Authored by the expert who managed and guided the team behind the Bulgaria Property Pack

Everything you need to know before buying real estate is included in our Bulgaria Property Pack

Bulgaria just joined the euro area on January 1, 2026, and the property market is buzzing with activity, which also means more risks for foreign buyers who do not know the local rules.

We constantly update this blog post to reflect the latest changes in Bulgarian property law, scam tactics, and market conditions.

This guide will walk you through everything you need to know to avoid the pitfalls that catch most foreigners off guard when buying property in Bulgaria.

And if you're planning to buy a property in this place, you may want to download our pack covering the real estate market in Bulgaria.

How risky is buying property in Bulgaria as a foreigner in 2026?

Can foreigners legally own properties in Bulgaria in 2026?

As of early 2026, foreigners can legally buy apartments and buildings in Bulgaria, but the land underneath is where things get complicated. The Bulgarian Constitution restricts direct land ownership by foreigners unless you qualify through specific EU or international treaty conditions, which means that buying a house with a garden is not as straightforward as buying an apartment. Many non-EU foreigners work around this by setting up a Bulgarian limited liability company (OOD) to hold the land, though EU citizens face fewer restrictions and can often buy directly after meeting residency requirements.

If you're interested, we go much more into details about the foreign ownership rights in Bulgaria here.

What buyer rights do foreigners actually have in Bulgaria in 2026?

As of early 2026, foreign property owners in Bulgaria have the same legal protections as Bulgarian citizens once their ownership is registered in the Property Register. If a seller breaches a contract in Bulgaria, you can pursue legal remedies through the Bulgarian courts, including claims for damages or specific performance, though enforcement can take significantly longer than in Western Europe. The most common right that foreigners mistakenly assume they have is the ability to resolve disputes quickly, when in reality Bulgarian court proceedings can drag on for years, making prevention through proper due diligence far more valuable than relying on legal recourse.

How strong is contract enforcement in Bulgaria right now?

Contract enforcement in Bulgaria is functional but slower than in countries like Germany, France, or the UK, where court proceedings typically resolve faster and with more predictable outcomes. The main weakness foreigners should be aware of in Bulgaria is the length of civil court proceedings, which can stretch well beyond a year for property disputes, meaning that if something goes wrong, you will spend significant time and money trying to fix it.

By the way, we detail all the documents you need and what they mean in our property pack covering Bulgaria.

Buying real estate in Bulgaria can be risky

An increasing number of foreign investors are showing interest. However, 90% of them will make mistakes. Avoid the pitfalls with our comprehensive guide.

Which scams target foreign buyers in Bulgaria right now?

Are scams against foreigners common in Bulgaria right now?

Real estate scams targeting foreigners in Bulgaria are common enough that you should plan around them, especially in resort areas along the Black Sea coast and in fast-growing Sofia neighborhoods. The most frequently targeted transactions are off-plan purchases and properties sold through powers of attorney, where the actual owner is absent and documentation can be manipulated. Foreign buyers who are new to Bulgaria, do not speak Bulgarian, and rely entirely on their agent without independent legal verification are the most common targets. The single biggest warning sign that a deal may be a scam in Bulgaria is pressure to sign a preliminary contract or pay a deposit before you have obtained an official ownership certificate from the Property Register.

What are the top three scams foreigners face in Bulgaria right now?

The top three scams that foreigners most commonly face when buying property in Bulgaria are fake or unauthorized sellers using forged powers of attorney, properties with hidden mortgages or liens that are not disclosed until after the deposit is paid, and off-plan schemes where developers collect money but fail to deliver the promised property. The most common scam typically unfolds when a friendly "representative" shows you a property, provides convincing documents, pressures you to sign a preliminary contract quickly because the "owner is abroad," and then disappears after you transfer the deposit. The single most effective way to protect yourself from each of these scams is to pull an official ownership and encumbrance certificate from the Bulgarian Registry Agency before signing anything, verify any power of attorney through a notary, and for off-plan purchases, confirm the developer's title and building permits independently.

We did some research and made this infographic to help you quickly compare rental yields of the major cities in Bulgaria versus those in neighboring countries. It provides a clear view of how this country positions itself as a real estate investment destination, which might interest you if you’re planning to invest there.

How do I verify the seller and ownership in Bulgaria without getting fooled?

How do I confirm the seller is the real owner in Bulgaria?

The standard verification process in Bulgaria requires you to request an official ownership certificate from the Property Register operated by the Bulgarian Registry Agency, which will show the registered owner, any co-owners, and the chain of title. The official document foreigners should check is the certificate or extract from the Property Register (available through the EPZEU portal), which must match the property identifier from the Cadastre and the seller's identity documents exactly. The most common trick fake sellers use in Bulgaria is presenting themselves as authorized representatives with a power of attorney for an absent owner, and this is common enough that you should treat any power of attorney situation as high risk and have your lawyer independently verify the document and the identity chain.

Where do I check liens or mortgages on a property in Bulgaria?

In Bulgaria, you check liens and mortgages at the Property Register operated by the Bulgarian Registry Agency, either in person at a regional office or through the online EPZEU portal. When requesting information, you should ask for a full encumbrance certificate covering the entire period since the current owner acquired the property, which will show mortgages, liens, seizures, and any other claims registered against the property. The type of encumbrance most commonly missed by foreign buyers in Bulgaria is a "preliminary contract" registration or a claim that does not appear obvious in a quick check, which is why you need a certificate covering the full ownership period rather than a snapshot.

It's one of the aspects we cover in our our pack about the real estate market in Bulgaria.

How do I spot forged documents in Bulgaria right now?

The most common type of forged document used in property scams in Bulgaria is a fake or manipulated power of attorney, and while professional forgeries are not extremely common, they happen often enough in resort areas and transactions involving absent owners that you should never rely on visual inspection alone. Red flags that indicate a document may be forged include notary stamps that look inconsistent, pressure to avoid using a notary you choose yourself, names or dates that do not match other records, and any reluctance to let you verify documents independently. The official verification method you should use in Bulgaria is to cross-check all documents against the Property Register and Cadastre, have your own lawyer present at the notary, and for powers of attorney, verify directly with the notary who allegedly issued them.

Get the full checklist for your due diligence in Bulgaria

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What "grey-area" practices should I watch for in Bulgaria?

What hidden costs surprise foreigners when buying a property in Bulgaria?

The three most common hidden costs foreigners overlook in Bulgaria are the municipal property acquisition tax (0.1% to 3% of the property value, or roughly 200 to 6,000 EUR on a 200,000 EUR property depending on the municipality), notary fees that scale with transaction value and can reach 1,500 to 3,000 EUR on larger purchases, and the ongoing requirement to register with BULSTAT within 7 days of purchase, which incurs penalties if missed. The hidden cost most often deliberately concealed by sellers or agents in Bulgaria is the true level of outstanding utility bills, building maintenance fund arrears, or unpaid property taxes, and this is common enough that you should always request written proof of cleared accounts before closing.

If you want to go into more details, we also have a blog article detailing all the property taxes and fees in Bulgaria.

Are "cash under the table" requests common in Bulgaria right now?

Requests to declare a lower price on the notary deed while paying part of the purchase in undeclared cash still happen in Bulgaria, particularly in transactions involving older properties or sellers who want to minimize their capital gains tax exposure. The typical reason sellers give in Bulgaria is that it will "save you both money on taxes and fees," which sounds appealing until you realize the risks. The legal risks foreigners face if they agree to an undeclared cash payment in Bulgaria include weaker legal protection if a dispute arises (since your declared price becomes your official truth), potential money laundering investigations from banks, and leverage for the other party to blackmail you later.

Are side agreements used to bypass rules in Bulgaria right now?

Side agreements are used in Bulgarian property transactions often enough that you should be alert to them, particularly around reservation fees, preliminary contracts with one-sided penalties, and "furniture packages" that shift value off the main notarial deed. The most common type of side agreement used to circumvent regulations in Bulgaria is a separate "protocol" or "supplement" that promises extras like parking spaces, storage units, or renovation work that never gets registered or legally formalized. The legal consequences foreigners face if a side agreement is discovered by authorities in Bulgaria include potential tax penalties, invalidation of promises that were never registered, and loss of any leverage to enforce what was agreed outside the official deed.

We made this infographic to show you how property prices in Bulgaria compare to other big cities across the region. It breaks down the average price per square meter in city centers, so you can see how cities stack up. It’s an easy way to spot where you might get the best value for your money. We hope you like it.

Can I trust real estate agents in Bulgaria in 2026?

Are real estate agents regulated in Bulgaria in 2026?

As of early 2026, real estate agents in Bulgaria are not required to hold a government-issued license, which means the quality and reliability of agents varies significantly across the market. While there is no mandatory national certification, reputable agents in Bulgaria often belong to professional associations like the National Real Estate Association (part of BFMA), which sets voluntary standards and ethical guidelines. Foreigners can verify whether an agent operates professionally by checking if the agency is registered as a business in Bulgaria, requesting membership proof in a professional association, and asking for references from previous foreign clients.

Please note that we have a list of contacts for you in our property pack about Bulgaria.

What agent fee percentage is normal in Bulgaria in 2026?

As of early 2026, the normal agent fee for a residential property purchase in Bulgaria is around 3% of the transaction price, plus VAT if the agency is VAT-registered. The typical range of agent fees in Bulgaria covers 2.5% to 3.5% for most standard transactions in cities like Sofia, Plovdiv, and Varna, though resort areas along the Black Sea coast sometimes see agents attempting to charge higher percentages, particularly to foreign buyers. In Bulgaria, the buyer typically pays the agent fee, though some agencies try to collect commissions from both buyer and seller, so you should always get the fee structure in writing before engaging an agent.

Get the full checklist for your due diligence in Bulgaria

Don't repeat the same mistakes others have made before you. Make sure everything is in order before signing your sales contract.

What due diligence actually prevents disasters in Bulgaria?

What structural inspection is standard in Bulgaria right now?

The standard structural inspection process in Bulgaria is less formalized than in countries like the UK or US, and many buyers rely only on a visual walkthrough, which is why hiring an independent engineer or surveyor is strongly recommended for any significant purchase. A qualified inspector in Bulgaria should check foundations, load-bearing walls, roof condition, moisture and water damage, electrical systems, plumbing, and for apartments, the condition of common areas and the building's technical passport. The professionals qualified to perform structural inspections in Bulgaria are licensed civil engineers or construction experts (often found through the Bulgarian Chamber of Architects and Engineers), and you should never rely on someone recommended solely by the seller or agent. The most common structural issues that inspections reveal in Bulgarian properties are moisture damage and mold (especially after cosmetic repainting), poor insulation and cheap windows in newer builds, unpermitted alterations like merged balconies, and deferred maintenance in older apartment buildings.

How do I confirm exact boundaries in Bulgaria?

The standard process for confirming exact property boundaries in Bulgaria is to obtain a cadastral sketch and data from the Geodesy, Cartography and Cadastre Agency (AGKK) through their KAIS portal, which shows the official boundaries, identifiers, and area of the property. The official document that shows the legal boundaries in Bulgaria is the cadastral map extract, which you should compare against the notary deed to ensure the property identifier and boundaries match exactly. The most common boundary dispute affecting foreign buyers in Bulgaria involves "bonus land" such as garden strips, driveways, or parking spaces that the seller uses but does not legally own, which becomes your problem after purchase. The professional you should hire to physically verify boundaries on the ground in Bulgaria is a licensed surveyor (geodesist), who can confirm that the physical property matches the cadastral records before you sign.

What defects are commonly hidden in Bulgaria right now?

The top three defects that sellers frequently conceal from buyers in Bulgaria are moisture and mold hidden behind fresh paint (common), poor thermal insulation and single-pane windows replaced with cheap substitutes (common in older buildings), and unpermitted structural alterations like removed walls or enclosed balconies (sometimes happens, especially in apartments). The inspection technique that helps uncover hidden defects in Bulgaria is a combination of thermal imaging for insulation and moisture issues, careful examination of walls and ceilings for recent repainting that might hide damage, and a review of the building's technical passport and municipal records to check for unpermitted work.

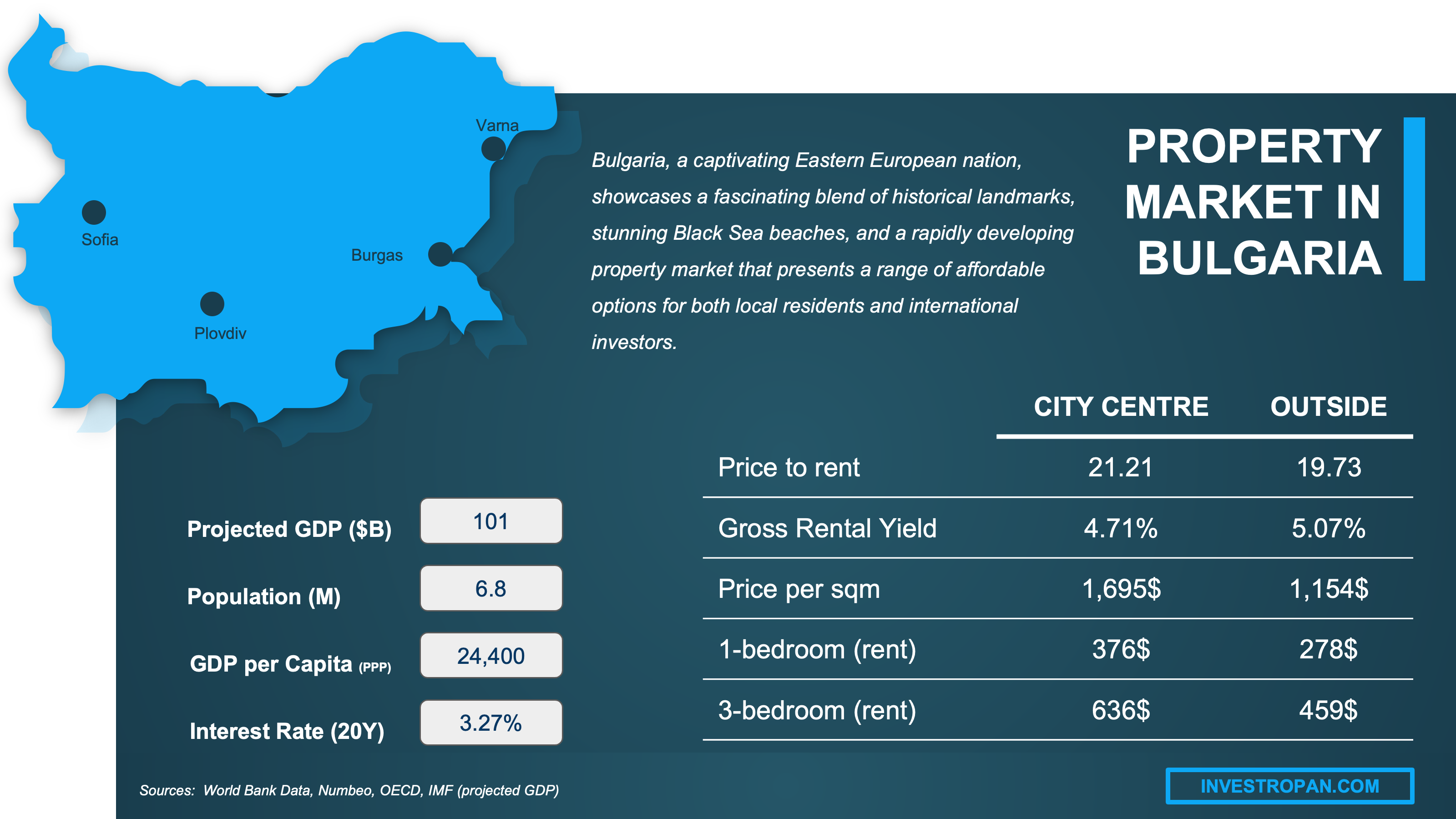

We have made this infographic to give you a quick and clear snapshot of the property market in Bulgaria. It highlights key facts like rental prices, yields, and property costs both in city centers and outside, so you can easily compare opportunities. We’ve done some research and also included useful insights about the country’s economy, like GDP, population, and interest rates, to help you understand the bigger picture.

What insider lessons do foreigners share after buying in Bulgaria?

What do foreigners say they did wrong in Bulgaria right now?

The most common mistake foreigners say they made when buying property in Bulgaria is trusting their agent to handle verification instead of independently checking the Property Register and Cadastre themselves or through their own lawyer. The top three regrets foreigners most frequently mention after buying in Bulgaria are signing a preliminary contract before pulling an official ownership certificate, not hiring an independent lawyer who works only for them, and underestimating the total closing costs and timeline. The single piece of advice experienced foreign buyers most often give to newcomers in Bulgaria is to never sign anything or transfer any money until you have an official certificate from the Registry Agency in your hands. The mistake foreigners say cost them the most money or caused the most stress in Bulgaria is paying a non-refundable deposit on a property with hidden encumbrances or ownership disputes that only surfaced after the money was already gone.

What do locals do differently when buying in Bulgaria right now?

The key difference in how locals approach buying property in Bulgaria compared to foreigners is that Bulgarians almost always pull a Property Register certificate early in the process and treat land versus building ownership as two separate questions from day one, while foreigners often skip this step or trust the agent's word. The verification step locals routinely take that foreigners often skip in Bulgaria is checking the building's Act 16 (habitation certificate) and the building management documents for outstanding maintenance fees or planned major repairs, especially in apartment complexes. The local knowledge advantage that helps Bulgarians get better deals in Bulgaria is their network of contacts who can provide informal intelligence about a seller's urgency, a building's reputation, or a neighborhood's actual livability, information that is difficult for foreigners to access without long-term local connections.

Don't buy the wrong property, in the wrong area of Bulgaria

Buying real estate is a significant investment. Don't rely solely on your intuition. Gather the right information to make the best decision.

What sources have we used to write this blog article?

Whether it's in our blog articles or the market analyses included in our property pack about Bulgaria, we always rely on the strongest methodology we can … and we don't throw out numbers at random.

We also aim to be fully transparent, so below we've listed the authoritative sources we used, and explained how we used them and the methods behind our estimates.

| Source | Why it's authoritative | How we used it |

|---|---|---|

| European Central Bank | Official monetary authority for the euro area. | We used it to confirm Bulgaria joined the euro on January 1, 2026. We also used it to explain why the market feels active and why scammers target transition periods. |

| Bulgarian Registry Agency (EPZEU) | Government body running Bulgaria's Property Register. | We used it to explain where ownership and encumbrances are verified. We also used it to recommend specific certificates foreigners should request. |

| European e-Justice Portal | EU's official portal summarizing member-state systems. | We used it to explain how Bulgaria's "personal entry system" works. We also used it to highlight why identity matching and powers of attorney matter. |

| Geodesy, Cartography and Cadastre Agency | Bulgaria's official cadastral authority. | We used it to show where property boundaries and identifiers are verified. We also used it to explain why boundary checks are essential before paying. |

| Bulgarian Ministry of Finance | Official source for national tax rules. | We used it to state the legal property acquisition tax range of 0.1% to 3%. We also used it to build a realistic closing cost estimate. |

| Law on Notaries (UNECE) | Statutory text mirrored by a major international organization. | We used it to explain the notary's legal role in Bulgarian transactions. We also used it to clarify what notaries verify and what they do not. |

| EU Justice Scoreboard 2024 | EU's official comparative dashboard on justice efficiency. | We used it to discuss court efficiency and enforcement timelines in Bulgaria. We also used it to explain why prevention matters more than relying on legal fixes. |

| Transparency International Bulgaria | Leading global index on perceived public-sector corruption. | We used it to contextualize why grey-area practices exist in Bulgaria. We also used it to calibrate how cautious foreign buyers should be. |

| World Bank Governance Indicators | Globally used governance dataset with documented methodology. | We used it as a reality check on rule of law trends in Bulgaria. We also used it to avoid relying on anecdotes when discussing enforcement strength. |

| Colliers Bulgaria Market Report | Reputable international real estate research firm. | We used it for market context on Sofia neighborhoods and new-build quality. We also used it to explain why prevention of defects matters. |

We created this infographic to give you a simple idea of how much it costs to buy property in different parts of Bulgaria. As you can see, it breaks down price ranges and property types for popular cities in the country. We hope this makes it easier to explore your options and understand the market.