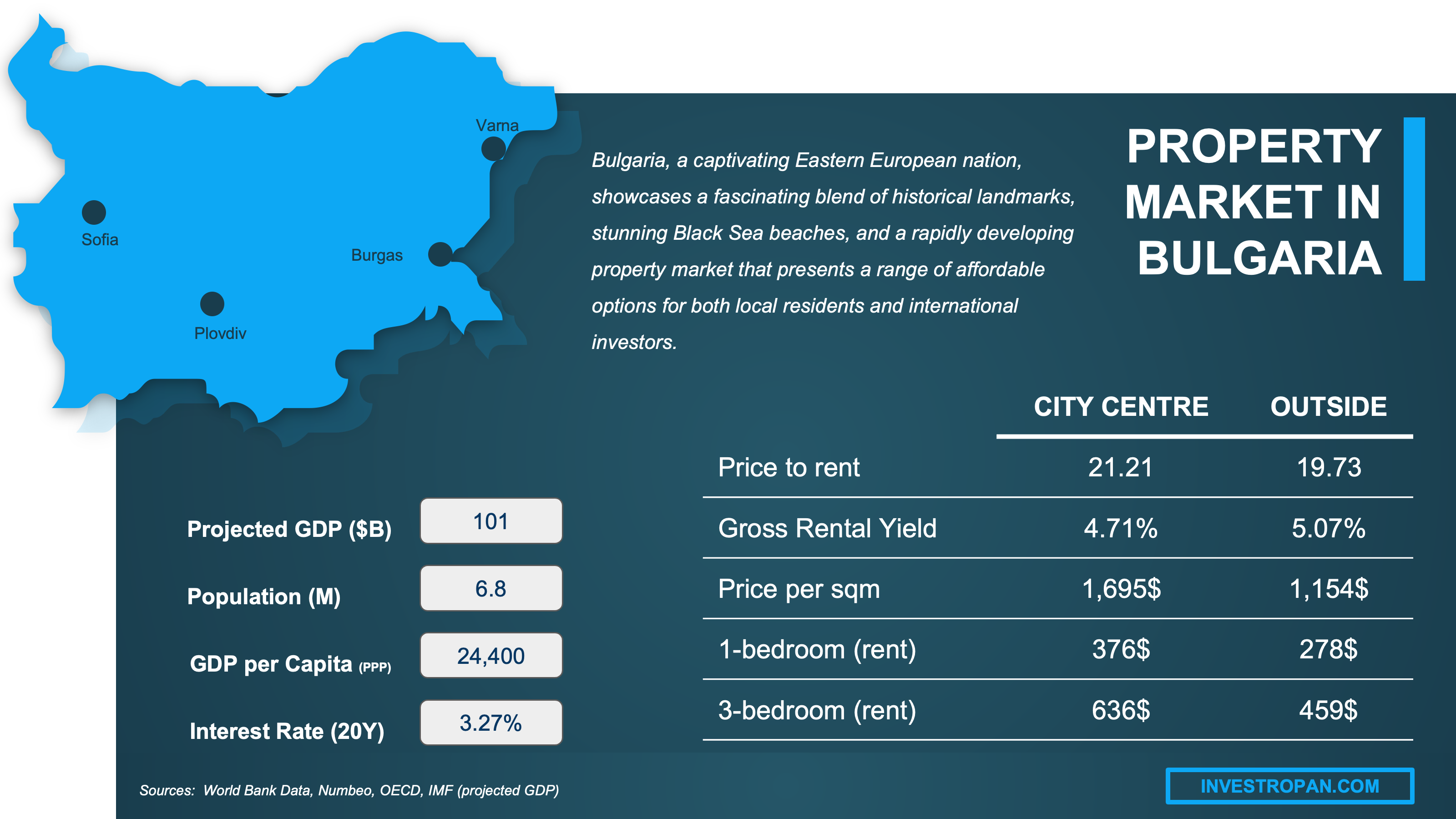

How is the property market in Bulgaria now?

Bulgaria is widely recognized, today, as a stable country

Positive

Stability is a necessary condition when investing in real estate because it promotes steady rental income and potential capital gains. It is an information you need as a foreigner buying a property in Bulgaria.

Yes, Bulgaria is a country with a stable environment. The last Fragile State Index reported for this country is 49.4, which is a highly satisfactory number.

Bulgaria is widely recognized as a stable country today due to its successful integration into the European Union, which has bolstered its economic growth and governance standards. Additionally, its strategic geopolitical position in Southeast Europe has led to increased foreign investment and strengthened regional cooperation, contributing to its overall stability.

Investing in this country rests on solid ground. Next, let's analyze the economic forecast.

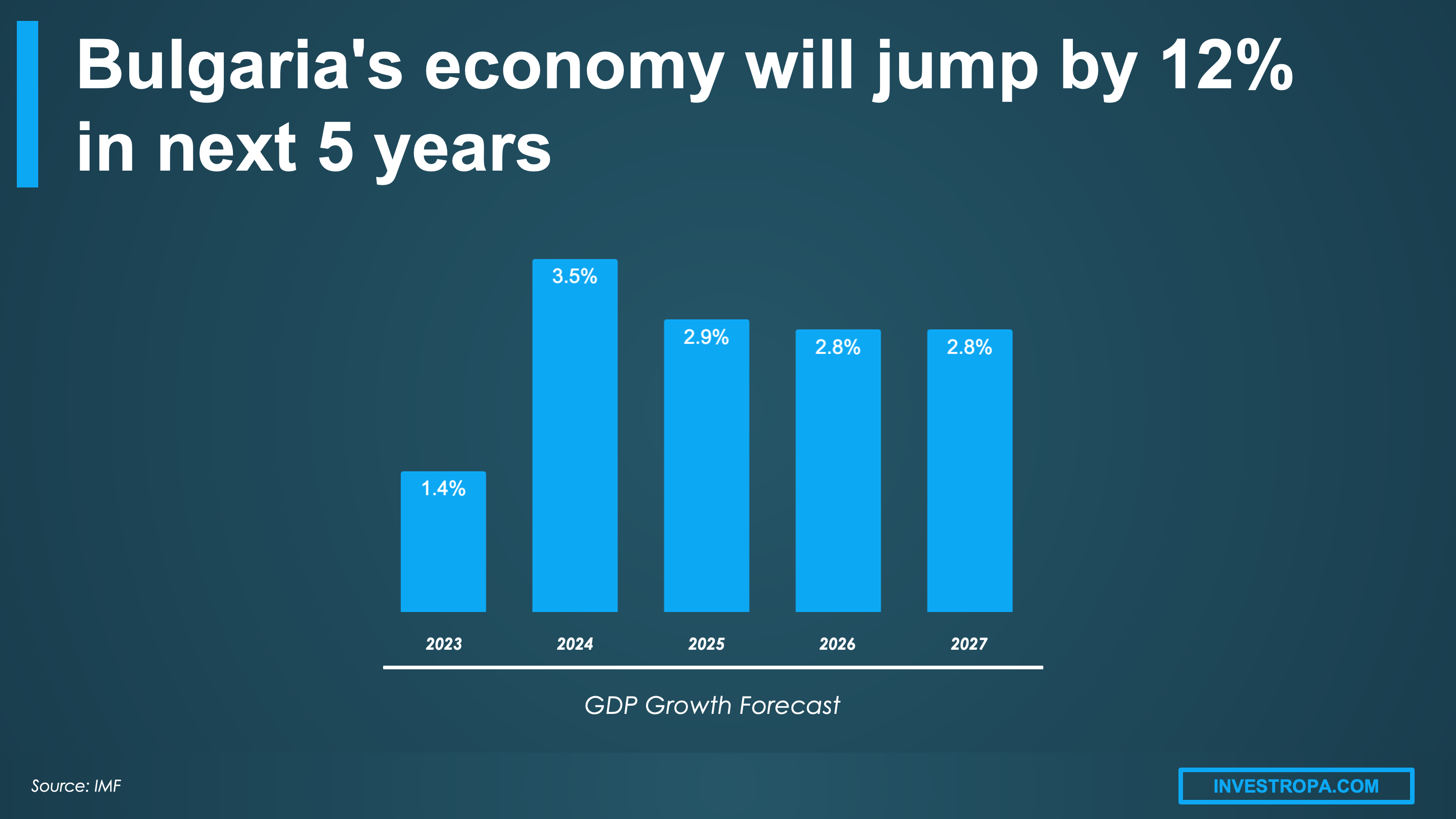

Bulgaria will keep growing in the next 5 years

Positive

To figure out if it's the right time to buy a property, start by checking how well the country's economy is doing.

In line with IMF predictions, Bulgaria will end 2024 with a growth rate of 2.7%, which shows the country is on the right path. As for 2025, the experts say 2.9%.

Besides that, the economy will keep growing since Bulgaria's economy is expected to increase by 12.8% during the next 5 years, resulting in an average GDP growth rate of 2.6%.

The expected sustainable growth rate in Bulgaria indicates a stable and growing economy, which can lead to increased property values and rental demand over time. For real estate investors, this means a higher potential for returns on their investment as the market continues to develop.

That being said, there are other indicators to monitor.

Bulgarian business owners project resolute confidence in the economy

Positive

The GDP growth is auseful measure, but may not encompass business community sentiments on property market. Fortunately, in Bulgaria there is an official metric that is consistently updated. We're lucky because this isn't true for every country.

The Business Consumer Index (BCI) is a metric that reflects the confidence of business leaders in both the current and future economic conditions. It is established through surveys and assessments.

According to the National Statistical Institute's data, the latest Business Confidence Index value is 23 for Bulgaria. For interpretation, this score is remarkably robust.

This trend is sound - optimism was already present 12 months ago. The score, back then, registered at 25.

With the Business Confidence Index in Bulgaria currently at a strong level, it's promising news for property investors. This indicates that the economy is anticipated to expand, resulting in more job opportunities and increased incomes. Consequently, there would likely be a heightened demand for properties, making it an opportune moment for investors to generate rental income and potentially witness an appreciation in the value of their properties over time.

Bulgaria is delivering a lot more building permits

Positive

If you're contemplating buying property in a country, it's worth considering the number of building permits that have been issued recently. When more building permits are issued, it indicates an optimistic outlook for the property market's performance.

We have excellent news for you: the number of building permits delivered is exploding in Bulgaria.

In the past 12 months, according to National Statistical Institute, Bulgaria, the number of building permits issued by the Bulgarian municipalities rose by 40.7%, from 7,047 to 9,917 units.

The data here strongly suggests that many people think it's a good time to invest in real estate.

Another important point to note is that there will be an increase in the number of real estate available in the market. Based on this information, it's possible that property prices will decrease in Bulgaria in 2025.

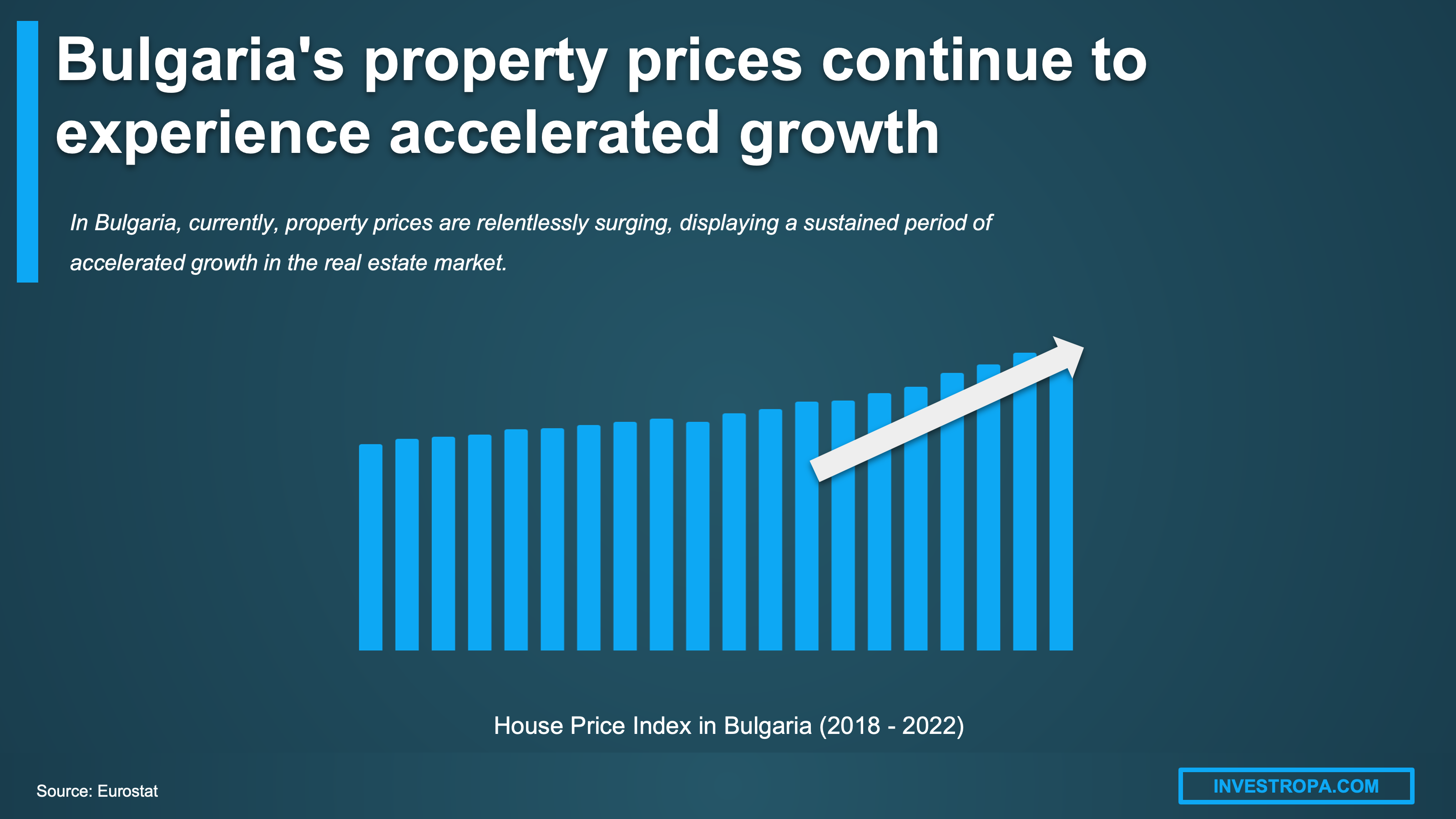

Bulgaria's property prices continue to experience accelerated growth

Positive

Bulgaria's home prices have increased by 46.5% in 5 years according to eurostat.

It means that if you had bought a villa in Sofia for $500,000 five years ago, then it would now be worth around $733,000.

Currently, property prices are relentlessly surging, displaying a sustained period of accelerated growth in the real estate market.

It's definitely a positive signal for whoever wants to invest in the Bulgarian property market. However, you might want to wait for the next market correction.

You can find a more detailed analysis of the real estate prices in our property pack for Bulgaria.

Everything you need to know is included in our Bulgaria Property Pack

Bulgaria's population is getting a lot richer

Positive

When you're looking to buy real estate, population growth and GDP per capita deserve careful consideration because:

- a growing population means more people needing homes

- a higher GDP per person means people have more money to spend on housing (which can lead to increased property value over time)

In Bulgaria, the average GDP per capita has changed by 20.8% over the last 5 years. Almost no country has done better.

This means that, if you purchase a cozy cabin in the Bulgarian mountains and rent it out, you will find that each year, you'll attract more tenants with sufficient funds to cover the rent.

If you're considering purchasing and renting it out, this trend is a good thing. Then, the rental demand might increase in Bulgarian cities like Sofia, Plovdiv, or Varna in 2025.

No high rental yields in Bulgaria

Neutral

Rental yield is a straightforward tool to evaluate the performance of real estate investments.

It represents the annual rental income generated by a property divided by its purchase price or market value. For instance, if a property in Bulgaria is purchased for 300,000 BGN and generates 18,000 BGN in annual rental income, the rental yield would be 6%.

Based on the data provided by Numbeo, rental properties in Bulgaria promise gross rental yields from 3.2% and 5.9%. You can find a more detailed analysis (by property and areas) in our pack of documents related to the real estate market in Bulgaria.

It indicates a moderate level of income generation.

Also, as we have seen before, there might be a fall in housing prices (because of more available properties) and potential tenants are getting wealthier. Consequently, gross rental yields are very very likely to soar in Bulgaria in 2025.

Everything you need to know is included in our Bulgaria Property Pack

In Bulgaria, expect minimal inflationary effect

Neutral

Simply put, inflation is the gradual rise in the cost of goods and services.

It's when your usual bottle of Bulgarian wine costs 25 Bulgarian leva instead of 20 Bulgarian leva a couple of years ago.

If you're considering investing in a property, high inflation can offer you several advantages:

- Property values have a tendency to increase over time, leading to potential capital appreciation.

- Inflation can result in higher rental rates, thereby increasing the cash flow from the property.

- Inflation reduces the real value of debt, making mortgage payments more affordable.

- Real estate can act as a hedge against inflation, effectively preserving the value of the investment.

- Diversifying your portfolio with real estate provides stability during periods of inflation.

- Tax advantages, such as depreciation deductions, can help offset the impact of inflation.

According to the IMF's estimations, over the next 5 years, Bulgaria will have an inflation rate of 1.0%, which gives us an average yearly increase of 0.2%.

It means that Bulgaria is anticipated to experience negligible inflation. Unfortunately, in the absence of inflation, purchasing a property now may not result in substantial price increases or substantial profits in the future.

Is it a good time to buy real estate in Bulgaria then?

Time to conclude !

Bulgaria is widely recognized today as a stable country, making it an attractive destination for property investment. Stability is a key factor when considering real estate, as it ensures a secure environment for your investment. With a stable political and economic climate, Bulgaria offers a sense of security that many investors look for. This stability is a solid foundation for the country's future growth, making 2025 an ideal time to consider buying property there.

Moreover, Bulgaria's economy is expected to grow by 12.8% over the next five years, resulting in an average GDP growth rate of 2.6%. This sustainable growth rate indicates a stable and expanding economy, which can lead to increased property values and rental demand over time. For real estate investors, this means a higher potential for returns on their investment as the market continues to develop. A growing economy often translates to a thriving real estate market, making it a promising time to invest.

Additionally, Bulgaria is issuing more building permits, which is a sign of a booming real estate market. This increase in construction activity suggests that the country is preparing for future demand, which can lead to accelerated growth in property prices. As the population becomes wealthier, the demand for quality housing is likely to rise, further driving up property values. This trend presents an excellent opportunity for investors looking to capitalize on the growing market.

Rental properties in Bulgaria also promise attractive gross rental yields, ranging from 3.2% to 5.9%, according to data from Numbeo. These yields indicate a healthy rental market, providing investors with a steady income stream. Furthermore, with minimal inflationary effects expected, the purchasing power of your investment is likely to remain stable. All these factors combined make 2025 a promising year to invest in Bulgarian real estate, offering both growth potential and financial security.

We genuinely hope this article was useful!. If you need to know more, you can check our our pack of documents related to the real estate market in Bulgaria.

-Will real estate prices go up in Bulgaria?

This article is for informational purposes only and should not be considered financial advice. Readers are advised to consult with a qualified professional before making any investment decisions. We do not assume any liability for actions taken based on the information provided.